Invesco‘s Claudia Castro and Wim Vandenhoeck explore how central banks can strike a balance between innovation and disruption with their sustainability agendas.

Introduction

The role of central banks has been debated for decades; in the late 1990s and early 2000s the focus became narrowly defined. The focus on one instrument – the policy rate – often seemed blunt but was, for the most part, effective. Over the past decade, the central bank toolbox has expanded to include a greater variety– and complexity – of instruments. As recent global events have imposed new challenges on central banks, policy frameworks in some cases are also being rethought. While we believe central banks should never embrace a political agenda, neither should they live in a vacuum. With pressure growing to address global environmental concerns, this article poses the question: what should central banks do to combat climate risk?

We also tackle the ‘elephant in the room’: the definition, measurement and pricing of uncertainty over an event that is foreseeable – and therefore actionable. This article discusses the challenges of synthesising the problem of uncertain climate change into identifiable climate risks that can be priced and incorporated into models for pricing and financial stability. While financial risks from climate change are real and translate into macro- and microprudential issues, the analytical framework is still developing, and gaining momentum and co‑ordination between central banks globally.

Finally, we explore potential actions central banks could take to further sustainability objectives – both the ‘high- and low-hanging fruit’, and normative and positive implications of the sequence and pace of changes. The task is daunting: it must incorporate the post-Covid‑19 environment and the forces changing financial intermediation. We note the commendable work in progress in central banks worldwide, with hope for more. By broadening the scope with sustainability agendas, central banks are heeding the call to adapt to this changing landscape.

The role of central banks

Over the past few decades, inflation targeting, or a transition towards it, has been the key goal for most central banks. By controlling short-term interest rates, they have hoped to achieve price stability (low and stable inflation) and manage economic cycles. Since the global financial crisis that began in 2007–08, most developed – and even some emerging market – central banks have added policy tools to manage crises with the aim of ensuring financial stability and managing volatility in financial markets. The pandemic undoubtedly triggered the widest array of these tools, with emerging markets central banks not only intervening in foreign exchange markets but also deploying asset purchase programmes. As an International Monetary Fund research paper suggests, while these asset purchase programmes were successful in providing liquidity and maintaining the flow of credit, a further expansion of these new policy tools in duration or size could accelerate the concerns of fiscal dominance, weakening central bank credibility. Would it be possible for central banks, for example, to mirror the European Central Bank balance sheet policy that navigates around the fact that one policy rate impacts countries at different stages in their economic cycles? Much like calibrating stimulus per country, could it be the job of a central bank to use its balance sheet to calibrate – whether to stimulate or to dampen – various sectors of an economy?

Given a sacrosanct principle of central bank independence, the question really focuses on the extent to which central banks can be involved with climate risk. For example, should they directly embrace a net-zero target or only consider the impact of a transition towards net zero on price stability? Would an embrace detract from their mandates, or are all stakeholders at risk given the universal desire for price and financial stability? Do climate risks fit into current central bank mandates and, if so, how? Should they be explicitly incorporated? These are some of the many questions policy-makers are struggling with and opinions can diverge widely. We believe explicit targets may be a step too far and could become a slippery slope amid changing political agendas. We also strongly believe central banks can and should have an impact, using their toolboxes to address not only climate risks but the path to a broader sustainability agenda.

While that transition is happening, its sequence and pace can create a wide array of good, bad or ugly outcomes. At the time of publication, for example, underinvestment in the old economy to the advantage of new-economy energy sources may have had an impact on inflation persistence, and therefore terminal monetary policy rates (the cost of funding for all government programmes, not just climate-related but also social). This could create further repercussions for countries with less stable political climates and hold back or even prevent the achievement of initial goals. Underinvestment in old-economy energy sources to the benefit of renewables makes sense; however, the transition will be bumpy, as we are likely to find out this winter with consistently high and rising energy prices. Would an active central bank policy encouraging a transition to net zero help or worsen the impact on price stability?

From a wider perspective, as central bankers are involved in broad country-wide policy-making dialogues, it would be useful for them to help build a positive narrative for action and for public policy. In the case of Brazil, which has suffered deforestation and is of global interest due to its vast biomes, research suggests we may not even need new technology to lower emissions to approach the Paris Agreement on climate change and UN Framework Convention on Climate Change targets of net-zero greenhouse gas emissions – although mitigation scenarios are compatible with higher GDP per capita and lower climate risks. There has been progress aligning the industry with the country’s Environmental, social and governance (ESG) goals over the past two years, in contrast with a different public perception.

