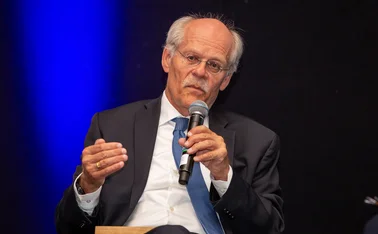

Central bank appointment gets warm welcome

Abul-Ayoun, who has served as deputy governor since 1999, has been credited with initiating a number of key policy moves in recent months, including the August devaluation, and has developed a strong working relationship with the country's senior bankers.

"It is a very good move," says a senior executive at one of the four public sector commercial banks. "It will bring a different mentality to the top level of central bank and should help to re-energise the financial market."

Abul-Ayoun replaces Ibrahim Hassan, whose second four-year term as governor ended on 13 October. Abul-Ayoun took over as acting governor as the government considered a number of candidates for the job. His appointment on a permanent basis was announced on 30 October.

Bankers say Abul-Ayoun has been keen to exchange ideas with the banking community about how best to tackle the problems facing the sector. Over the past 18 months, the Egyptian pound has been devalued by some 20 per cent, and the central bank has introduced a number of measures aimed at bringing down interest rates. However, the central bank discount rate still stands at 11 per cent, and analysts say that the high cost of borrowing is a major obstacle to any economic recovery.

Bankers say the challenge facing Abul-Ayoun has become more difficult following the 11 September attacks on the US because Egypt will have to cope with a sharp drop in hard currency earnings from tourism. "There may have to be a trade-off between cutting interest rates and maintaining exchange rate stability," says one Cairo-based international banker. With the anticipated squeeze on foreign exchange, any cut in Egyptian pound interest rates is likely to cause fresh pressure on the value of the local currency, the banker says.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Most read

- Trends in reserve management 2024: survey results

- People: RBI appoints senior officials

- China to start selling ultra-long term sovereign bonds