This article was paid for by a contributing third party.

Central banks and securities lending: A lever for monetary policy and liquidity management

Securities lending is often considered an alternative mechanism for generating revenue by asset owners, fund managers and others who invest with profit in mind. Central banks, however, do not share this viewpoint. Rather, their securities lending programmes are an important and unobtrusive way to influence markets and monetary policy. By John Arnesen.

Although buffeted by Basel III regulations, the securities lending industry remains a vibrant and important part of financial markets. Investors have committed more than $17 trillion to potentially be lent, and a record 94% of large asset managers in a recent survey said they engaged in lending, or were about to start. Although banks have pulled back on some borrowing, securities lending still generates $8 billion–9 billion worldwide annually in revenues for asset owners across equities and fixed income, according to market data vendors. Securities lending – and the short selling it supports – are globally recognised as key contributors to the development of robust, liquid and effective financial markets.

Central banks have found that securities finance transactions – including securities lending and repo – can play an understated yet important role in financial market stability. The decision criteria for central banks to engage in any financial activity are based on their mandate. Whether the objective is to keep inflation at a steady 2%, manage unemployment levels or protect market liquidity, central banks consistently keep a close eye on how their actions impact the real-world economy. This does not mean that policies and market actions stay constant, as witnessed by a range of central bank programmes since their creation – the most recent quantitative easing and asset purchase programmes are the latest examples of this. Securities lending suits central banks in terms of programme mechanics and end-goal results.

Central banks and the mechanics of lending

Whether lending to approved counterparties directly, or through an agent lender or central securities depository, the act of lending securities is a well-understood function of central banks. Similar to providing overnight liquidity, there is a market operations group that is utilising central banks’ assets to support the needs of their clients directly.

The trade is the same in any securities lending transaction. Borrowers access securities for short-selling, settlement or balance-sheet management purposes. Borrowers post cash or non-cash collateral close to the value of the collateral lent, with haircuts based on collateral types and counterparty safety. At the end of the trade – whether overnight or term – the assets are unwound, with the central bank recovering its loaned securities. Central banks know this business well, which means there is a healthy degree of comfort with the risks involved.

A big difference in recent years has been who the borrowers are – central banks worldwide have gone from lending exclusively to commercial banks, to lending to asset managers and other financial entities, as well as commercial banks. Examples of this include the US Federal Reserve Board’s reverse repo facility – which will lend repo to approved money funds, government-backed entities and dealer banks – and the European Central Bank (ECB), which will accept collateral and provide cash to a wider range of counterparties than just dealer banks. Who has access to securities has a direct impact on the transmission of monetary policy.

A monetary policy tool

Securities finance is also an important monetary policy tool – though it is not always thought of in this light. When a central bank lends securities it is doing two things: taking cash out of the market and providing the market with a security that can be sold or used for settlement. If conducted on a large scale, the removal of cash via securities finance is similar to any other monetary policy move seeking to reduce competition for assets. For example, the ability to invest cash for a return on government assets in a repo programme keeps prices and spreads down by eliminating bidding wars for a finite amount of securities. The same is true for securities loans. By providing securities for settlement, central banks help clearing firms and brokers avoid costly penalties and operational inefficiencies.

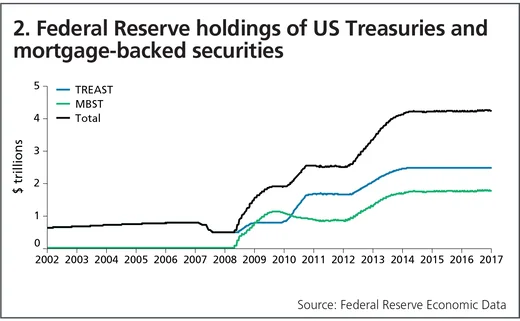

While securities lending by central banks is always helpful, it has taken on a new urgency as central banks have bought trillions of dollars worth of securities under quantitative easing programmes. The ECB increased its holdings across seven asset purchase programmes from €217 billion in December 2014 to €2.1 trillion in July 2017 (see chart 1). Likewise, the Fed has built up its system open-market account assets from $476 billion in December 2008 to $4.2 trillion in August 2017 (see chart 2). These large sums mean that central banks are now market-movers in securities finance.

