Fed opts for asset purchases as liquidity solution

Central bank chooses not to address possible plumbing issues – at least for now

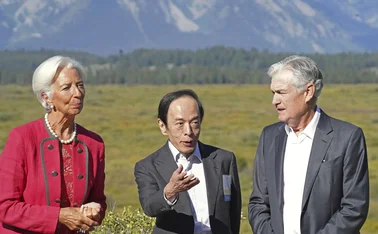

The Federal Reserve is soon going to resume outright Treasury purchases to help ease routine funding pressures, chairman Jerome Powell said on October 8.

The move aims to provide a solution to last month’s volatility in secured overnight rates and is not a form of monetary easing, Powell emphasised. After much speculation, the announcement shows the Fed has – for now – opted for a fresh top-up of reserves instead of other proposed solutions.

Last month, money market rates and repo rates rose

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com