This article was paid for by a contributing third party.

A powerful new force – Central banks and climate-related risks

This article provides commentary on the Central Banking 2019 Climate Change Survey

Increasing global concern about climate change is causing central banks to take notice of the issue and its potential implications. Frédéric Samama, head of institutional client coverage at Amundi, examines the findings of Central Banking’s survey on climate change, in which 64% of respondents described it as a significant concern.

Climate change is now perceived as a primary risk to humanity, and there is growing consensus that countries and corporates are facing major challenges in this area. Although latecomers, central banks are now paying attention to climate change worldwide. This is illustrated by the members of the Network for Greening the Financial System (NGFS), whose countries represent more than 44% of global GDP. Membership boomed from seven to 28 within one year of the NGFS’s formation in December 2017. In a unique survey of 34 central banks worldwide conducted by Central Banking in partnership with Amundi (see pages 76–87), 64% of central banks recognise climate change as a clear concern they were closely monitoring. Fifty-nine per cent of central banks are considering climate-related scenarios or are looking to implement them in their next stress tests. This new mobilisation of central banks is sending a very impactful message to the finance community: that climate change is a genuine concern for central banks, as it should be for all investors worldwide.

Recognising the magnitude of the problem

According to studies based on data from Climate Action Tracker data, a range of potential future scenarios of global greenhouse gas emissions show that decisions taken today will severely influence climate warming by 2100. If no climate policies are implemented, warming of around 4.1–4.8° Celsius is estimated by 2100, whereas if current climate policies are implemented, warming of 3.1–3.7°C is estimated. However, even if all countries achieve their current targets and pledges set by the Paris Agreement on climate change, it is estimated average warming by 2100 will be 2.6–3.2°C. This will go significantly beyond the overall target to keep warming “well below 2°C” and to “continue the action taken to limit it to 1.5°C”.3

There is a range of emissions pathways that would be compatible with limiting average warming but it would require a significant increase in the ambition of the current pledges. An adjustment is also necessary in the short term, which could bring about a potentially disruptive period. According to the survey, climate change is clearly a concern for central banks (64%) and a key concern for some, even if not all regard it as an issue that they as institutions should act on (27% of the respondents).

The impacts of climate change on the economy and finance take on multiple dimensions in a dynamic and non-linear system. Multiple interactions between the different forms of risk – regulations, society, nature – and their consequences directly affect bank, asset prices and even society. Different transmission channels exist through which gradual global warming, a transition to a low-carbon economy and extreme weather events can create turbulences, the effects of which would impact monetary policy. In addition to large physical and economic losses, unmitigated climate change could also affect the stability of the financial system. If these risks constitute one of the first financial risks, considering them is part of central banks’ current mandate (see figure 1).

Central banks are jumping in

Institutional investors have already organised an initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change. Climate Action 100+ is already gathering 289 investors across 29 countries, who together manage more than $30 trillion in assets under management.5 Investors, as part of their risk management approach, are challenging the 100 most polluting companies on their strategies on climate change. For their part, central banks must also take the same path. The survey shows that 68% of central banks do not consider it necessary to add a specific section to their mandates to mitigate climate change risks. However, climate change risk is a problem that is, by itself, threatening financial stability. Some central banks have started studying the implications of climate change and the low-carbon transition for the financial sector and real economy, primarily due to their responsibility for economic stability. Following the lead of Mark Carney, governor of the Bank of England and chair of the Financial Stability Board, a multitude of central banks and financial regulators addressed this topic in their speeches at the NGFS Conference.1,2,3

Since the announcement of the creation of the NGFS during the One Planet Summit in December 2017, eight founding members, 28 members and six observers have joined the network. This initiative encourages central banks, supervisors and financial institutions to contribute on a voluntary basis to the development of environment and climate risk management in the financial sector, and to mobilise mainstream finance to support the transition toward a sustainable economy. As there are opportunities as well as vulnerabilities for financial institutions and the financial system, there has been a concrete mobilisation of stakeholders to help strengthen the global response to climate risks and to meet the goals of the Paris Agreement.

Central banks are paying a lot more attention to climate risks, and the survey illustrates this trend, revealing that 59% of respondents are considering climate-related scenarios or looking to implement climate-related scenarios in their next stress tests. Comprehensive climate stress-testing would require improved provision and accessibility of high-quality data. According to the survey, 85% of respondents do not collect data directly related to climate change risk, but a growing number of institutions are developing capabilities. However, the more accurate the data, the better the understanding of all these risks to take action.

