Governance Benchmarks 2024 – model banks analysis

Additional breakdowns of the data reveal details of central bank powers, staffing and more

Chinese policy-makers warm to PBoC bond trading

PBoC’s trading of government bonds will be different from QE, central bank official says

RBI forbids major bank from adding new customers digitally

Kotak Mahindra’s IT systems showed “serious deficiencies and non-compliances”, regulator says

US requests three-year prison sentence for Binance founder

World’s largest crypto exchange agreed to pay $4.3 billion for violating money laundering laws

BoE's forecasting review

Bernanke calls for total redesign of BoE forecasting

Report calls for major changes to infrastructure, core models, staffing, communications and more

Taking stock of Bernanke: the original sin of forecasting

Jagjit Chadha says the Bernanke review should be the start of more profound discussion at the BoE

Bank of England: time for fourth-generation forecasting tools?

Economists suggest ways to improve BoE’s framework ahead of Bernanke’s report

Fixing forecasting at the Bank of England

NIESR’s Stephen Millard makes the case for three key changes to the BoE’s forecasting

Editor's choice

Supervisors grapple with the smaller bank dilemma

How are the guardians of stability moving to address risks linked to smaller banks in the aftermath of SVB’s collapse?

Governance Benchmarks 2024 report – central banks’ core processes

The benchmarks shed light on central bank profitability and distributions, independence and more

Maximising the impact of banknote communications

Antti Heinonen highlights the ongoing evolution in how central banks talk about their banknotes

A new climate of change

Central banks are warming up to address climate risks just as US interest cools

Benchmarking

Central banks reveal top staffing constraints

Career progression limits, skills gaps and red tape identified as challenges

Most read

- ECB says iPhone is currently incompatible with digital euro

- Supervisors grapple with the smaller bank dilemma

- ‘Do I die, or do I survive?’ Officials reflect on Basel III complexity

A new climate of change

Central banks are warming up to address climate risks just as US interest cools

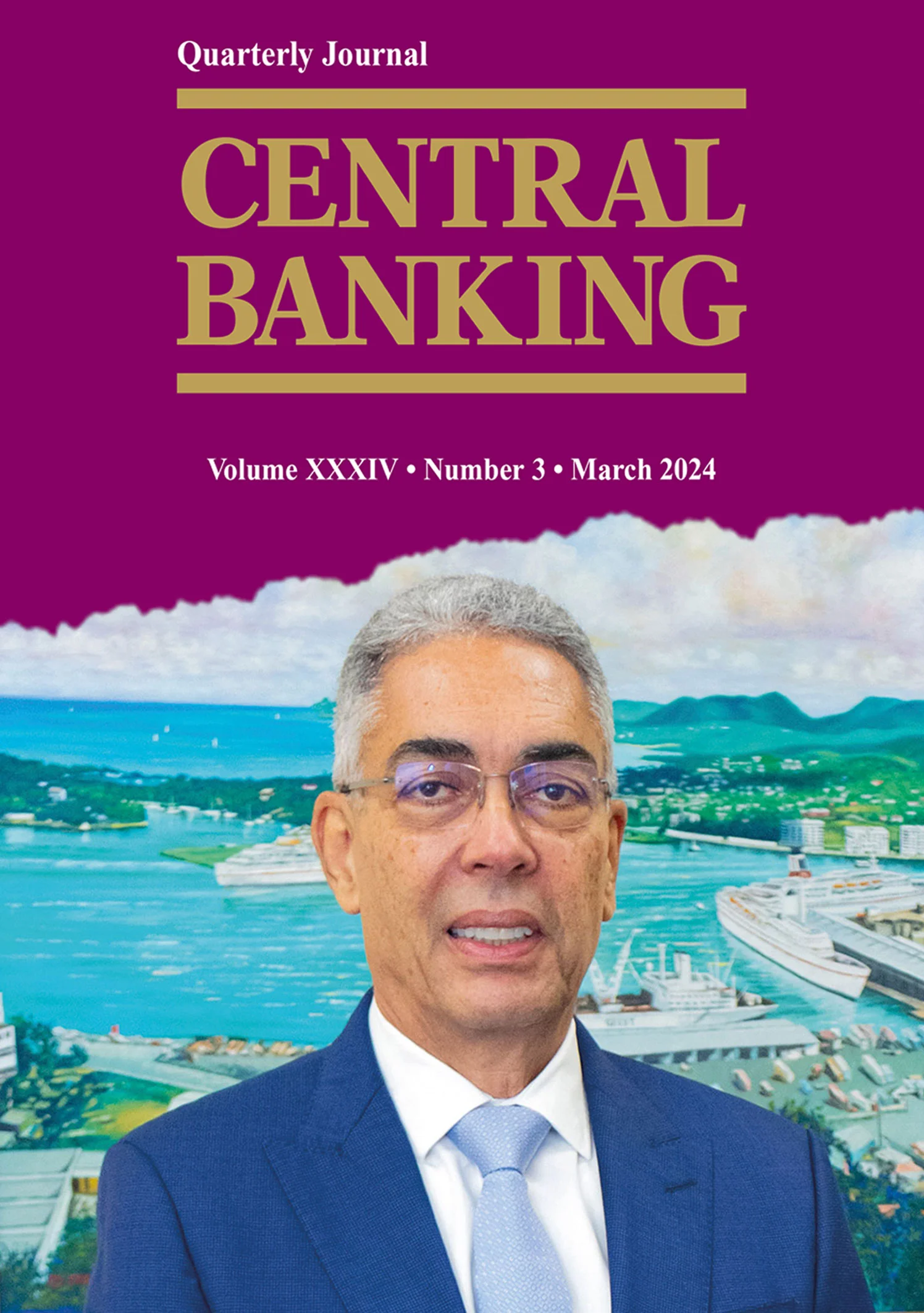

Awards

Central bank of the year: Central Bank of Brazil

The Latam central bank has pursued its mandate in an exemplary fashion, despite external pressures

Governor of the year: Andriy Pyshnyy

Pyshnyy kept Ukraine’s wartime economy stable and won vital foreign support under huge pressure

Central Banking Awards 2024: second group of winners unveiled

Ukraine’s Andriy Pyshnyy named Governor of the year

Central Banking Awards 2024: first winners unveiled

Awards go to Central bank of the year, plus Reserve manager, Risk manager and more

Sponsored content

About

These articles were paid for by contributing third parties. Click here for more information on content funding.