Monetary Policy

RBA 'open-minded’ to currency intervention

Reserve Bank of Australia governor Glenn Stevens says the central bank would consider intervening in the exchange rate, and insists it ‘remains part of the toolkit’

Yellen wins Senate committee approval

US Senate Banking Committee backs Janet Yellen as the next Federal Reserve chair; latest FOMC minutes reveal support for a cut in the interest rate the Fed pays on excess reserves

Yellen wins over key sceptic in bid for Fed confirmation

Republican senator and noted opponent of doveish monetary policy says he will vote for Janet Yellen to lead the Fed based on her commitment to transparency and ‘rules-based' monetary policy

Currency peg speculation can 'damage' balance sheets

Researchers find that questions over the credibility of a currency peg can have ‘damaging effects’ on bank balance sheets – consistent with monetary mismatch theory

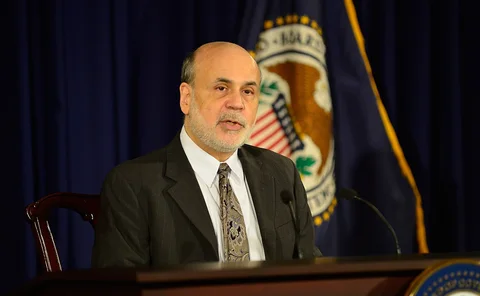

Departing Bernanke takes stock of Fed's unprecedented actions

Federal Reserve chairman discusses the ups and downs of the bank's asset purchases and attempt to guide market expectations; admits shortcomings but maintains policies are warranted

OECD joins calls for eurozone QE

Organisation says ECB should consider ‘institutional changes' to allow it to buy corporate and sovereign bonds; suggests a timetable for US taper

Polish economists say rate cuts damaged trust in ECB

Working paper says central bank interest rate cuts can damage public trust if they come at a time when households have ‘pessimistic expectations'

Belgian paper posits method for robust optimal monetary policy

Working paper suggests way of supplementing optimal monetary policy with elements of a rules-based policy, punishing policy-makers for deviation but not preventing them from exercising discretion

ECB cut prompts record FX intervention in Serbia

Central bank expresses ‘firm and prudent’ resolve to lean against capital flows resulting from ECB rate cut, but eschews a fixed exchange rate

Central bankers face tough monetary policy dilemmas

Central bankers around the world need to rethink their approaches to monetary policy

Monetary policy is the incorrect tool to curb asset bubbles

There is no evidence the use of monetary policy in Sweden to keep household debt in check actually works. Such a policy only undermines employment and results in the Riksbank breaching its mandate

Developing countries focused on financial inclusion are reshaping central banking

Efforts in developing and emerging economies to promote financial inclusion for the world’s 2.5 billion unbanked population offer lessons to their developed world peers

Riksbank policy-makers differ 'fundamentally' on role of central bank, says deputy governor

Sveriges Riksbank deputy says policy approach is marginally beneficial at best and risks undermining 'public confidence' in central bank's targeting of inflation

Leaning against the wind does more harm than good, warns Svensson

Former Riksbank deputy Lars Svensson argues higher interest rates to combat asset bubbles and financial instability have the opposite effect by raising the real debt burden of households

Norges Bank deputy discusses institutional underpinnings of central bank activities

Jan Qvigstad highlights the importance of institutions in facilitating payments in an era when money lacks intrinsic value; chides Argentinian government for meddling with statistics

Finnish deputy outlines credibility triad

Pentti Hakkarainen says a central bank’s financial position, legal independence and communications all influence the credibility, and therefore efficacy, of its monetary policy

Latvia central bank brings rates and rules in line with eurozone

Bank of Latvia slashes rates to match ECB's ultra-low 0.25%; economists say the move, along with new regulations, was designed purely to ready the country to join the eurozone in January

ECB's Asmussen defends 'unorthodox measures' in pursuit of 'orthodox objectives'

Executive board member highlights distinction between policy goals and instruments; says LTROs, OMTs and forward guidance crucial to ensure monetary transmission and hit inflation target

UK data boost could spell early end to BoE forward guidance

Inflation report out today predicts consumer price inflation will reach 2% target sooner than predicted after sharp drop in October; revised forecast on unemployment may undermine forward guidance

Spanish economist urges IMF to complete its ‘metamorphosis’

Bank of Spain economic study says the International Monetary Fund needs to test its new surveillance and lending policies before it can take its place as the ‘guarantor’ of the new economic order

Collateral could be useful tool at zero lower bound, says ECB paper

Working paper shows broader collateral eligibility makes funding conditions easier for banks; notes this could be useful for policy, but central banks should not forget sound risk management

Minneapolis paper finds stable Phillips curve in regional data

Researchers find relationship between unemployment and inflation holds in regional data but breaks down at national level; suggest this could be used for policy-making

Bank Indonesia's surprising rate hike to mitigate worse-than-expected trade deficit data

Unexpected rate hike leads economists to fear worse data is on its way; 'deficit problem could be more serious than markets expected', says DBS economist

RBI's independence under threat, says former chief general manager

Grace Koshie says proposed changes could give the government greater involvement in the Reserve Bank of India’s operational areas; warns other central banks' legal independence is being ‘altered’