Plosser warns US regulations could cause unnecessary bail-outs

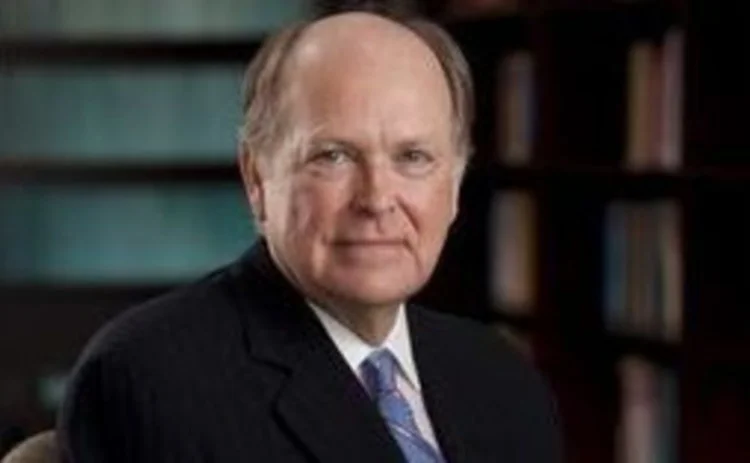

Charles Plosser, the Federal Reserve Bank of Philadelphia president, yesterday criticised US efforts to end the too-big-to-fail problem and advocated a more rules-based approach to bank resolution.

"Can we end too-big-to-fail? I think we can, but I believe the current efforts may come up short," he said.

The Dodd-Frank Act, under Title II, provides a framework for the Federal Deposit Insurance Corporation (FDIC) to act as a receiver and carry out the liquidation of failing banks, including

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com