Daniel Hinge

Editor, Benchmarking

Daniel Hinge es editor del servicio de evaluación comparativa de Central Bankingy especialista en economía y política monetaria. Lleva informando sobre la comunidad bancaria central desde 2012, desempeñando funciones como editor de noticias y editor de comentarios. Es licenciado en Política, Filosofía y Economía por la Universidad de Oxford.

Puede seguir a Daniel en Bluesky.

Sigue a Daniel

Artículos de Daniel Hinge

Banks face higher capital requirement under Basel trading book review

Basel Committee impact study on the fundamental review of the trading book implies minimum capital allocated to market risk will rise substantially for some banks

Shawwa succeeds Al-Wazir as Palestine governor

Azzam Shawwa set to take over as Palestine Monetary Authority chief as Jihad Al Wazir’s eight years at the helm draw to a close

The big data revolution and central banking

Central banks are increasingly turning their attention to the challenge of analysing very large datasets. But is ‘big data’ as revolutionary as some claim?

The Islamic liquidity facility conundrum

The rapid growth of Islamic finance could undermine both financial stability and monetary policy if central banks do not set up sharia-compliant facilities

Open Forum: Market maker of last resort presents host of issues for central banks

Axel Weber and Minouche Shafik point to perils for central banks looking to step into the role of market maker during a liquidity crisis

Open Forum: BoE event highlights gulf between perception of public and regulators

Open Forum attempts to break new ground in communication, but a sense emerges that regulators have failed to address public dissatisfaction with financial markets

Rajan picked as BIS board vice-chair as he calls for global ‘rules of the game’

RBI governor chosen to take over position Masaaki Shirakawa vacated in 2013; delivers lecture in Frankfurt calling for global ‘rules of the game’

‘Disclosure task force’ can tackle climate risks, FSB says

Industry-led group would develop voluntary disclosures relating to climate change; Mark Carney says better information could head off a ‘climate Minsky moment’

FSB unveils final TLAC standard

Global systemically important banks will need to build sizeable stocks of loss-absorbing capacity by 2019; many jurisdictions are lagging behind on implementing resolution framework

Central Bank of Iceland under scrutiny on crisis response

Supervisory board to investigate complaints over the handling of breaches in capital controls and legal uncertainty surrounding the holding company established by the central bank

No fireworks as Bank of England keeps rate options open

Rates remain on hold as BoE balances domestic strength with signs of weakness overseas; MPC hints a few forces could prompt an earlier hike than markets are predicting

Bank of Israel unveils plans for better credit data gathering

Registry designed to improve both credit provision and financial stability; deputy governor says central bank has learnt from others while tackling what has been a major project

BoE’s Brazier defends new stress testing framework

Executive director says the Bank of England already has much of the forecasting infrastructure it needs, but will not overestimate its ability to spot the UK’s position in the financial cycle

Economists challenge foundations of monetary economics

‘Neo-Fisherian’ approaches use standard New-Keynesian models to show that cutting interest rates will produce lower, not higher, inflation – and the result is surprisingly difficult to overturn

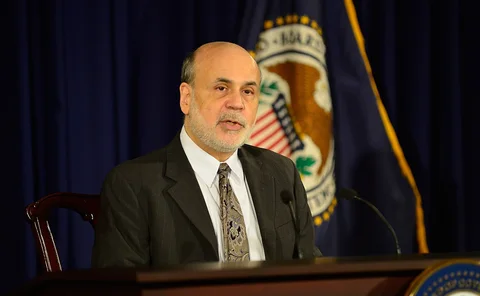

Bernanke offers insight into Fed’s political balancing act

Former Fed chair tells of navigating both political and economic pitfalls in crisis response, and says the US central bank’s independence is still under threat

Vocalink to deliver ‘new generation’ real-time payments in US

CEO David Yates tells Central Banking there will be unique challenges to delivering real-time payments in the US, as Vocalink is chosen to provide software behind faster payments project

Liquidity issues demand further work, says BoE’s Cunliffe

Greater fragility of market liquidity requires reassessment of regulation, new stress tests and better data, BoE deputy says; private sector economists warn of distortionary effects from QE

Regulators push back at complaints of fatigue

EBA chief and secretary-generals of Basel Committee and Iosco defend their work so far and stress the bulk of regulation will be completed in 2016 – though there is more on the horizon

Carney wants ‘clear principles’ to safeguard non-euro members

Bank of England study of EU membership finds union has broadly contributed to ‘dynamism’ in the UK economy, but imposition of regulation from afar may not suit UK needs

BoE unveils new systematic stress tests

Stress tests designed to move counter-cyclically with the financial cycle and inform decisions on capital buffers; BoE looking to improve modelling techniques to keep pace

EBA plots shift to new phase of work

As European banking legislation is finalised, the institution plans to concentrate more on harmonisation and less on standard-setting; expanding workload contrasts with shrinking budget

Central banks starting to unlock potential in big data

Some central banks are making tentative inroads into the study of big data, and many more want to, a study by the BIS’s Irving Fisher Committee finds

BoE unveils final plans for ring-fencing banks

Consultation sets out how bank holding companies should structure themselves to comply with legislation on ring-fencing, but a decision on extra capital buffers is yet to come

BoE turns attention to risk-free rate as markets push out expectation of hike

MPC mulling the question of whether lower rate expectations will provide enough stimulus to overcome growing risks from emerging markets; rates stay on hold