Daniel Hinge

Editor, Benchmarking

Daniel Hinge es editor del servicio de evaluación comparativa de Central Bankingy especialista en economía y política monetaria. Lleva informando sobre la comunidad bancaria central desde 2012, desempeñando funciones como editor de noticias y editor de comentarios. Es licenciado en Política, Filosofía y Economía por la Universidad de Oxford.

Puede seguir a Daniel en Bluesky.

Sigue a Daniel

Artículos de Daniel Hinge

David Mayes: 1946–2017

The internationally minded professor was a stalwart of the central banking community

Mario Draghi confirms Basel III is complete

Governors and heads of supervision grant final approval to the amended Basel III framework, but the parties fail to agree on sovereign asset treatment

BIS top body poised to approve Basel III

The GHOS meets on December 7, and all signs indicate it will finally give Basel III the green light

BoE officials deny policy pass-through is their job

Michael Saunders says Bank of England lacks tools to force banks to change rates

Fernando Restoy looks to realign Basel’s FSI

The Financial Stability Institute chair discusses the prospects for implementing Basel III, the challenging political context and the FSI’s role in it all

The rapid evolution of data

As big data enters the mainstream, it is critical to understand how it can transform our thinking, but also to be realistic about its shortcomings and biases

Making the most of big data

Per Nymand-Andersen, adviser to senior management at the European Central Bank, discusses how central banks can benefit from embracing big data and what this could mean for the industry in the near future.

Bank of England pulls trigger on rate hike

Committee split 7-2, but Carney strikes hawkish note on need for further hikes

A new era for the BIS

As Basel III inches towards closure and a new BIS general manager prepares to move into his post, Jaime Caruana talks to Daniel Hinge about his eight years at the helm

BIS could have done more to convey capital benefits – Caruana

Outgoing general manager says he would like to have better conveyed the “positive message” around capital, and made more progress on policy spillovers

Teaching machines to do monetary policy

Machine learning may not yet be at the stage where central bankers are being replaced with robots, but the field is bringing powerful tools to bear on big economic questions

Interview: Edward Prescott

The Nobel Prize-winner speaks to Daniel Hinge about time inconsistency and real business cycle theory, and explains why there is no ‘productivity puzzle’

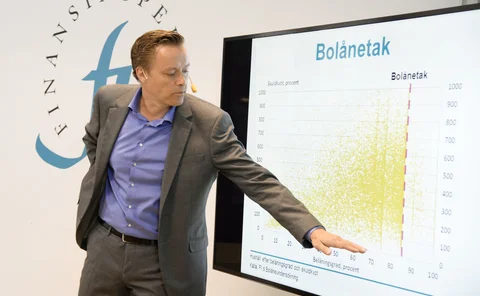

Riksbank’s new stability chief resigns after less than a week

Henrik Braconier says he regrets stepping down from his former role with Finansinspektionen

Central banks should take transparency further, economist argues

Dissenting MPC members can hide behind vagueness and “verbiage”, says Tony Yates

Debelle calls for more thought on financial stability independence

RBA deputy says financial stability needs its own intellectual framework; panellists warn independence likely to face tougher challenges ahead

BIS study flags ‘missing debt’ as exuberance spreads

Strong macroeconomic backdrop is encouraging risks to grow, BIS warns; new and updated datasets launched

Bank of Canada rebuts ‘epic fail’ communication claim

Central bank’s head of comms rejects criticism from Bank of Montreal that policymakers failed to properly signal its recent rate hike

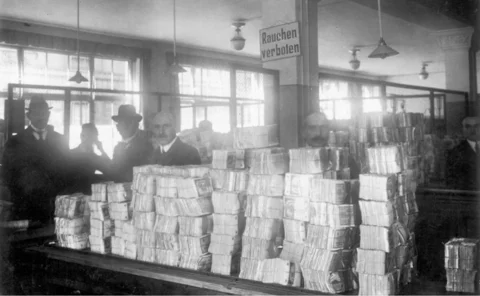

Dispelling the German monetary myth

Economic historian Simon Mee finds the famous German aversion to inflation was the product of political battles in the mid-twentieth century

Draghi’s ‘whatever it takes’ is not credible – Nobel laureate

Chris Sims says ECB cannot be sure it will be able to stop a run on the euro until it is backed by a central eurozone fiscal authority

Opaque money markets work well, Nobel laureate says

Bengt Holmström says policymakers should not try to make money markets more transparent

New NY Fed dataset shows weakening labour market

New York Fed unveils new, more granular labour market data; results so far indicate wage growth is still elusive

Banks are scrambling to hit IFRS 9 deadline – survey

Many banks appear to have been caught off-guard by the complexity of adapting to IFRS 9; impact assessments still patchy, but some see provisioning needs up by 40% or more

Court dismisses ‘irrational’ Sarb mandate challenge

Judge finds South African public protector’s attempt to change the Sarb’s mandate was illegal, irrational and unfair

UK economy vulnerable to consumption-led recession

Fragile consumer spending could take a toll on growth, former BoE officials warn, leaving the central bank with a tough job ahead