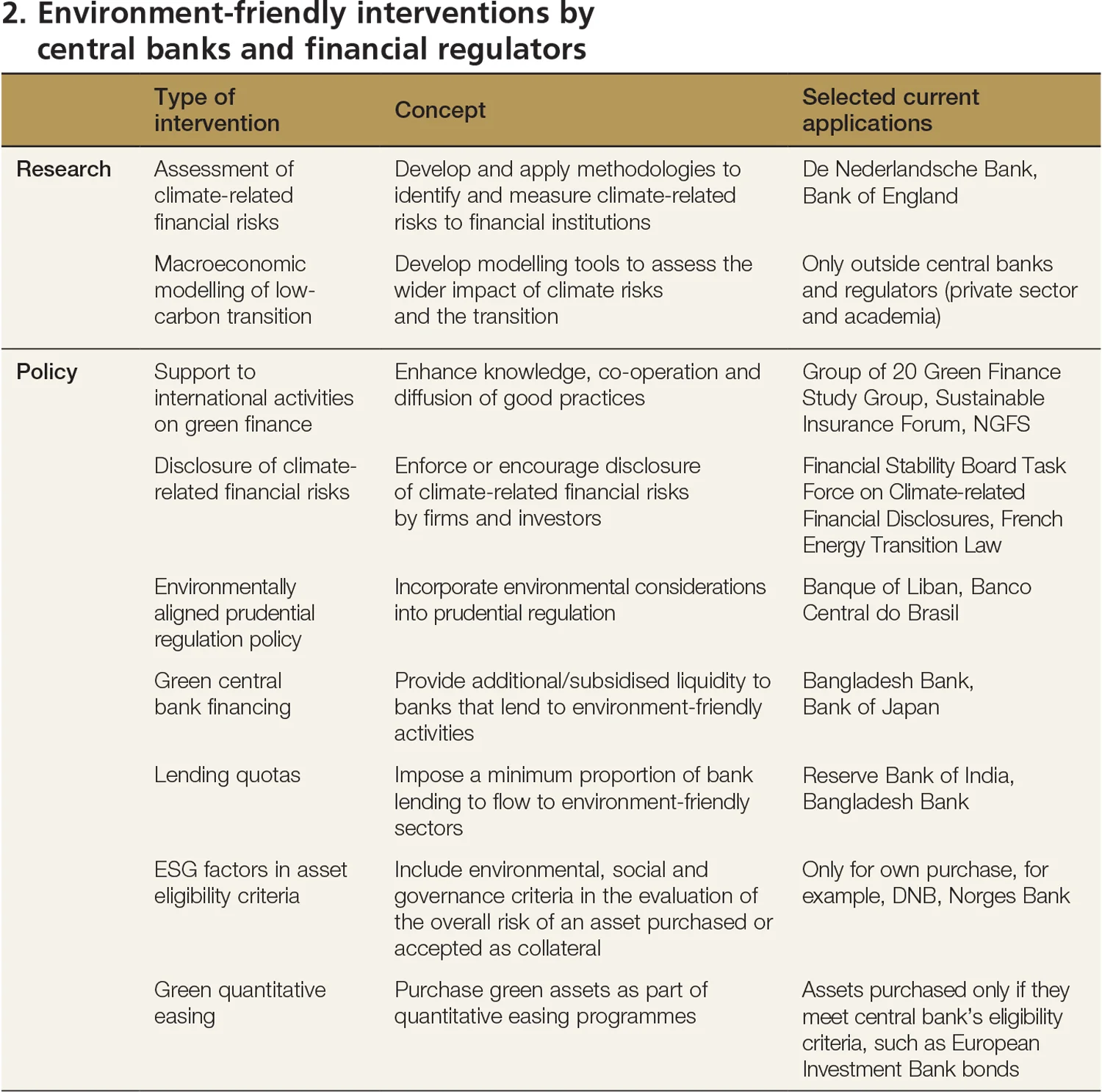

For the moment, we can already observe several environment-friendly interventions from central banks and financial regulators (see figure 2).