The current transition period is further complicated by the pandemic, but we believe central banks can guide and facilitate sustainability goals as a principle. However, we also believe a combination of government policies and market forces provide a better path. The impact central banks can have is important, but our view is that it works through the channels of co-ordination, measurement, risk assessment and oversight of a climate agenda, as explored later in this article, rather than the incorporation of an explicit mandate.

We assume it will happen

The inherent mission of all central banks is to maintain price stability with the least possible cost to output and, given their supervisory and regulatory roles, to preserve financial stability – more explicitly since the global financial crisis. Climate risks fit within both remits. Monetary policy is likely more impacted by physical risks, as it translates into inflation volatility and changes in relative prices and output. It is notable how the pandemic – a global shock ill-suited to central banks models and analytical work – is bringing to the fore the debate over the tradeoffs that arise with negative supply-side shocks; inflation is currently transitory yet persistent, as demand recomposition meets supply constraints.

Transition risks will also likely play a role in the outlook for inflation, given the change in relative prices – especially energy prices – likely to impact inflation expectations. To the extent that inflation expectations are forward-looking, long-term developments can be priced into valuations early. Central banks routinely consider structural changes based on long-term trends, such as demographic and technological shifts, and their impact on factors of production and the macroeconomy. Climate change adds a more significant challenge, given the depth and breadth of its reach across stakeholders, and the fact it is irreversible. Currently, analytical work needs to advance, in our view, before central banks are sufficiently well positioned to actively use monetary or prudential policies actively to foster the transition to a low-carbon economy.

Climate risk falls within central bank mandates and should be a strategic priority. Aiming for an orderly transition to a low-carbon world requires taking action – financial markets have already taken a stand on climate risk, as implied by the decline of the market capitalisation of old-economy industries. Meeting Paris Agreement targets will likely require a reallocation of capital, and public policy is likely to to help facilitate financing the transition to net zero.

Based on the analytical work to quantify climate risk, it might be concluded that the cost of transition may depend on its sequencing and pace. This is because the main climate risks – physical risks and transition risks – are intertwined. While a slow transition could increase physical risks and liability costs, a fast one could increase risks to financial stability. It is important to note that, while negative shocks pose risks to the economy and financial system, prevailing levels of leverage and valuations may amplify the financial risks from such shocks.

The key impediment to central banks’ more active role in fostering a transition to a lower-carbon world is a lack of confidence in understanding the risks of climate change to the overall economy. Substantial improvements in data and predictive models are needed to add to the existing static analysis of financial exposures and dynamic analysis of stress tests. Incorporating climate models of a new climate regime does not come without specific challenges. Climate models lack the granularity to assess the geospacial-specific or heterogeneous effects of climate change, for example. And extrapolations from historical weather data lack accuracy because of non-linearities in climate conditions that correlate risks in the aggregate across economic agents. Despite consensus on climate change trends, future climate outcomes remain uncertain. Hence, climate risks are associated with a range of outcomes, and are a function of mitigation efforts. It is also difficult to measure the mitigation efforts to reduce physical risks because of time-inconsistency issues caused by a delay between implementation and results.

But the reason central banks may need a different strategy altogether lies in the asymmetries in information and in externalities, which prevent the smooth incorporation of climate risk into their economic and asset-based pricing models. A visionary approach was proposed by US economist William Nordhaus around 50 years ago, treating economic activity as an output of climate models. Using a climate damage function, the effects of climate change on economic and financial outcomes come from deteriorating public health and public infrastructure, labour productivity, agricultural yields, rising mortality rates and property destruction. It is easy to see how these link directly to financial risks through asset prices, credit and cashflow changes, and indirect risks to economic activity, which can amplify the financial risks and one another. At the same time, aggregate climate models linking climate change directly to economic output are not well suited for near-term baseline and balance of risk assessments, in our view, because they draw on very long-term simulations.

Measuring climate risk is uniquely difficult, and only at an early stage, and there are several challenges to overcome. Also crucial to understand is the interdependence of risks, leading to decisions on pricing, investment and risk management. A taxonomy for sustainability and climate risks, enabling financial disclosures, monitoring risks with scenario analysis, pooling of data and computationally intensive analysis is also required. Finally, stakeholders will need to agree on how to develop the financing of climate change, since certain industries and communities will likely be exposed to costs while others may benefit, and it is unlikely that winners will fully compensate losers.

