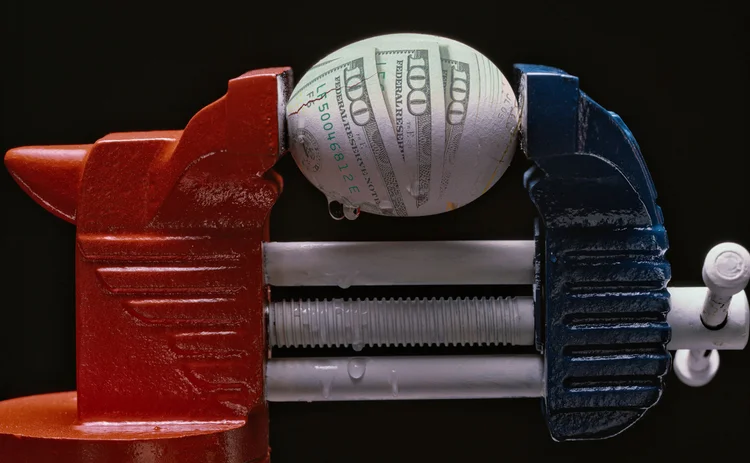

Fed caps dividends after stress tests show big potential losses

Brainard says decision not enough as tests show loan losses could exceed those during financial crisis

The Federal Reserve is limiting the amount of dividends large US banks can distribute after stress tests showed lenders’ capital levels could fall sharply.

The impact of the coronavirus pandemic could see some large banks’ loan losses hitting levels much higher than the average reached during the financial crisis in 2008.

The stress tests revealed some banks’ capital levels could fall very close to the minimum requirements, making it “prudent” to restrict some capital distributions, the Fed

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com