Monetary Policy

Uzbekistan central bank cuts rates by 100bp

Emergency meeting loosens policy in response to pandemic and energy price fall

Fed takes first step to unwind repo support

Repo market is showing signs of “more stable” conditions, New York Fed says

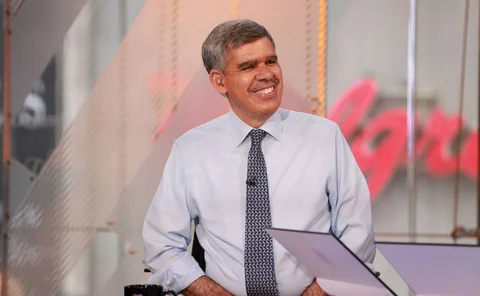

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Sarb cuts rates to historic low

Unanimous decision comes as growth outlook and inflation forecasts revised; South Africa’s risk profile has increased

Crises enliven ‘totalitarian temptations’

The coronavirus pandemic will embolden governments and bodies such as the International Monetary Fund to grasp for more power, writes Steve Hanke

Fed unveils $2.3 trillion package for ‘Main Street’

Package launched as 6.6 million more people claim for unemployment insurance

ECB minutes reveal resistance to lifting self-imposed limits on PEPP

Some governing council members did not deem new programme necessary, proposing to use APP or OMT

National Bank of Poland cuts rates to record low of 0.5%

Central bank includes state-guaranteed bonds in its asset purchase programme

Bank of England to lend directly to government

Central bank agrees temporary expansion of “Ways and Means” facility

ECB takes unprecedented steps to preserve credit provision

Central bank accepts state-guaranteed loans as collateral, reduces haircuts, and raises limit on unsecured bank bonds in collateral pool

Central banks may have to become ‘dealers of last resort’ – BIS economists

EMEs have not overcome “original sin” by deepening local currency bond markets, authors warn

RBNZ to start buying local government debt

Central bank expands its large-scale asset purchases in the wake of the Covid-19 shock

Riksbank expands incentives for lending to small firms

Central bank continues with flurry of crisis-fighting measures

ECB buys Italian bonds well above capital key in March

Central bank bought €11.8 billion in Italian sovereign bonds last month, up from €2.2 billion in February

Bank of Mexico lacks scope to counter Covid-19 – minutes

Officials highlight limited scope to lower rates below 6.5% without stoking inflation

Is the ESM the eurozone’s best weapon against Covid-19?

Eurobonds face economic and political hurdles, say former officials

Bank of Israel launches targeted lending operations

Central bank offers cheap loans to banks as part of Covid-19 response package; research department estimates point to major growth impact from virus

China cuts rate on excess reserves for first time in 12 years

PBoC levels up stimulus, cutting rate on excess reserves while reducing RRR for the third time this year

Should the Fed be next to implement yield curve control?

The Reserve Bank of Australia is now the second G20 central bank trying to control longer-term interest rates. Could the Fed be next?

ECB extends strategy review until mid-2021

Central bank postpones public events by six months due to the Covid-19 crisis

Amplifying the soundwaves: the evolution of social media communications

Central banks’ social media usage is on the rise, but their choice of platform is shifting more and more towards the visual

Chile cuts rates to record low 0.5%

Central bank expands banking bond purchases to $5.5 billion, GDP expected to shrink by 5% quarter on quarter

ECB makes record sovereign bond purchases

Central bank ramped up purchases under the PSPP programme in the week to March 27

Singapore eases monetary policy sharply and taps reserves

MAS flattens currency appreciation slope to zero after government unveils $34 billion stimulus