Bank of Jamaica increases efforts to stimulate inflation

Central bank cuts policy rates and reserve requirements to spur credit growth

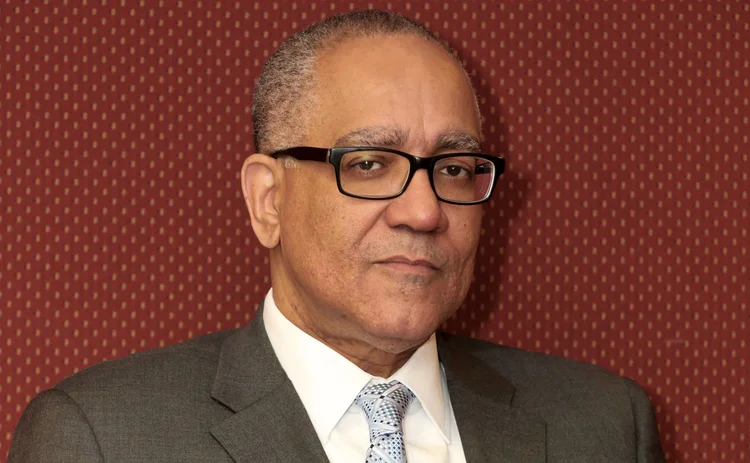

The Bank of Jamaica will lower its reserve requirements for banks in an effort to spur credit growth, governor Brian Wynter announced in a speech on February 21.

The central bank also cut its policy rate on February 20, hoping the combination of interventions will bring inflation back to target more quickly.

Jamaican banks’ reserve requirements will be reduced by 3 percentage points to 9%, effective from March 1, in the first of a series of planned cuts. The reduction should release nearly $17

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com