Invesco addresses the concerns of large institutional investors investing in the corporate bond market, covering key metrics when evaluating strategies for inclusion in portfolios, and the strength of fixed income factor investing in the corporate bond market.

The ‘Norway model’ and the benefits of factors

Chambers, Dimsom and Ilmanen describe the governance and investment objectives of the Norwegian Government Pension Fund Global (GPFG) in their 2012 paper, The Norway model. As the authors point out, the fund is one of the largest and best-run funds in the world. They analyse the characteristics of the fund and distil several key principles that have been key to its success.

First, they highlight its emphasis on risk control through diversification using liquid publicly traded securities. Second, the fund relies on a long-term investment horizon with little need for marketability. The long-term horizon makes the fund tolerant of return volatility and short-term loss. Given the fund’s size, it only looks to invest in strategies with large capacity. Given the long-term investment horizon with stable risk preferences through time, the fund focuses on serving as an opportunistic liquidity provider through contrarian strategies. Finally, the fund focuses on low-cost strategies with a transparent investment process.

Factor investing has been adopted by GPFG to improve diversification and returns, as stated in its 2020 annual report. The key reason for this is that factor investing fulfils the necessary criteria outlined by Chambers, Dimsom and Ilmanen. Factors have relatively low long-term correlation, which ensures the fund can manage risk through diversification. They are scalable and come at relatively low cost. In its most recent review of the portfolio’s risk and return characteristics, Norges Bank (2020) – which administers the GPFG – reported the coefficient betas from multivariate regressions of its external managers’ active returns.

The estimated coefficients can be interpreted as exposures to factors over the analysis period while the intercepts can be attributable to manager value creation over and above the exposure of the factors. Norges Bank uses five factors in equities, including the market, and four style factors: size, value, profitability and investment factors from Fama and French (2015). The number of factors used reflects the substantial academic work behind equity factors. In the same report, Norges Bank only uses credit and term in its regression for fixed income managers which is consistent with the two factors for bonds used by Fama and French (1993).

The credit and term factors have more in common with equity market factors than style factors. The term factor is the return of longer-maturity treasuries relative to shorter-maturity treasuries. The credit factor is the return of lower-rated securities over a maturity-matched higher-rated security. A corporate bond’s yield and return can be deconstructed into two sources: interest rate and spread. Interest rate risk is directly related to the bond’s duration. The spread is the yield of the corporate bond above a maturity-matched treasury and represents the higher returns associated with owning a riskier security than a treasury bond. While term may suffice to describe the interest rate exposure of a bond, the credit factor may not. In a way, it is the ‘capital asset pricing model’ equivalent in corporate bonds. By only using the credit factor, investors are making an assumption that the spread return of the bond is due to its exposure to systematic credit risk. In diversified portfolios, this single factor suffices to explain the portfolio’s risk and return. The concept of a single factor has been rejected in equities; there is no reason multiple factors should not also exist in corporate bonds.

Fixed income can offer similar benefits to equity

This article reviews several factors used in the literature and evaluate whether factor investing can sufficiently fulfil the criteria laid out by Chambers, Dimson and Illmanen. Specifically – do the factors provide strong diversification? Do they have capacity? Can they enable the fund to act as an opportunistic liquidity provider? Can it be implemented at low cost in a transparent way?

