Financial Stability

HM The Queen confirms banking ring fence plan

UK set to see controversial ring fence between retail and investment banking operations introduced after Queen includes the plan in her annual speech before the government

Central Bank of Ireland issues new €20 gold coin

Irish central bank launches commemorative €20 coin; monastic art features on the coin, of which 12,000 will be issued

New deputy governor notes increasing Swedish economic dependency

Kerstin af Jochnick describes points of importance relating to monetary policy and financial stability; highlights growing dependency of Sweden on events abroad

Honohan discusses lessons from central banks' response to financial shocks

Governor of the Irish central bank outlines lessons for central bankers from the impact of shocks to financial system

BIS paper examines potential substitute monetary policy tools

Bank for International Settlements working paper discusses potential for interest rate and capital adequacy requirement tools to contribute to financial stability

Bahrain modernises cheque truncation system

Central Bank of Bahrain announces same day cheque clearing system will go live on May 13; system is part of initiative to improve efficiency and confidence in cheques

First CSDs sign T2S Framework Agreement

Senior European Central Bank officials commend first nine European central securities depositories to sign Framework Agreement for T2S central settlement project

Malawi devalues kwacha to boost economy

Malawi ends peg to dollar; hopes to speed government’s efforts to restart International Monetary Fund aid programme

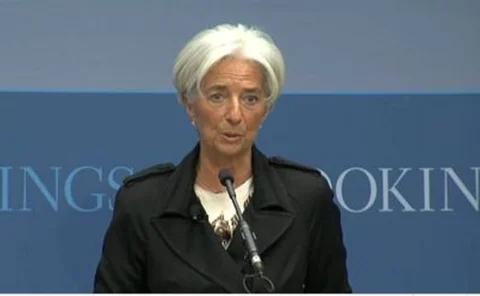

Lagarde calls for ‘gradual’ austerity moves

Lagarde calls for gradual and country-specific approach to austerity; says supply-side measures needed to achieve sustainable growth

Estonia issues 50 million new coins

Bank of Estonia announces increased stock of 1- and 2-cent coins; also discusses new role in producing euro banknotes

IMF research discusses bank capitalisation as a signal

International Monetary Fund working paper discusses bank capitalisation levels as market signals and the role of supervisory authorities

Zeti outlines key factors in ensuring sustainable growth in Asia

Zeti Akhtar Aziz discusses factors important in ensuring sustainable growth and stability in Asia

BoE’s Tucker calls for international co-operation on bank resolution

Deputy governor of the Bank of England highlights challenges for policy-makers in setting up international resolution regimes and calls for cross-border vetting of resolution mechanisms

ADB’s Kuroda says governance and supervision reform needed in Asia

Haruhiko Kuroda believes improvements in governance and regulatory reform are needed to enhance Asia’s future growth prospects

Basel Committee proposes scrapping VAR

Review recommends switch to expected shortfall, postpones CVA charge overhaul, and retains split between banking and trading books

Bank of Canada unveils new banknote

New C$20 polymer banknote unveiled by Bank of Canada; enhanced security features aimed at thwarting counterfeiters

Draghi calls for growth to top the agenda for eurozone

ECB president Mario Draghi calls for 'growth compact' to complement fiscal compact in eurozone; says individual countries need to meet responsibilities on fiscal consolidation

Reserve Bank of New Zealand’s Spencer outlines macro-prudential initiatives

New Zealand central bank deputy governor outlines macro-prudential policy initiatives and says the reserve bank expects to take the lead on implementation

Dombret calls for faster EU action on regulation of Sifis

Deutsche Bundesbank's Andreas Dombret calls for EU to act faster on regulation of Sifis; says individual countries implementing their own frameworks creates ‘problems for the future'

Gensler confident clearing location requirements will not be imposed

Regulators are unlikely to insist local currency OTC derivatives trades be cleared domestically, says CFTC chair Gary Gensler

IMF research highlights benefits of dynamic loan-loss provisioning

International Monetary Fund working paper advocates dynamic approach to loan-loss provisioning to smooth costs over the credit cycle

King admits BoE should have done more to prevent banking crisis

Bank of England governor says central bank should have done more to prevent crisis despite its limited powers to act; says new resolution mechanism will not work for global banks

Dallas Fed chief calls for taxes on 'too-big-to-fail' financial institutions

Dallas Fed's Richard Fisher calls for more action on 'too-big-to-fail' entities; says new taxes should be introduced to encourage institutions to shrink balance sheets

Fed’s Tarullo laments delays in shadow-banking reform

Federal Reserve’s Daniel Tarullo hits out at slow speed of money market and repo market reform; urges debate on functions that ‘shadow banks’ should perform