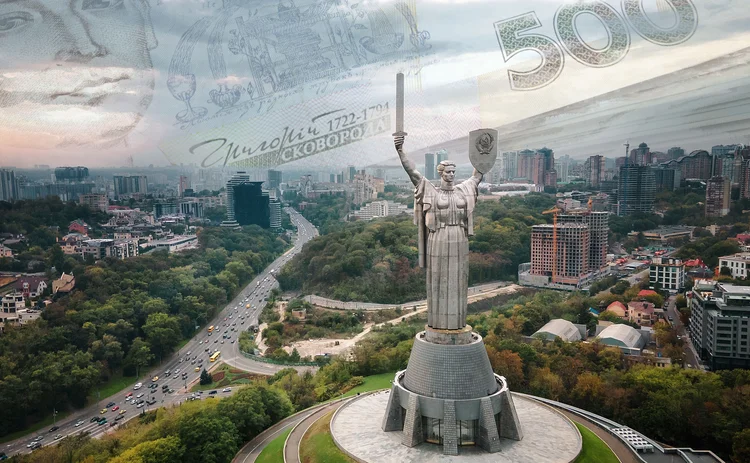

Ukrainian debt holders brace for restructure

Investors could see a 40% haircut on the bonds, though final figure will depend on complex talks

How much money are the holders of Ukrainian government bonds about to lose? The country must make a $900 million foreign debt payment in September, yet it faces a funding gap of $5 billion every month, the country’s finance minister Serhiy Marchenko has said.

Losses are inevitable. The size of those losses is negotiable. “If you’re a hedge fund and you hold bonds in a country that’s getting restructured, you’re going to get hosed,” says a former banker.

The conflict engulfing Ukraine has

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com