A new tool for central banks

Many central banks attempt to take climate change into account in their investments in their own funds and pension funds. According to the survey, central banks increasingly see green credentials as a precondition when choosing reserve assets. Over 69% of respondents said reserve managers should take these factors into account when making investment decisions. They could, for example, invest in green bonds, which play a signal role. The market for green bonds has developed rapidly in recent years, with global issuance rising from less than €1 billion in 2008 to more than €167 billion in 2018. Euro-denominated net green bond issuance has increased tenfold since 2013. Another possibility is to use low-carbon indexes, which intend to help identify potential risks associated with the transition to a low-carbon economy while representing the performance of the broad equity market. These frameworks could help central banks anticipate these risks when they take decisions, and thus minimise their risk’s exposure.

In his 2015 speech, Carney, relying on the idea that what is measured can be managed, had already pointed out that the first step to manage climate-related risk was to precisely measure such risks. Some central banks have started assessing the exposure of their domestic financial systems to climate-related risks and integrating climate risks on economic scenarios. For example, the European Central Bank has begun computing the impact of climate-related changes on banks’ capital positions and on the supply of funds to the economy. In particular, ECB executive board member Sabine Lautenschläger considers the channels through which climate-related risks are propagated to the economy as a whole.4

“Increasing transparency makes markets more efficient, and economies more stable and resilient,” former mayor of New York Michael Bloomberg famously said. The real task in climate change lies in better understanding the risks, as central banks don’t ask commercial entities to disclose their climate-related risk exposure. However, some banks have asked for clear guidance from regulators or more information about best practices or business opportunities. Central banks could implement a robust and internationally consistent climate and environmental disclosure framework and a taxonomy that enhances the transparency around which economic activities contribute to the transition to a green and low-carbon economy and are more exposed to climate and environment-related risks – both physical and transition. NGFS members have collectively pledged support for the recommendations of the Task Force on Climate-related Financial Disclosures, which develops consistent climate-related financial risk disclosures for use by companies in providing information to all type of stakeholders.

The NGFS could help organise and co-ordinate the work of the different groups to unburden the financial industry with myriad different information-collecting exercises. Developed and developing countries have each become aware of climate risk issues on financial stability. In many developing and emerging economies, central bank mandates are more comprehensive and include sustainability, as well as social and economic objectives. They have been comparatively more active in promoting green finance and sustainable development.

Conclusion

The debate over the choice actors had to make between “going green” and “making profit” is outdated. The economic and financial structure has to deal with new risks that are materialising and do not fit the current framework. Not only central banks but all institutional investors must change their approaches to save the assets of their pensioners, and as an indirect impact to aid the mobilisation on climate change. Central banks are playing a pivotal role in society and can thus help the mobilisation of the financial world. The good news is that this movement has already awoken.

Disclaimer: This document is not intended for citizens or residents of the United States of America or to any “US person”, as defined in SEC Regulation S under the US Securities Act of 1933. Amundi accepts no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material. Amundi can in no way be held responsible for any decision or investment made on the basis of information contained in this material. The information contained in this document shall not be copied, reproduced, modified, translated or distributed to any third person or entity in any country or jurisdiction which would subject Amundi to any registration requirements within these jurisdictions or where it might be considered as unlawful without the prior written approval of Amundi. Accordingly, this material is for distribution solely in jurisdictions where permitted and to persons who may receive it without breaching applicable legal or regulatory requirements.

The information contained in this document is deemed accurate as at April 30, 2019. Data, opinions and estimates may be changed without notice. Document issued by Amundi Asset Management, a French société par actions simplifiée – SAS with capital of €1,086,262,605 – Portfolio Management Company approved by the AMF under number GP 04000036

Registered office: 90 boulevard Pasteur, 75015 Paris, France | 437 574 452 RCS Paris

www.amundi.com

Notes

1. F Villeroy de Galhau, Climate risk – Call to Action, April 2019, NGFS Conference, Paris

2. F Elderson, Opening remarks by Frank Elderson at the NGFS Conference, April 2019, NGFS Conference, Paris

3. S Lautenschläger, Central bankers, supervisors and climate-related risks, NGFS Conference, Paris

4. Sabine Lautenschläger’s (member of the executive board of the ECB) speech, Central bankers, supervisors and climate-related risks, presented at the Network for Greening the Financial System Conference, Paris, France, April 17, 2019.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com