Paul Fisher, fellow at the Cambridge Institute for Sustainability Leadership and senior adviser for Oliver Wyman, discusses how central banks can act to contribute to mitigating and adapting to climate change, and identifies some worthwhile interventions.

In recent years, a debate has emerged concerning the asset purchase programmes of the Eurosystem1 and, to a lesser extent, the Bank of England (BoE).2,3,4 In buying portfolios of corporate bonds, the central banks are supporting economic activity that is not yet consistent with the 2050 net zero carbon emissions targets of the European Union and the UK.5,6,7,8

This debate has been much too narrow. It has ignored the wider context of central bank balance sheet expansion. Since the global financial crisis that began in 2007–08, the Eurosystem balance sheet has expanded more than fivefold, and that of the BoE more than twelvefold. These expansions will be persistent, reflecting both monetary policy and financial system requirements. But there has been little academic or public debate about the optimal composition of the resulting asset portfolios. The case has been made that these asset portfolios – and the operations used to acquire them – could be managed to affect financial stability conditions, without prejudice to monetary objectives.9

This article argues that:

- Not only is it permissible for a central bank to be involved in climate mitigation activities, their existing mandates require it.

- The expansion of their balance sheets has given central banks the ability to act, without impacting adversely on monetary policy.

- The debate should consider all assets, not just corporate bond portfolios.

- Arrangements could be made to avoid central bank staff making detailed capital allocation decisions.

- Future debate should centre constructively on what problems central bank operations can help to fix and which policies are effective.

Central bank balance sheets and recent developments

Since the financial crisis, the approach to monetary policy by many central banks has changed markedly. Given the large demand shock, interest rates were cut to around zero, and central banks resorted to base monetary creation to stimulate inflation and support output.

In particular, the BoE and the Eurosystem embarked on large-scale asset purchase programmes of corporate bonds and sovereign debt. To achieve the monetary outcomes of these expansions – increasing the quantity of base money and lowering prevailing interest rates – it did not matter what was bought. Buying large quantities of sovereign debt brought down the risk-free rate – against which most asset prices are calculated. All rates of return were similarly affected and all spreads between assets were reduced. This can be fairly labelled quantitative easing.

The choice of which assets to buy was nevertheless significant and driven by related policy objectives. The yield curve was influenced by the choice of maturities bought. Direct action to purchase corporate bonds may also have had an additional impact on corporate financing, which was desirable given the weakness of commercial bank lending. In the US, concern over the housing market led the Federal Reserve to purchase housing-related assets. Purchase of private assets, rather than sovereign bonds, to ease particular market conditions in addition to expanding the money supply, can be fairly described as credit easing.

Fisher and Hughes Hallett9 argue that these expansions will persist, and not just because of monetary policy considerations. After the financial crisis, the liquidity regimes for commercial banks were tightened and the banks must now hold considerably more liquid assets on their balance sheets. Their reserve accounts (above any minimum required) are the most liquid asset they have. If central banks now reverse their expansions, they will discover demand for reserves is much higher than pre-financial crisis. From 2018, the Fed tried to actively reduce its asset holdings as interest rates were increased, but in 2019 – before they had proceeded very far with reversal – they started to experience episodes of volatility in short-term interest rates. That is exactly what one would expect as the supply of base money starts to edge below demand.

The broad question that arises is that, given the desired scale of the monetary base and in the absence of monetary policy or financial stability requirements, which assets should central banks hold in future? It could be largely sovereign debt as now, but there is no requirement that it must be. Different choices of asset composition could be consistent with the same level of interest rates and the same level of base money. Hence monetary policy would not be impacted significantly by making different choices.

