Venezuela to adopt a more flexible exchange rate

Analysts say liberalisation and US sanctions on oil industry are likely to further boost inflation

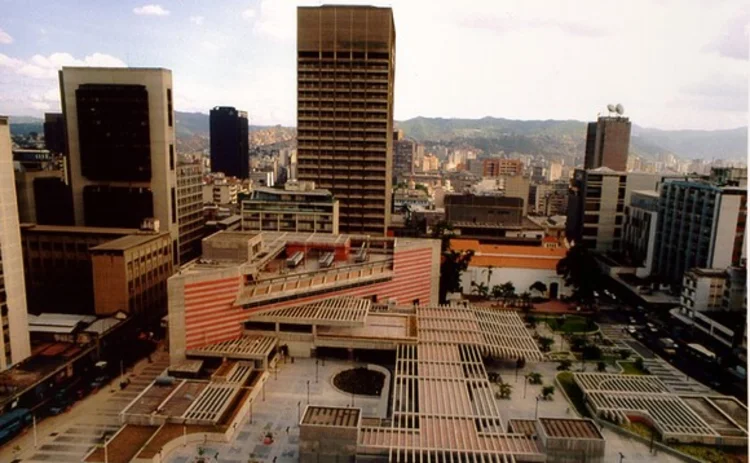

Venezuela announced a partial liberalisation of its restrictive exchange rate system on May 7 as the economy battles hyperinflation and US sanctions limit access to hard currency.

The new regulation allows local banks to act as intermediaries for exchange rate operations in the private sector for corporate and retail investors. The aim appears to be to achieve a more market-determined exchange rate and reduce the black market for the bolívar, although authorities did not explain the rationale

Solo los usuarios que tengan una suscripción de pago o formen parte de una suscripción corporativa pueden imprimir o copiar contenido.

Para acceder a estas opciones, junto con todas las demás ventajas de la suscripción, póngase en contacto con info@centralbanking.com o consulte nuestras opciones de suscripción aquí: subscriptions.centralbanking.com/subscribe

Actualmente no puede imprimir este contenido. Póngase en contacto con info@centralbanking.com para obtener más información.

Actualmente no puede copiar este contenido. Póngase en contacto con info@centralbanking.com para obtener más información.

Copyright Infopro Digital Limited. Todos los derechos reservados.

Tal y como se indica en nuestros términos y condiciones, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (punto 2.4), la impresión está limitada a una sola copia.

Si desea adquirir derechos adicionales, envíe un correo electrónico a info@centralbanking.com prueba prueba prueba

Copyright Infopro Digital Limited. Todos los derechos reservados.

Puede compartir este contenido utilizando nuestras herramientas para artículos. Tal y como se indica en nuestros términos y condiciones, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (cláusula 2.4), un usuario autorizado solo puede hacer una copia de los materiales para su uso personal. También debe cumplir con las restricciones de la cláusula 2.5.

Si desea adquirir derechos adicionales, envíe un correo electrónico a info@centralbanking.com prueba prueba prueba