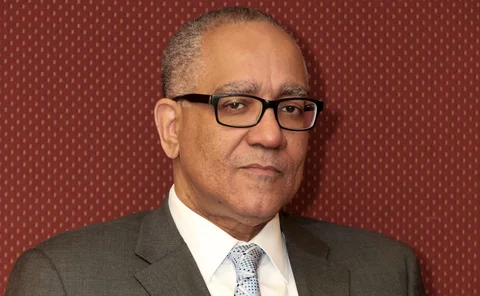

Christopher Jeffery

Editor jefe, Publicaciones sobre banca central

Christopher Jeffery es redactor jefe de Central Banking. Desempeña una función global y es responsable del contenido editorial y los equipos de Central Banking, lo que incluye el servicio Benchmarking Service y la revista Central Banking Journal. Cuenta con más de 20 años de experiencia periodística en temas relacionados con la gestión de activos, la banca, la banca central, los derivados, la economía, las finanzas, la tecnología financiera, los pagos, las políticas públicas, la gestión de riesgos y la estrategia. Actualmente afincado en Londres, Chris ha trabajado anteriormente en América y Asia. Chris es cofundador del servicio de evaluación comparativa de Central Banking y fundador de los premios Central Banking Awards. Anteriormente fue editor de Asia Risk; subdirector , editor europeo y editor de noticias de Risk.net; y director editorial de Lafferty Publications.

Sigue a Christopher

Artículos de Christopher Jeffery

Brian Wynter on Jamaica’s inflation-targeting transition

Jamaican governor says the end of fiscal dominance plus the creation of a two-way forex market and an effective interest rate policy mechanism essential for “full-fledged” inflation target

Next financial crisis “will be brewing” in shadow banking – Bullard

Silicon Valley disruption represents threat to financial stability; Fed has limited powers to counter it despite FSOC and tough new bank rules, says Eighth District president

James Bullard on 2% rates, tariffs and Fed leadership

The president of the Federal Reserve Bank of St Louis speaks about the impact of US trade policies, the disruption to the banking industry from Silicon Valley, shrinking the Fed balance sheet and the potential for agent-based modelling

Shock end to euro floor avoided ‘enormous’ speculative attack, says SNB’s Jordan

Swiss central bank chairman believes sudden removal of forex controls was least bad policy option and limited reputational damage

SNB chairman dismisses calls for revised inflation targets

Jordan says raising targets would 'harm credibility' built up over decades; sees room for more negative rates

Switzerland’s Jordan on extraordinary monetary policy and sovereign money

The Swiss National Bank governor speaks about currency intervention, negative rates, sovereign money and the diversification of reserves

No failure of governance in English-speaking Caribbean, says Wynter

Jamaica’s governor says dismissal of Barbados and T&T peers reflects government agendas; “has been a scandal” in Curaçao and Sint Maarten

New Jamaican law could end Caribbean’s ‘colonial era’

Granting the Bank of Jamaica operational independence to pursue an inflation target could transform central banking in the Caribbean

Bank of Jamaica’s Wynter on the path to inflation targeting

Bank of Jamaica’s governor talks about revamping accountability, communications and operations as the central bank embraces inflation targeting

Argentina falters at ‘historic’ moment for BCRA

Replacing Federico Sturzenegger with a finance minister with close ties to the president sends a confused signal about central bank independence

Central banks still value diversification, say reserve managers

Rise in US yields does not outweigh the benefits of forex diversification, say delegates attending Nalm Americas

Trigger for emerging market sell-off still playing out, warns Argentine governor

There is a possibility of Argentina being “challenged further”, says Sturzenegger

Chilean deputy points to US inflation as biggest risk

US growth is broadly positive, but sustained wage growth could drive up rates causing sharp portfolio outflows from emerging markets; Chile relatively well positioned

Time for Central Bank of Argentina independence

Monetary financing has fallen sharply under Mauricio Macri’s administration, but must now end; independence law would help efforts to shatter Argentina’s inflationary shackles

Federico Sturzenegger on Argentina’s efforts to create a credible central bank

The Central Bank of Argentina governor, in his last interview before leaving office, speaks about panic in emerging markets, the IMF bailout, and bringing to an end high inflation and monetary financing

Regulatory efficiency or rollback?

Team USA’s new clarion call for regulatory “efficiency” comes with a worrying undertow, particularly related to regulatory rollback and ‘light-touch’ supervision of algorithms

Philip Lane on systemic risk, transparency and Brexit

The Central Bank of Ireland governor speaks with Dan Hardie and Chris Jeffery about transparency, shadow banking, ECB succession and tackling systemic banking risk in the eurozone

BoE faces ‘uncomfortable’ approach to May meeting – Forbes

Former MPC member says pre-announcing a rate rise “could be quite dangerous”, as Mark Carney appears to row back from signalling a hike

CFTC’s fintech catch-up effort includes ‘global sandbox’ push

Chairman Christopher Giancarlo says the US derivatives regulator is seeking co-operation agreements around the world

Quarles: yield curve flattening not “likely” a signal of recession

Flattening of yield curve is due to “expected lags” in the adjustment of longer-term rates once shorter-term rates start to rise, says Fed vice-chair

Kganyago on central bank independence and future plans for the IMFC

The South African Reserve Bank governor spoke with Christopher Jeffery at the Central Banking Awards about the South Africa’s new president, the importance of operational independence and key targets for the IMFC

A route to economic growth – The Belt and Road Initiative 2018 survey

To mark the fifth anniversary of the Belt and Road Initiative (BRI), the IFF – in collaboration with Central Banking – conducted its inaugural Belt and Road Survey of central banks from more than 25 countries and regions. The survey examines BRI…

A changing of the guard

Risks emerge amid leadership changes at the US Federal Reserve Board and the People’s Bank of China

Saudi Arabia’s Alkholifey on economic restructuring, reserves and cyber security

The Saudi Arabian Monetary Authority’s governor talks to Christopher Jeffery about the restructuring of the Saudi economy, the impact of low oil prices on reserves and anti-money laundering efforts