Central banks and climate change

Some commentators, such as The Wall Street Journal, argue that climate change is not a valid policy matter for the central bank.10 To take climate change matters into account would mean a central bank operating outside of its monetary policy mandate that would bring its independence into question. Moreover, given the existing power of unelected central bank officials, it would be undemocratic and dangerous to stretch their objectives further. Even those who accept that it is a responsibility for central banks have argued it is not the central bank’s role to allocate capital, and that market neutrality is necessary to avoid unintended economic distortions.2,11

The counter-arguments include:

- Everyone must play their part. Climate change is an existential threat to human existence. The Intergovernmental Panel on Climate Change describes the issue as being “widespread, rapid and intensifying”,12 and UN secretary-general António Guterres said this was “code red for humanity”. It is imperative for all actors in society to do whatever they can to mitigate (and help adaptation to) climate change.

- Secondary objectives. About half the world’s central banks have secondary objectives that usually require them to support governments’ broader economic policies.13 Since climate change mitigation and adaptation is part of those broader policies, these central banks have a duty to engage.

- Both the European Central Bank (ECB) and the BoE have secondary objectives. The Treaty on the Functioning of the European Union states: “Without prejudice to the objective of price stability, the European System of Central Banks shall support the general economic policies in the Union with a view to contributing to the achievement of the objectives of the Union.” In 2021, the UK government included climate change explicitly in its guidance and remit letters to the BoE’s policy committees, to clarify this.14

- Primary objectives. Climate change has significant, pervasive effects that impact all of the primary objectives of a central bank.15 Therefore, they have no choice but to take it into account. Most of the policy action to date has been in relation to prudential regulation and supervision, but climate shocks – both from physical events and the transition to a low-carbon economy – are a threat to monetary and financial stability.

- Independence. The most likely consequence of inaction is that central bank mandates will be changed to not only permit, but require, climate action. But, once a mandate is reopened, other politically motivated changes might be proposed. The hard-won independence of central banks – essential for monetary policy – may be best preserved by realising they need to take climate action, rather than by rejecting it.