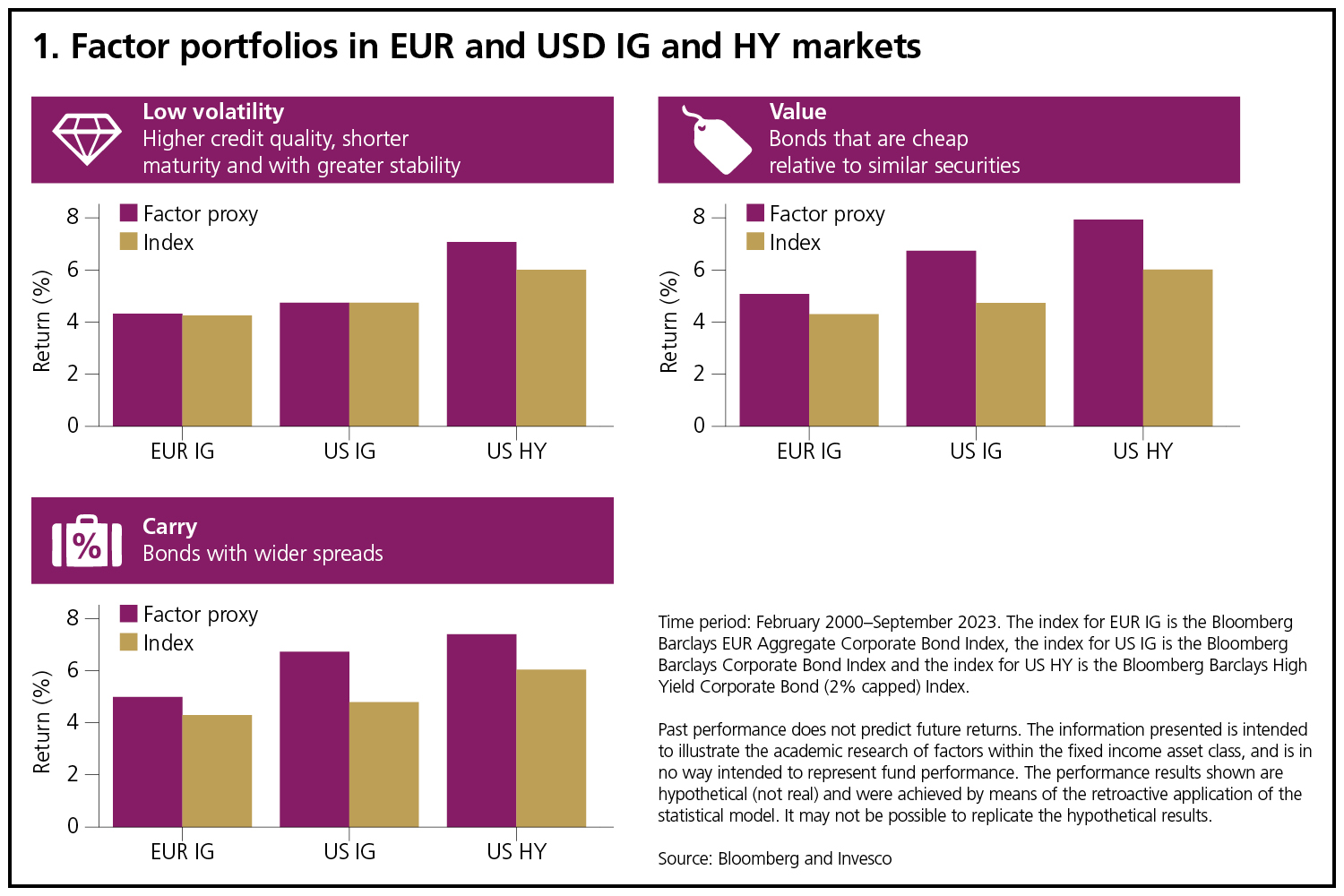

We focus on three factors – low volatility, value and carry – to demonstrate the efficacy of a factor-based approach. Our choice of factors is not exhaustive and does not represent a set of orthogonal factors to explain the returns of the credit universe. Our goal is only to show that factors can be applicable to institutional investors. We included those most commonly used in the literature. In addition, these three factors are of significant practical importance. A recent survey of investors found that a majority would consider using value, carry, quality/low volatility and liquidity, with a minority of survey participants willing to consider momentum. Therefore, we concentrate on the three factors that have more broad consensus among investors, with consistent definitions in the literature.