There is progress

Keeping in mind that we are only a decade into this new monetary policy experiment based on various central bank tools, much uncertainty remains on its impact over a longer period. So far, we have seen the erosion of nominal terminal policy rates – which is positive for funding of various government programmes over the long term – and the explosion of central bank balance sheets. The bigger question, however, is the threat to central bank independence and the potential blurring of the lines between monetary and fiscal policy. We believe the responsibility for fiscal policy lies squarely with politicians and not independent central bankers. Others, however, may argue that climate risk is an integral part of any macro-prudential policy since it represents a systemic risk. The role of clear, objective, regulatory authority and supervisory powers should be established, in our view, and we believe the role of the Network for Greening the Financial System (NGFS) will be crucial in this. Launched in 2017, the NGFS is a group of 95 central banks sharing best practices on a voluntary basis for the development of environmental and climate risk management in the financial sector, and the mobilisation of mainstream finance to support the transition towards a sustainable economy.

There are also investment opportunities, where financing the transition requires new investment portfolios and new financial allocations. While there is broad acknowledgement of the need to meet these challenges, there is far less harmony over how to translate goals into policy prescriptions or macro- and micro-prudential measures. There will likely be low-hanging fruit for central banks to grasp, and the NGFS and the Basel Committee on Banking Supervision may play a bigger role. At some point, we will likely have a large variety of ‘green’ prudential instruments but, much like the experience with quantitative easing, the experience in advanced and emerging economies will likely be different – especially where lending limits are present in traditional banking. For now, central banks are not yet in a position to envisage calibrating such prudential policies.

Progress is under way. Central banks are not only proceeding with climate scenario exercises, but are also developing a sustainability agenda. Beyond (and because of) climate change, ESG considerations have moved to the forefront of the political, economic and social debate, as populations on the ground feel the impact of weather disruptions, reinforced by digitisation trends driven by the pandemic. While there was a global response to the pandemic to support ailing economies and a strategy for global vaccination, advanced economies and emerging markets are feeling those forces differently. Social instability born out of income inequality and inadequate political leadership may put governability and institutions in emerging markets at risk, damaging the prospects for efficient and market-friendly policy-making, and, in some cases, macroeconomic stability – even though the ongoing global economic recovery has surpassed early expectations and there is relatively less concern about long-term scars.

Central banks have wisely embraced ESG agendas to promote financial inclusion and education, transparency, competitiveness and sustainability. They have also put financial innovation to work to move forward with the new forces behind changes in financial intermediation, for example, digital disintermediation: “banking is necessary, banks are not”. During Invesco’s engagement conversations, central banks from Brazil to Ghana are emboldened to tackle diverse challenges. The annual Invesco global sovereign asset management study, which has been conducted since 2013, shows that Covid-19 has led to an increased focus on ESG – particularly among central banks. According to the 2021 study, central bank sentiment has shifted significantly over the past year, with 63% of respondents now seeing climate change as falling within their remits. The survey also tackles issues of reserve management and liquidity, addressed elsewhere within this report.