Some central banks have elected to engage in securities finance transactions at fixed rates, but securities lending is best conducted at market rates based on supply and demand. By looking at lending as a liquidity provision tool, and allowing the market to set prices, borrowers will bid on loans based on their own needs. Market pricing means central banks must compete fairly against other market participants, and is an important factor in preventing central banks from overcrowding the private sector. Securities lending does not set a ceiling or floor for interest rates, but rather supports the development of healthy market transactions, regardless of the macroeconomic environment.

The market liquidity impact

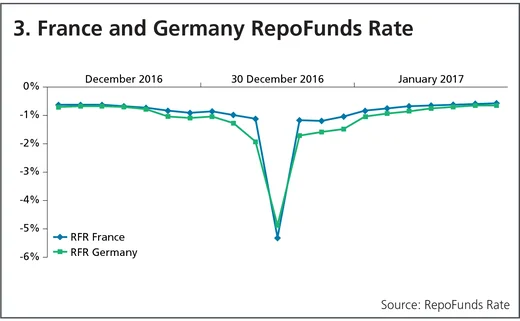

The importance of an effective securities lending programme to central banks increases in relation to the size and concentration of their assets. While the Fed does not often hold securities with outsized demand, the growth of the ECB’s portfolio relative to the amount of government securities that can be bought means the ECB controls large chunks of EU27 government debt. The ECB has absorbed an estimated 27% of outstanding German bonds and 15% of outstanding French bonds. If these assets remain closed off to the market, it will create a liquidity squeeze – particularly at quarter- and year-ends. This is visible in the pricing of repo transactions – at the end of 2016 the RepoFunds Rates for German and French bonds dropped to an unprecedented -5% and, in some anecdotal cases, to -7% or -8% (see chart 3). There were simply not enough assets in the financial system relative to availability to maintain normal pricing.

This is where a securities lending programme is most important, and is among central banks’ top priorities in monetary and fiscal policy management. Central banks have engaged in quantitative easing to support short-term interest rates, which in turn should spur inflation and encourage economic growth. In doing so, they have deprived the market of assets required to engage in basic financial transactions. Securities lending programmes go part of the way toward creating a solution to this problem by reintroducing central bank assets into the market based on demand from borrowers.

Exactly how impactful a central bank’s securities lending programme is depends largely on the market. In cases where the central bank is the primary holder of a given security, its lending programme becomes a primary means of accessing supply. In other cases, a willingness to lend a broad dispersion of potentially interchangeable securities from a borrower’s standpoint may help keep pricing reasonable for all market participants. This supply and demand-based balance is important to remember, and helps maintain appropriate liquidity levels for the central bank and broader market participants.

Central banks and their government treasuries also benefit from a specific impact of lending. The more liquid a market for government securities, the more easily governments can sell bonds – and with lower costs (see chart 4). Although a government’s borrowing costs are not necessarily a leading priority for central banks, this consideration should not be lost on them from a broader fiscal policy perspective.

Securities lending and tapering programmes

Securities lending is not only for periods when central banks hold unusually large amounts of assets on their balance sheets. It can – and should – occur in normal times too, with normalised balance sheets. The fact that the ECB, the Fed, the Bank of England and the Bank of Japan currently hold a combined $10 trillion in assets more than they did before the introduction of quantitative easing programmes makes securities lending important to maintaining normal market function. But, even with reduced balance sheets, a continued ability to influence market liquidity by lending, remove cash by supporting borrowing and improve operational processes should be a regular consideration for achieving monetary policy objectives.

About the author

John Arnesen began his current role as head of agency securities lending at BNP Paribas Securities Services in 2011. The business provides securities lending solutions to a range of institutional investors including pension funds, asset managers, insurance companies and central banks. It operates from offices in New York, London and Sydney, with supporting services based in Paris and Chennai. In 2009 Arnesen began a role as a senior business consultant at Data Explorers – a data-led firm with a strong pedigree in the provision of research and consulting services to practitioners throughout the securities financing industry, which was acquired by Markit in 2012. Prior to his work with Data Explorers, he was head of securities lending in Europe, the Middle East and Africa for the Bank of New York, based in London, where he initiated and developed the bank’s securities lending presence in Europe in 1990. Apart from a brief period as head of Clearstream’s Strategic Securities lending product in 1997, Arnesen had spent his entire career at the Bank of New York – 18 years of which were spent working in securities lending.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com