We will show that the fixed income factors reviewed here do indeed have strong diversification benefits. The factor premiums are persistent in a large diversified cross-section of the corporate bond universe. While all of these historical simulations argue factors should be implementable at low cost, the positive factor exposures of existing managers demonstrate they have positive premiums after transaction costs.

Finally, in the interests of transparency – a key criterion – we use simpler definitions of factors relative to those found in the literature where possible. Given the dominance of investment grade (IG) in institutional portfolios, we confine our discussions of factors to this particular credit sector for the remainder of this article. Factor strategies can easily be extended to other asset classes as high-yield (HY) and emerging-markets hard currency.

Low volatility

The low volatility factor explains the higher risk-adjusted returns associated with holding low-volatility bonds, as is widely observed in the academic literature across several asset classes. Low volatility can be a noisy measure when using monthly realised returns. As a simple proxy, we rank bonds by maturity with a credit quality of BBB+ or better. Our construction is like others that focus on definitions that emphasise short-duration and higher-rated bonds.

Value

The value factor explains the high risk-adjusted returns from owning bonds with higher spreads than fair value. There have been several different definitions offered to define value. We have chosen a simple definition that selects bonds with the highest options-adjusted spread within their respective industry and ratings groups.

On the surface, this differs from the approaches taken in the existing literature. Both Houweling and van Zundert (2017) and Israel, Palhares and Richardson (2018) rely on a regression-based approach that uses rating, maturity and other characteristics to predict the spread of every bond in the universe. Value bonds are those with high spreads relative to predicted values. We choose our definition for its simplicity and believe it captures the same dynamic as the regression-based approach.

Carry

The carry factor explains the high risk-adjusted returns for investing in bonds with highest option adjusted spread. Relative to value and low volatility, there is less consensus in the literature around carry as a factor. Only Israel, Palhares and Richardson (2018) argue for it, among those who have looked at multifactor models, including Howeling and van Zundert (2017) and De Carvalho, Dugnolle, Xiao and Moulin (2014). We have decided to include it in this study since previous work has found carry to be a common factor in many other fixed income markets beyond credit.

Figure 1 highlights the performance of three-factor portfolios in the EUR and USD IG the USD HY markets from February 2000 to September 2023. While the low-volatility factor is only able to generate index-like returns in IG, it leads to a significant risk reduction due to the construction methodology focusing on shorter durations and higher credit qualities. Other factors show higher returns, but come with higher drawdowns and a positive correlation with the value factor.

Factors are also a useful tool to analyse portfolios. Invesco conducted multiple portfolio analyses and found a pronounced bias of active managers towards the carry factor. An allocation to the low-volatility factor as a completion portfolio can help smoothen portfolio returns.

Institutional investors should ask hard questions about their fixed income portfolios. Chambers, Dimsom and Ilmanen offer an excellent framework to judge the suitability of any strategy within a large portfolio. We find that factor investing can fulfil these criteria. They represent a fundamental risk/return relationship not explained by term and credit factors within the corporate bond market.

Long horizon investors can take advantage of these factors by taking on the risks associated with the factors. The factors are scalable with efficacy across a large part of the market in different ratings, sector and maturities. Factor diversification can be used to target excess returns while controlling risk. Finally, the factors do not exhibit any exposure to typical liquidity metrics, making their implementation costs similar to passive market value-weighted portfolios. The simple definitions offer transparency of the investment process. Finally, the potential to automate this investment process and bring economies of scale means they should come at extremely low cost. New market inventions such as portfolio trading can help reduce transaction costs and increase the feasibility of factor-investing strategies in fixed income.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

This marketing communication is for discussion purposes only and is exclusively for use by professional clients in the UK. It is not intended for and should not be distributed to, or relied upon, by the public.

Data as at October 27, 2023 unless otherwise stated.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Issued by Invesco Asset Management Limited, Perpetual Park,

Perpetual Park Drive,

Henley-on-Thames,

Oxfordshire RG9 1HH

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com