China’s path to financial deepening

Chinese leadership is increasingly promoting a more market-based system

When compared with the rapid advancement in the manufacture of Chinese products, supported by some of the best physical infrastructure in the world, the Chinese financial system still remains relatively inefficient and closed. Most financial intermediation is conducted through banks. Capital markets activity - including bond and equity markets - is relatively small, with low participation by institutional investors. In addition, bank loans are subject to quantitative controls, so private enterprises often find it difficult to borrow. Interest rates and exchange rates are not fully liberalised and domestic residents face high hurdles to investing abroad.

The inadequacy of the financial system is being addressed through constant policy changes. Since the Third Plenary Session of the Eighteenth Party Congress, the Chinese leadership has increasingly promoted a more market-based system. The result is that there is likely to be a period of steady evolution of the old financial system, where policy-makers constantly strive for a balance between reforms to eliminate inefficiency and necessary risk management during liberalisation. In this section, China's path towards financial deepening is discussed, along with highlights of the latest developments, drawing on policy-makers' perspectives.

Current financial system

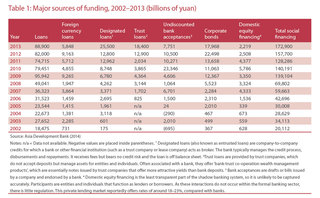

The Chinese financial sector contains the essential components of a modern financial system: banks, insurance companies, equity and bonds markets, as well as payment systems. But banks dominate financial intermediation, providing around 60% of loans to the private sector, according to the Asian Development Bank (ADB). The banking system is also concentrated, with the five largest banks providing about 50% of loans. Total social financing (which measures the total funding that the non-government sector obtains from the financial system) includes funding from bank and non-bank lending channels (see table 1).

As part of the legacy of the state-owned economy, the government still maintains significant influence on the financial system. The central bank sets the cap on retail deposit rates and the floor for retail lending rates. Over the last year, some of these restrictions have been relaxed, with a floating range of deposit rates being expanded and a market-based prime lending rate introduced as the benchmark rate for loans.

However, interest rate controls still have a powerful effect on both borrowing and lending rates. In addition, the volume of loans is controlled by quotas, and preferential sectors are still subject to direct or soft targets. Local governments also influence the lending decisions of regional bank branches at times, and this sort of lending has been particularly active in the years following the global financial crisis, when fiscal and monetary conditions were relaxed to shore up the economy.

Implicit and explicit guarantees are also prevalent in the financial system. For example, there are implicit or explicit guarantees offered for borrowings by state-owned enterprises (SOEs) and local government vehicles (the firms affiliated with local governments that borrow and invest in public-sector projects).

A deposit insurance, which would offer up to 500,000 yuan in compensation for deposit losses, took effect on May 1. Prior to this, it was widely viewed that the state implicitly insured all deposits.

Other liabilities of banks to retail investors - in particular, deposit-like wealth management products that offer market returns - have also been viewed as having implicit guarantees.

The state's influence and controls have also contributed to uneven access to finance. Moreover, as the formal financial system tends to favour larger SOEs and private companies - partly because of the lack of incentives for risk pricing under interest rate controls - small companies tend to face difficulties in accessing funds, and have to resort to self-finance or curb lending. This has in turn spurred the growth of peer-to-peer (P2P) lending in the past couple of years.

To a large extent, the still-primitive financial system reflects a cautious approach to liberalisation and its associated risks. China's financial reforms started in the 1990s (see appendix), yet the pace has been gradual and incremental with a view to managing shocks to the economy.

For emerging markets, the empirical evidence regarding the growth benefits of financial deregulation is mixed, and academics have highlighted that institutional thresholds and maturity are needed to favour a more comprehensive financial reform agenda. Indeed, many have attributed the resilience of the Chinese economy following the global financial crisis to its underdeveloped financial markets and closed capital account. The Chinese government has therefore largely pursued an experimental approach towards financial reforms until recently.

‘Decisive' role of market

In the Third Plenary decision of the Eighteenth Party Congress, the new leadership under president Xi Jinping and premier Li Keqiang stressed the need for market-orientated reforms. One key point was made about the need to change the role of the market from ‘basic' to ‘decisive', stipulating that the country will deepen its economic reforms to ensure market forces will play a more decisive role in the allocation of resources. At the same time, the Chinese government wants financial reform to support macroeconomic stability and the growth of the real economy. A modern financial system needs to include multi-layered capital markets, further interest rate and exchange rate reforms, capital account convertibility, and the development of private financial institutions. Financial regulation also needs to be strengthened.

The call for more comprehensive financial reform stems from the need for more balanced growth and better management of risk. Financial repression in the form of interest rate controls and loan quotas, along with preferential lending to state enterprises, has contributed to underpriced borrowing costs for and overinvestment by these companies.

Meanwhile, the dominance of banks in financial intermediation also implies inefficiency and a concentration of risk, and the rise of non-bank financing has challenged the traditional bank-centred regulatory approach. More broadly, a robust and sophisticated domestic financial system is needed to support China's outreach in global trade and investment (as outlined in sections one and three).

Main areas of financial reforms

Financial reforms involve changes to an ecosystem that is intertwined with China's growth model and the cyclical challenge it faces.

For instance, the banking system has been instrumental in deploying large financial resources quickly to fund investment projects. This helped to bolster economic growth, especially during cyclical downturns, but also contributed to duplicated capacity-building and an accumulation of bad loans. The merit of a more efficient financial system and further financial deepening is generally accepted within policy-making circles.

But in practice, the government needs to weigh the benefits and costs of each step, and consider the cyclical outlook and global conditions, among many factors, when pressing ahead with reforms. Carving out a path that allows the system to move towards a new and better equilibrium, while managing the risks along the way, features prominently in the view of policy-makers.

The details of the financial reform agenda were released a few months ahead of the Third Plenary decision, and represent a summary of the reform agenda for the financial system by the Chinese government (see http://tinyurl.com/kuqyjwe).

There are several main ingredients to the financial deepening process. First, there is a need to develop a multi-layered capital market to satisfy diversified needs of financial intermediation and enable a greater role for market forces (instead of government) to allocate resources. Second, factor prices must be liberalised without destabilising the macroeconomic environment.

And finally, risk management of an increasingly complex financial system is required to replace ‘more regulation' with ‘better regulation'.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com