Libya’s Bengdara pleads for softer sanctions on central bank: report

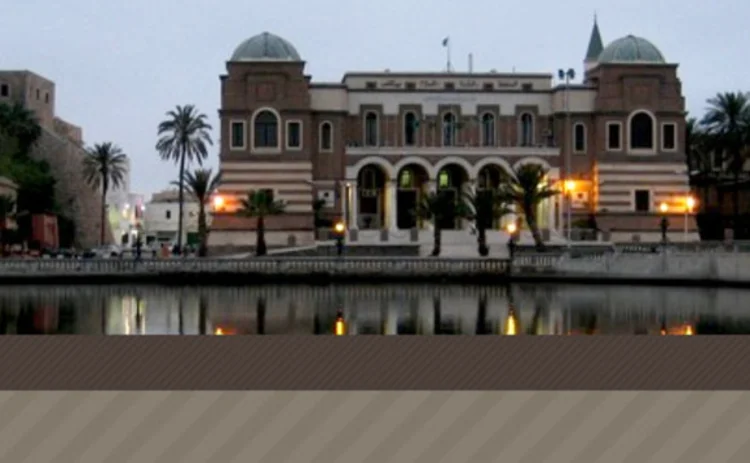

Farhat Bengdara, the governor of the Central Bank of Libya, has been lobbying foreign governments to soften sanctions on the central bank while based in Istanbul, the Wall Street Journal reported on Wednesday.

Bengdara told the newspaper in an interview conducted at Istanbul's Ataturk Airport that he "obviously" could not return to Tripoli, and confirmed that Abdulhafid Zlitni, Tripoli's minister of planning and finance and a former governor of the central bank, has been temporarily named his

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com