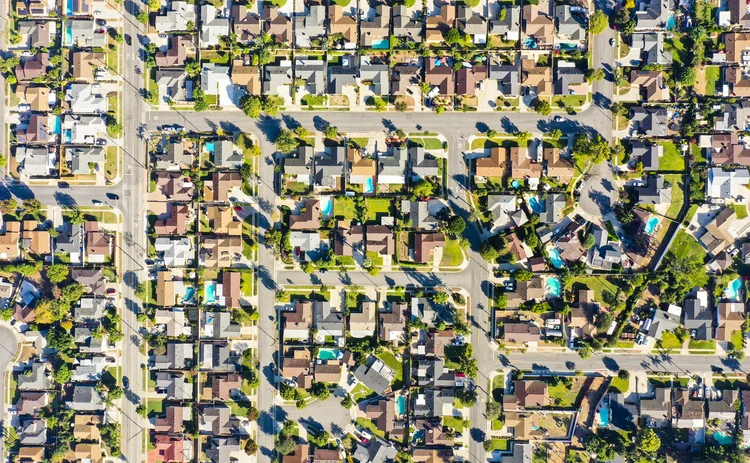

US house price-to-rent ratio likely to fall – Dallas Fed study

Expected decline could also signal future course of inflation, research argues

The US house price-to-rent ratio and real home prices are both likely to decline, according to research from the Federal Reserve Bank of Dallas.

The ratio of US house prices to rents has risen by 20% since the start of the pandemic, the author, J Scott Davis, finds. This, he says, is close to the previous high reached in 2006.

“The future course of inflation may well be influenced by how this now-lofty ratio reverts to a more usual level,” he writes.

The high point in 2006 was followed by a global

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com