Greening the balance sheet

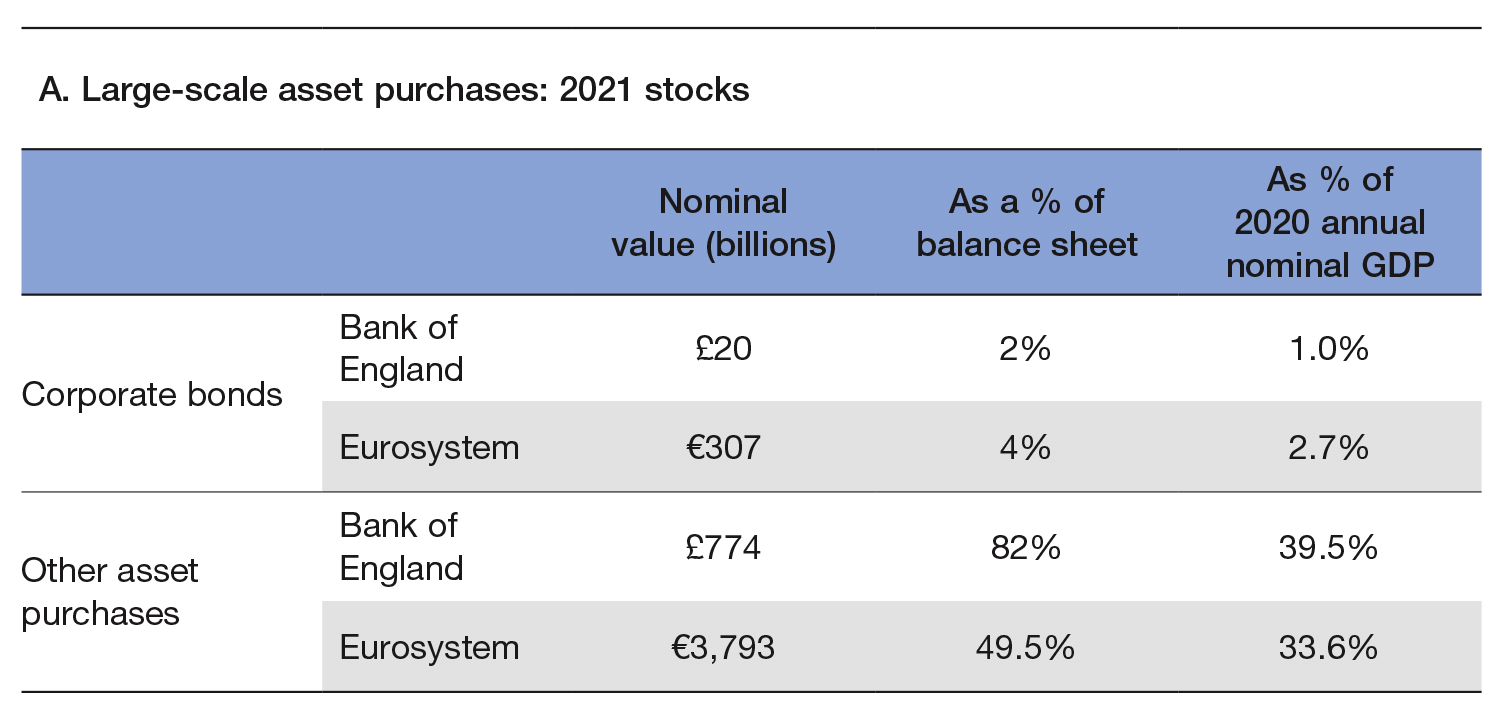

To date, the discussion around greening central bank balance sheets has largely focused on corporate bond portfolios, but these are not a large part of the respective central bank balance sheets – just 2% in the case of the BoE and approximately 4% for the ECB (see table A). ‘Tilting’ these portfolios by favouring green assets is possible, but the direct market impact would be small, though it may still be worthwhile, and the BoE invites private market participants to discuss the process for tilting.16 This could help establish new, voluntary market standards, which could be more important than any changes to the BoE’s own portfolio.

There is some discussion about changing eligibility rules for collateral in central bank lending operations to favour green assets or penalise ‘brown’ assets. This may be worth doing at the margin but, due to the massive injections of liquidity through quantitative easing, there is minimal lending being undertaken by either central bank and this is likely to remain the case for the foreseeable future.

The overarching question that needs to be addressed is: What should be the composition of central banks’ assets sheets as a whole? In this context, that means whether and how might they be used to direct finance to support a low-carbon economy. For example, one possible policy would be to buy specific portfolios of green assets.

The challenge to that is not one of mandates, nor conflict with monetary policy, nor lack of space on enlarged balance sheets. The main challenge for central banks is to establish what needs to be done and why. In general, evidence of market failure would be needed to justify a policy intervention in financial markets. As it stands today, we have no evidence of insufficient demand for green assets in general – those green bonds that come to market can be hugely oversubscribed, with increasing evidence of a premium for the issuer.17 A central bank operation to simply increase demand indiscriminately could damage nascent market growth by reducing liquidity. The real problem seems to be a lack of supply, which is not obviously within the scope of central bank operations.

If specific evidence of a shortage of demand was forthcoming – perhaps because private returns from some green investments did not reflect the public benefits – that would justify action. But one also needs to establish whether such action should be taken by the central bank or by the government.

The existing assets of both the Eurosystem and the BoE comprise largely sovereign bonds. Effectively – albeit at one remove – they have made it possible for their governments to issue more debt. The proceeds from issuing that debt could be used to finance green investments, especially where there are significant public benefits would accrue. And the government, rather than than the unelected, apolitical central bank, would be better placed to judge that, Against this, one could argue that government budgets have become overly stretched – first by the financial crisis and now by the Covid-19 pandemic. And governments are not very good long-term financial investors either. It might be efficient and effective if central banks were able to intervene to help finance the green transition.

