How to divest public sector assets

Exit programmes for public sector assets could create uncertainty through supply/demand imbalance, but a tap facility – a private sector triggered exit programme – could be the solution, writes Hon Cheung, chief investment strategist, official institutions group at State Street Global Advisors

Post-2008 unconventional monetary measures have included the build-up of very large positions in bonds and equities as part of an asset-purchase programme. In many cases, policy objectives require that these holdings be maintained. But, as policymakers begin planning their exit programmes, the key question given the current environment is: what will be the impact of asset disposals on market stability and, more broadly, financial stability?

There is already a good case study of a successful equity exit programme designed with financial stability in mind – following Hong Kong’s asset-purchase programme during the Asian financial crisis in 1998, a ‘tap facility’ disposal mechanism operated through the Tracker Fund of Hong Kong.

This article examines this tap facility and the type of market behaviour this mechanism induces in market agents – and how this behaviour creates an environment in which equity disposal transactions tend to be countercyclical and avoid exacerbating periods of market stress. The model presented here is a simplified version of the actual tap facility used in Hong Kong, but it nevertheless provides useful insight into the operation of exit programmes that are market-based and private sector triggered, and their potential to enhance financial stability.

With respect to an exit programme for public sector assets, a major consideration will be the potential risk that the disposal programme drives down prices and creates market instability through severe imbalances in demand and supply. This policy uncertainty may, in turn, result in the market pre-emptively pricing down the assets in response to this risk. A transparent, contractual, market-based disposal that is triggered by the private sector and not by the public sector – such as a tap facility – will, in effect, eliminate this policy risk and provide greater certainty for market participants.

In this article, we identify and illustrate five key features of a tap facility and how these features can contribute to financial stability:

- The mechanism is open, transparent and market-triggered, thus reducing the risk of policy uncertainty.

- Market incentives drive the tap facility, and disposals tend to be triggered only during periods of market strength.

- Users are also incentivised to avoid disposal during periods of excessive volatility.

- The mechanism provides comparable incentives to both long-term portfolio investors and short-term proprietary traders, thus creating a diversity of market agents.

- The design of the tap facility is flexible and can accommodate the public sector’s different divestment policy postures.

While this article focuses on the disposal of equities accumulated during an asset-purchase programme, the ideas are also relevant to other situations such as company privatisation, or indeed to non-equity asset classes such as bonds.