Conclusion

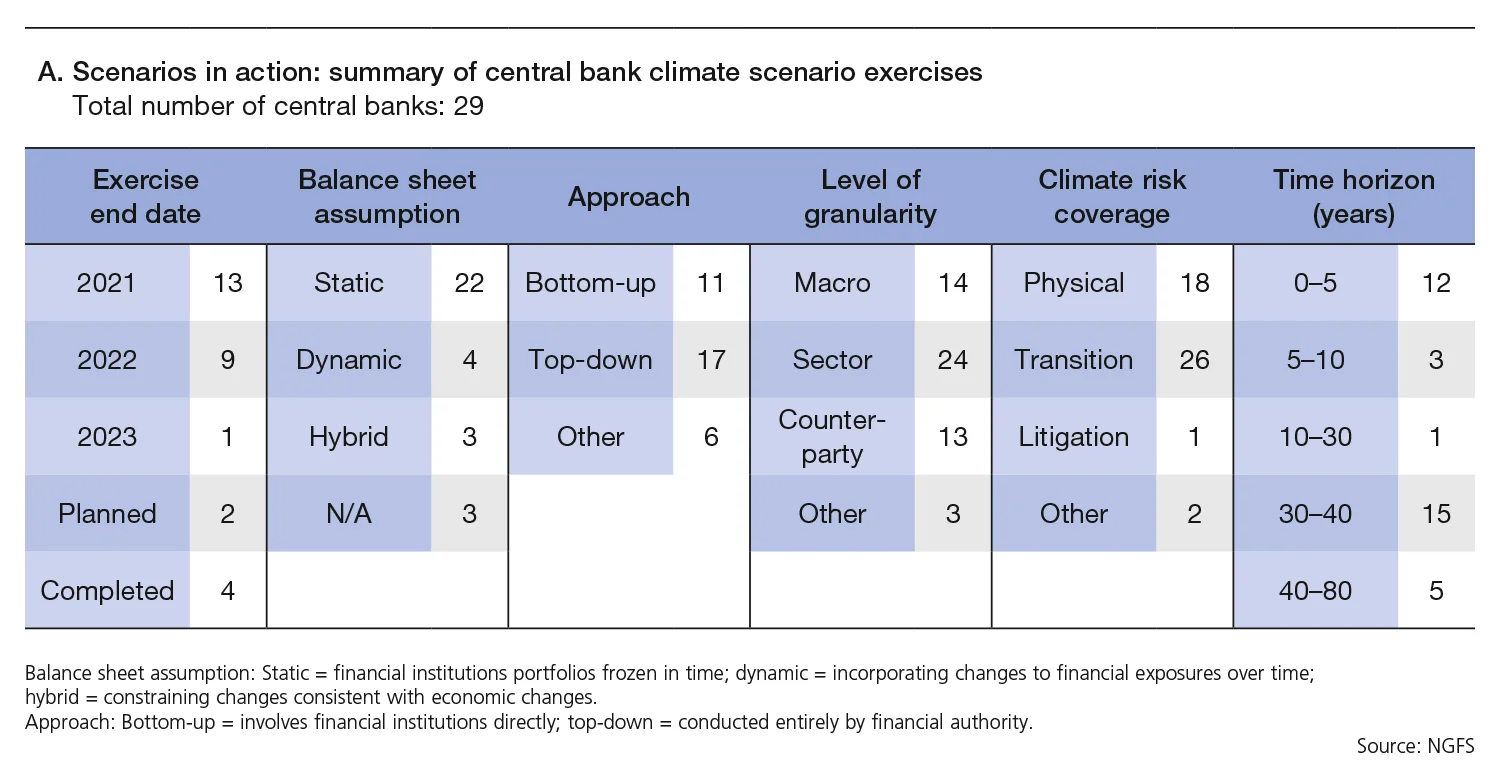

ESG agendas are an important tool in policy management and accountability – they make central bank actions more transparent. Different central banks will likely take a different approach to incorporating ESG agendas. The first versions of central bank climate scenario exercises, for example, choose between hybrid, static or dynamic balance sheet assumptions, bottom-up or top-down approaches, different levels of granularity – whether by sector, counterparty or macroeconomic perspective – different types of risk, such as physical, transition or both, and different time horizons ranging from 0 to 80 years (see table A).

Many central banks have undertaken the hard work of climate scenario analysis as summarised in table A. Though only 29 central banks are in the process of completing climate scenario exercises, several others have made plans to do so. The Central Bank of Brazil has told us it plans to collect information on ESG risks from individual banks via a survey in December 2021 and will conduct annual stress tests from next year

The current landscape calls for change and central banks have several stakeholders, including governments, private banks, payments providers, corporations and citizens. Central banks are being mindful to strike a balance between innovation and disruption, and are finding this balance within their own new sustainability agendas and fields of activity. With new tools, such as climate scenario analysis, added to their toolboxes, central banks are seeking to understand climate risks and their impacts on their economies and financial systems.

Notes

1. M Arena, R Bems, N Ilahi, J Lee, W Lindquist and T Lybek (September 2021), Asset purchase programs in European emerging markets, IMF Departmental Paper, www.bit.ly/3q67zJ8

2. C Brunetti, B Dennis, D Gates, D Hancock, D Ignell, E Kiser, G Kotta, A Kovner, R Rosen, and N Tabor (March 2021), Climate change and financial stability, www.bit.ly/2ZMnZff

3. C Castro, M Duffy, W Vandenhoeck, M Vargova, Invesco (September 2021), ESG Engagement Report: Central Bank of Brazil.

4. Central Bank of Brazil (September 2021), Report on social, environmental and climate-related risks and opportunities, www.bit.ly/2Zc5LDa

5. Invesco (2021), Invesco global sovereign asset management study, www.bit.ly/3nS6QbJ

6. D Kyriakopoulou, Official Monetary and Financial Institutions Forum (OMFIF) (2019), Central banks and climate change, OMFIF Special report, www.bit.ly/2ZMOXDu

7. Moody’s (September 2021), Four forces reshaping financial landscape have potential to dislodge incumbents, www.bit.ly/31lBJhb

8. NGFS (October 2021), Scenarios in action: A progress report on global supervisory and central bank climate scenario exercises, Technical document, www.bit.ly/3bRYKdT

9. YaleNews (October 2018), Yale’s William Nordhaus wins 2018 Nobel Prize in Economic Sciences, www.bit.ly/3nS4XvF

This feature forms part of the Central Banking focus report, ESG for central banking 2021

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

This article is for Central Banking only and is not for consumer use. Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This is marketing material and is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Issued by Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com