The policy could be for the central bank to buy fewer sovereign bonds and instead finance those green assets that the market would not (subject to appropriate risk considerations). However, unlike fiscal authorities, central banks cannot simply spend or take undue risk with public money. So any intervention would probably be debt finance of some description.

This proposal raises an additional challenge – central banks are not skilled in allocating capital or even in what counts as ‘green’. How would they be able to pick out which green assets to acquire? They have experience in managing foreign currency reserves, but that mostly comprises high-quality sovereign, agency or supranational debt. In the longer version of this paper, the authors explain in greater depth how central banks could organise green asset purchases through outsourcing. This could range from financing a special purpose vehicle – which is how the BoE organises its gilt purchases – to buying the debt of, or placing a deposit with, an external public green development agency. The green assets would thereby be chosen and managed at some remove, but the investment outcome could be achieved. Indeed, as a ‘core investor’, central bank participation could help leverage more private investment.

Conclusion

Central banks can and should be taking action to contribute to climate change mitigation and adaption, including through their expanded balance sheets – not just corporate bond portfolios acquired for monetary policy purposes. The policy debate should be focused on identifying constructive interventions. Should they be limited to market development issues? Or are there green investments, justified in terms of public welfare, that cannot be privately financed and would warrant public intervention?

To the extent that this is conforming with secondary objectives, we assert that there would be no threat to independence if such action was discussed and agreed with governments and be subject to appropriate oversight and accountability – and the outsourcing approach would facilitate that. The greater threat to independence could be to do nothing. Uninvited, explicit direction and control from governments on this issue could lead to further, less welcome encroachments.

This article is a summary of a working paper by Paul Fisher and Diarmuid Murphy, published by King’s College Business School, Data Analytics for Finance and Macro Research Centre, where Fisher is a senior research fellow. All views expressed here are those of the author.

Notes

1. For the consolidated balance sheet we refer to the Eurosystem rather than the European Central Bank (ECB) or the European System of Central Banks. However, monetary policy decisions are taken at ECB level, hence we interchange appropriately throughout this article.

2. Weidmann, J (October 2019), Climate change and central banks, Welcome address at the Deutsche Bundesbank’s second financial market conference

3. Cochrane, J (October 2020), Challenges for central banks, European Central Bank

4. Villeroy de Galhau, V (February 2021), The role of central banks in greening the economy, Banque de France

5. Bank of England (June 2020), The Bank of England’s climate-related financial disclosure 2020

6. Bank of England (June 2021), The Bank of England’s climate-related financial disclosure 2021

7. Ilzetzki, E, and J Jia (March 2021), The ECB’s green agenda, VoxEU

8. Hassler, J, Krusell, P, Olovsson, C, and M Reiter (February 2020), On the effectiveness of climate policies, Working paper

9. Fisher, P, and A Hughes Hallett (December 2018), Can central bank balance sheets be used as a macro-prudential policy tool?, King’s College School, Data Analytics for Finance & Macro Research Centre, Working Paper 2018/6

10. Sindreu, J (July 2021), Fixing climate change isn’t the central bank’s job, The Wall Street Journal

11. Weidmann, J (November 2020), Combating climate change – What central banks can and cannot do, Speech at the European Banking Congress

12. Intergovernmental Panel on Climate Change (2021), Summary for policy-makers, AR6 climate change 2021: The physical science basis, Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, Cambridge University Press

13. Dikau, S, and U Volz (March 2019), Central bank mandates, sustainability objectives and the promotion of green finance, Working Paper series, Department of Economics, SOAS University of London

14. Bank of England (March 2021), MPC remit statement and letter and FPC remit letter

15. Fisher, P, and K Alexander (2020), Central banking and climate change, Making the financial system sustainable, chapter 3, pp. 49–74.

16. Bank of England (May 2021), Options for greening the Bank of England’s Corporate Bond Purchase Scheme, Discussion paper

17. Climate Bonds Initiative (March 2021), Green bond pricing in the primary market H2 2020

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com