The tap facility – Basic concepts

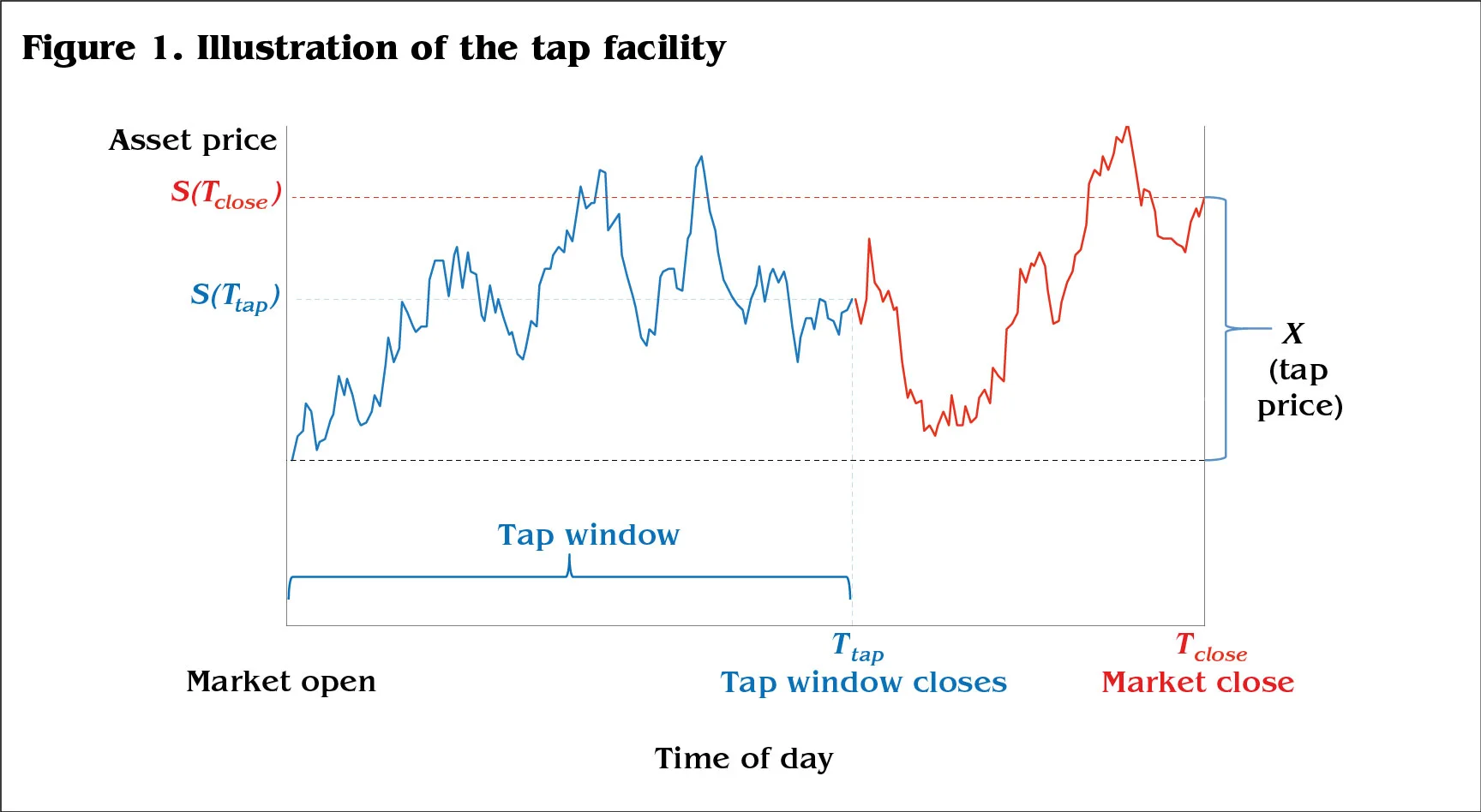

Figure 1 illustrates the conceptual framework for the operation of a tap facility.

During the trading day, the price of the asset is denoted by S. At time Ttap when the asset price is S (Ttap) and known, the ‘tap window’ closes and approved market agents (‘tap users’) must decide if they wish to draw on the tap by agreeing to purchase a specified quantity of the asset from the government at the unknown future tap price, X, which will only be fully determined when the market closes at time Tclose (for example, X could be stipulated to be the average of the open and close prices).

The use of the tap facility is driven by the financial incentives for tap users that will only draw down assets from the tap (effectively, the private sector triggers a government asset disposal that moves the asset into private sector hands) when it is profitable. A key question therefore is: when is the tap profitable for tap users?

Consider the case of a tap user that utilises the tap facility at time Ttap with a view to selling the asset immediately when the asset price is S (Ttap) and covering the sale by using the tap facility at the, as yet unknown, purchase price X, which will only be fully determined at market close. We can interpret this type of tap user as engaging in a ‘proprietary trade’ and the ‘prop’ trader will profit when S (Ttap) > X; this is an oversimplification of a proprietary trade to better illustrate the analysis in this paper.

Alternatively, consider the case of a tap user that intends to hold the asset beyond the trading day, either on its own behalf or as agent for another party – this is a ‘customer order’ for a longer-term investor in the asset. For such a customer order, an important measure of whether the tap facility will be used is the likelihood that the execution price will be below the day’s close, effectively X < S (Tclose); again an oversimplification, but an illustration of the behaviour of a customer order-driven transaction.

Therefore, at time Ttap when the tap user must decide whether to draw on the tap facility, a key driver for the decision will be the probability1 that the tap user will profit from the tap (as a proprietary trade or a customer order) when the observed asset price is S (Ttap). By analysing the properties of these profit-probability functions, we can infer tap users’ decision behaviour: whether to use the tap or not when faced with an observed asset price S (Ttap) at the time the tap window closes. Theoretically, each tap users’ utility function in conjunction with these profit-probability functions will fully describe the decision-making process for a tap user motivated by utility maximisation, but the profit-probability functions help explain tap user behaviour in the market aggregate.

We now examine five features of the profit-probability functions to infer how the tap might be used by the market as a whole under different market conditions.

1. The tap facility is open, transparent and market-based

The tap facility described enjoys the following characteristics:

- Open: tap users are any market agents qualified to contract to use the tap facility, to pay the government in cash and to settle the transactions under the tap facility. Typically, these will be brokers or banks operating in the asset market or, for customer orders, long-term investors that execute through brokers or banks;

- Transparent: the usage of the tap facility will be reported on regularly and the government will provide details to the market on the size and other conditions of the tap facility during a certain operating period.

- Market-based: tap users make use of the facility at their option; the government will not ordinarily release assets onto the market through other means – it is the private sector that triggers the disposal.

These characteristics are important as they can eliminate one of the key concerns associated with public sector asset disposal programmes: the ‘stock overhang’. The stock overhang creates many concerns for market agents: what will happen to the assets held by the public sector; how and when will the disposal occur; whether disposals will ‘push down’ the market; will disposals increase market volatility; how will government policy changes impact the overhang; will the government sell ‘sensibly’? As described in the next sections, an open, transparent and market-based tap facility can eliminate many of these concerns.

