Why the EU needs an asset management company

EBA authors lay out designs for an asset management company that could tackle the EU’s NPL problem

As much as €1 trillion of non-performing loans (NPLs) are still clogging the lending channel in the European Union. An EU asset management company (AMC) could address market failures in the secondary market for NPLs as part of a suite of measures designed to tackle the broader NPL problem. It should do so in a way that fully respects existing rules on state aid and resolution and without any mutualisation among EU member states.1

The problem

The process of repair of the EU banking sector requires three key steps. The first is capital strengthening. Supervisors have pushed banks to raise a significant amount of capital, increasing the CET1 ratio from 9% in 2011 to over 14% at end-2016. The second step is to identify problem assets. Supervisors led asset quality reviews on the largest banks across the EU in 2014 using European Banking Authority (EBA) definitions to start this process. The third step is cleansing balance sheets. This step is now imperative because of the scale of the NPL problem across the EU and its impact on economic recovery, as capital is trapped in non-performing investments. The average NPL ratio is 5.5%, with 10 jurisdictions reporting average NPL ratios of over 10%.

Notwithstanding the differences in NPL levels across jurisdictions, three channels of contagion suggest this is a single market problem. The first is the sheer volume of NPLs in the EU, including in its largest economies. The second is the direct and indirect exposure of large EU banks to NPLs across borders. The third relates to banks' inability to resume new lending in some jurisdictions, which hinders the effectiveness of monetary policy and holds back economic growth across the single market.

No silver bullet

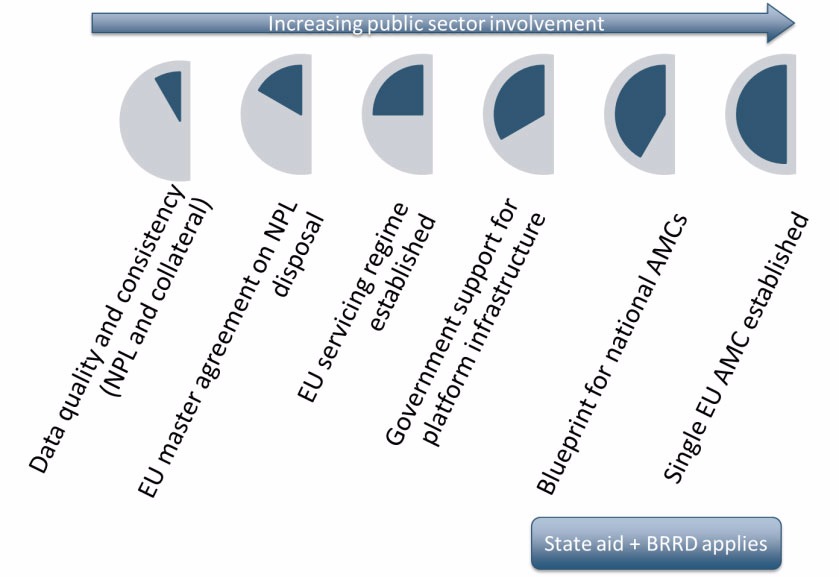

There is no silver bullet for addressing NPLs, but rather a series of interdependent actions:

- Supervisory pressure on banks to proactively manage and dispose of NPLs is needed; banks must raise provisioning coverage, improve their arrears management systems, and accept the short-term pain that is unavoidably linked with the removal of NPLs from the balance sheet.

- Overburdened and slow legal systems and judiciary procedures need to be reformed to ensure faster and more efficient recovery processes, or assisted via greater reliance on out-of-court procedures;

- Initiatives to support the development of a more efficient secondary market for impaired assets.

This article will focus on the last aspect.

