Fed paper looks at different CBDC types

“Account-based”, “cash equivalent” and “hybrid” CBDCs all have varying advantages – researchers

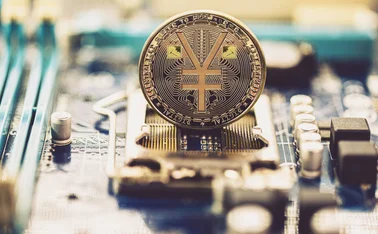

A central bank-issued digital currency’s possible advantages over current payment systems could depend on what archetype is selected, research published by the Federal Reserve finds.

“Central banks will need to decide which features a CBDC should improve upon and choose the archetype that can best achieve these goals,” Paul Wong and Jesse Maniff say.

Wong and Maniff compare “cash equivalent”, “account-based” and “hybrid” CBDCs against cash and real-time gross settlement (RTGS) systems. They

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com