2. The tap facility is mainly used when markets are rising

Figure 2 illustrates the profit-probability function for a proprietary trader, assuming certain parameter settings.

In this example, assuming that the prop-trader has a hurdle of 90% likelihood of profitability before opting to use the tap facility, this will only occur if the asset price at the end of the tap window exceeds the open by 1.16%. In the general case, the tap tends to be used in rising markets.

3. The tap facility is mainly used when volatilities are low

In figure 2, the level of asset price appreciation needed to achieve a 90% profit-probability was 1.16% in the case of 20% asset price volatility. In figure 3, the level of asset price appreciation necessary to achieve a profit-probability of 90% is shown for different levels of asset price volatility.

As expected, when faced with higher volatilities, asset prices have to appreciate to a greater degree at the tap window close before tap users are willing to make use of the tap facility. For example, at 50% volatility levels, asset prices have to be almost 3% above the opening price before the tap facility is used (at a 90% profit-probability level).

4. Financial incentives apply to both proprietary traders and customer orders

Figure 2 provides an example of the profit-probability function for proprietary trades. The profit-probability function for customer orders is very similar. Given there are very comparable levels of incentives between both customer orders and proprietary trades (even for very high levels of asset volatility), we would expect a tap facility to be used by both short-term and longer-term investors. It is important, of course, for there to be a market ecosystem to support such activity. For example, for customer orders to thrive ideally requires the presence of wealth management, pension funds, insurance companies and other long-term investors; similarly, proprietary trading requires the presence of a risk-taking culture together with trading and settlement support systems and potentially derivatives instruments to facilitate hedging.

5. The design of the tap facility is flexible

There are many aspects of the tap facility design that can be calibrated to accommodate different policy approaches towards the asset disposal programme. For example: the size of the programme; frequency of renewal when the existing tap facility becomes exhausted; and whether daily tap limits are applied. One interesting parameter choice embedded in the model of this article is the time at which the tap window closes – when tap users are forced to make an irrevocable decision to use the tap or not. As figure 1 illustrates, this is a free parameter in the model: the tap could close very early during the trading day or it can close very late, near market close.

When the tap window closes very early during the trading day, tap users will still be subject to the uncertainty of the rest of the trading day before the tap price is established and will, therefore, only use the tap facility after a significant increase on the opening price. However, a large increase in asset price in a short time span after the open has low probability, so the tap is seldom used.

Conversely, when the tap window closes very near to market close, tap users are only subject to uncertainty for the small residual of the trading day before the tap price is established. This lower level of risk exposure allows tap users to make use of the tap more readily – a more moderate increase in the asset price is all that is necessary for the tap to be viable. Such a small increase in asset price during the elapsed trading day has reasonable probability; therefore, the tap is likely to be frequently used, with greater opportunity for the private sector tap users to generate profitable trades.

The choice of the tap window parameter provides one example of how policymakers could calibrate a tap facility. Factors driving this choice might include the state of their market (for example, volatility, fast trading systems and the sophistication of market players) and policy objectives (for example, the pace of disposal, private sector incentives and capital market development).

Conclusions

A price-triggered disposal mechanism underlying the tap facility contains a number of attractive features that foster an environment of increased financial stability. The five key features are:

- An open, transparent and market-based mechanism in which disposals are triggered by market participants and not by the public sector.

- Market-based incentives ensure that the tap tends to be used during periods of market strength.

- Users will tend to avoid using the tap during periods of volatility.

- The incentive mechanism applies equally to both long-term portfolio investors and short-term proprietary traders – thereby encouraging broad participation by different market agents.

- The design of the tap facility is flexible and can accommodate different divestment policy postures of the public sector. When measured against core public sector objectives for exiting asset-purchase programmes, the tap disposal mechanism provides some significant benefits that address key concerns regarding financial and market stability.

When measured against core public sector objectives for exiting asset-purchase programmes, the tap disposal mechanism provides some significant benefits that address key concerns regarding financial and market stability.

Notes

1. Technically, this is the conditional probability of profit conditional on the observed asset price S (Ttap), effectively P[X < S (Tclose) | S (Ttap)] for a customer order.

For public use

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor. All material has been obtained from sources believed to be reliable. There is no representation or warranty as to the accuracy of the information, and State Street shall have no liability for decisions based on such information. The views expressed in this material are the views of Hon Cheung through the period ended June 26, 2017 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ (SSGA) express written consent.

© 2017 State Street Corporation. All rights reserved.

Tracking number: INST-7870

Expiry date: June 30, 2018

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com