Creating an efficient secondary market in NPLs

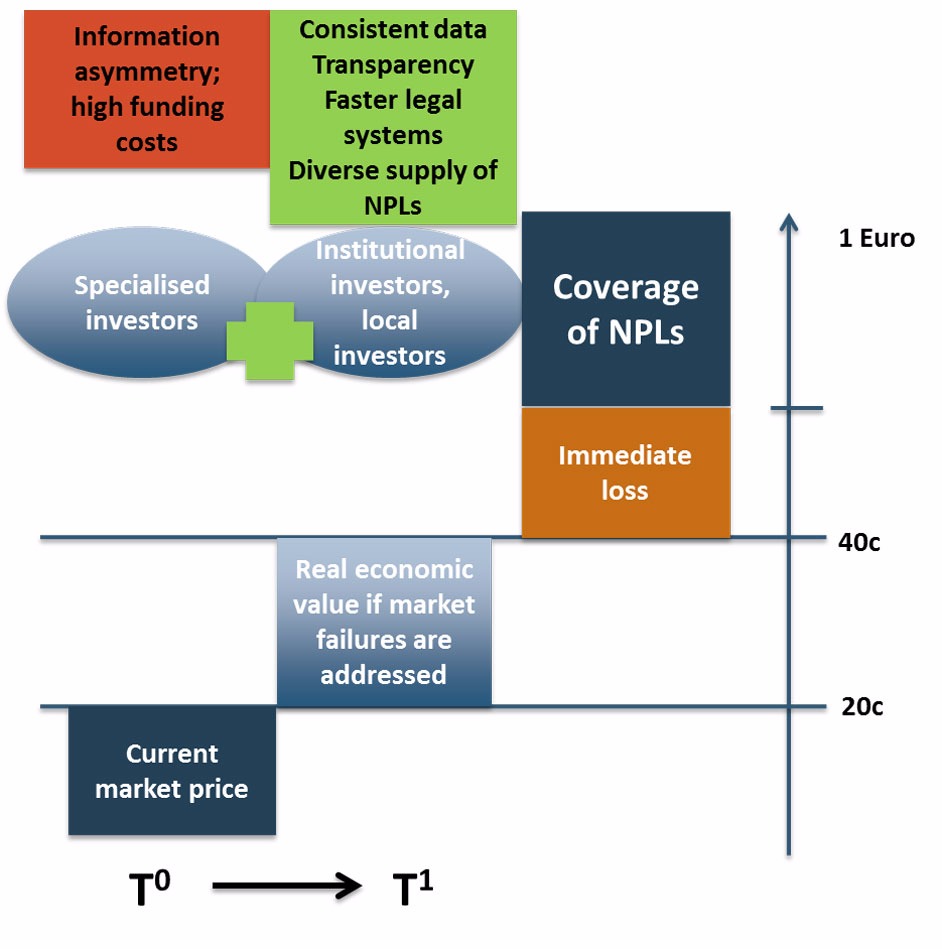

Market failures are present in the EU market for impaired assets, notably:

- Information asymmetry, due to the absence of easily accessible, comparable data on loan, debtor and collateral characteristics.

- Inter-temporal pricing problem: if, at present, markets are illiquid and shallow there is a first-mover disadvantage to sell into the market.

Forcing banks to write off or dispose of NPLs in a very short period of time in the absence of a deep and liquid secondary market for impaired assets and with remaining structural impediments, may lead to an inefficient gap between bid and ask prices. In such conditions, and in the absence of efficient market clearing prices, forced NPL sales may create financial stability concerns amid questions about the viability of the sector as a whole. The following corrective actions to address market failures would improve the secondary market:

- Addressing incentives for banks' management to take action on NPLs.

- Improving price discovery via: improving the quality, quantity and comparability of data available to investors; providing transparency of existing NPL deals; simplifying and standardising legal contracts.

- Addressing the inter-temporal pricing problem by overcoming current market illiquidity issues. This would entail stepping into the market at a price reflecting the "real economic value" or future efficient clearing price as opposed to the current market price, with a view to selling into a deeper and more liquid market at a later date.

Purely private sector solutions are not sufficient given the scale of the problem and the market failures present. Historical examples of success in the disposal of non-performing assets demonstrate the key role of the official sector in kick-starting the market, at least for some segments. In several cases, this has involved governments, or special purpose entities sponsored by public authorities, directly taking over impaired assets or supporting with guarantees their sale to private investors.

Constructing a European AMC

To date, a patchwork of national solutions has been trialled, all different in approach. A common European approach, or a co-ordinated blueprint for a government-sponsored asset management company, segmented by geography and/or asset class, could provide the following benefits: clarity and simplicity for both banks and investors in understanding the interaction with relevant state aid and Bank Recovery and Resolution Directive (BRRD) rules and the underlying data and mechanisms of the AMC; enhanced credibility of the initiative while ensuring that due process is followed in the implementation phase; lower funding costs and greater operational efficiency; critical mass on both the supply and the demand side, helping accelerate the process of repair in banks' balance sheets.

Formal public support could be offered in the shape of a European-backed AMC (ideally with "segments" by asset class). Public support could be used to provide capital (say to 8% of total purchasing power), which would in turn crowd in private funding. As a hypothetical example, an AMC could purchase up to a quarter of total outstanding NPLs (about €250 billion), and could be capitalised to the tune of €20 billion. Banks with NPL ratios above a given threshold (eg 7%) would be required to transfer certain specified assets to the AMC by supervisors. This would require the standardisation of data according to pre-agreed formats (which could be provided by the EBA). The solution must be in line with BRRD and state aid rules. Further, it should avoid any risk mutualisation of legacy assets.

The process for establishing the AMC would be the following.

Firstly, stress tests are used to identify the total envelope of potential state aid for each bank. Such a stress test could take a number of forms, ranging from a full balance sheet assessment against complex adverse macro scenarios, to more targeted assessments, such as the impact of increasing provisions to meet stressed market price target levels over a three-year timespan. The stress test may also, in isolated cases, identify the need for the immediate resolution – for instance for banks failing in the baseline scenario – and immediate recapitalisation (with conditions) for others. As an example, the stress test could be used for identifying the capital shortfall against Pillar 2 minimum capital requirements.

The state aid envelope calculated in the stress test identifies the theoretical amount of state aid that would be allowed for each bank's precautionary recapitalisation. In turn, this theoretical state aid envelope would determine how much state aid could be used to facilitate the transfer of NPLs, which would be equal to the difference between current market prices and real economic value.

Next, an assessment of real economic value vs current market prices is carried out and banks transfer some agreed segments of their NPLs to the AMC at the real economic value, under due diligence from the AMC and accompanied by full data sets available to potential investors. The transfer of assets to the AMC would first hit the existing shareholders to the extent that the net book value of NPLs is above the transfer price to the AMC. This may be accompanied by a liability management exercise and some bail in of junior debt to equity as determined by the European Commission under state aid rules.

At the time of the transfer to the AMC, the bank bears losses equal to the possible difference between the book value and the real economic value.

To ensure that banks keep skin in the game and avoid moral hazard issues, an ex post clawback could be identified from the bank, if the real economic value price is not finally achieved in the market within a specified time frame.

The clawback would not involve any return of assets to the banks' balance sheet. These are irrevocably transferred at the point of sale. Instead, the clawback would take the form of a parallel issue of equity warrants to national governments at the time of the asset sale to the AMC, with a strike price which would be triggered if the final sale price is lower than the real economic value. The warrants issue is designed to mitigate the risk that the bank is effectively paralysed with an unknowable potential capital hole until such time as the assets are eventually sold.

The AMC would set a timeline (eg three years) to sell the assets at the real economic value. If that value is not achieved, the bank must take the full market price hit, covered if necessary by warrants exercised by the national government as state aid with the full conditionality that accompanies that.

The warrants keep banks' skin the game and, as they are issued to national governments, also ensure that the AMC capital is fully protected and any eventual cost must be borne by shareholders and if necessary national governments. The objective is that the real economic value should reflect only the removal of market imperfections and therefore any price improvement due to increased confidence or economic growth would accrue to the AMC.

A viable EU solution

The proposal for an AMC addresses market failures in the secondary market for NPLs. It addresses information asymmetry and the intertemporal pricing problem in a way that, in our view, respects existing rules on state aid and resolution, without mutualisation among EU member states.

The proposal keeps shareholders on the hook for economic losses but offers viable banks an opportunity to speedily remove problem assets from the balance sheet at an efficient clearing price, albeit with clawback if that price is eventually not realised. The clawback in the form of warrants to national government reduces the uncertainty of an overhanging contingent liability and avoids any burden sharing across EU countries – it is the member state that injects capital if necessary. A more efficient secondary market in NPLs also facilitates supervisory pressure on banks to reduce NPLs, and where those banks are not viable under efficient market conditions, hastens their exit from the market.

An EU solution to NPLs, either as a single AMC or a blueprint for national AMCs, adds clarity for investors, reduces funding costs, and can create a critical mass in supply and demand of NPLs to further facilitate the market. As a key step in the process of repair for the EU banking sector, it will remove a major impediment to economic recovery across the EU.

Piers Haben is the EBA's director of oversight, and Mario Quagliariello is head of the risk analysis unit.

Notes

1. The opinions expressed are those of the authors and do not necessarily reflect those of the EBA or its board of supervisors.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com test test test

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com test test test