Matthew Tagliani, exchange-traded fund (ETF) head of product and sales strategy, Emea at Invesco, explores the diversification impacts ETFs can have on central banks’ portfolios.

Although investment returns aren’t always central banks’ top priority, corporate bonds and other investment assets are now being used to diversify reserve portfolios away from the traditional focus on gold, deposits and treasuries. How much diversification is possible depends on several factors, including risk tolerance, financial objectives and mandate restrictions, but the ETF structure has attractive characteristics for every central bank to consider, including low cost of ownership, transparency, ease of access, choice and precision. Indeed, many central bankers are now using ETFs more frequently, with the significant growth in assets and increased liquidity making these tools more viable for inclusion among their holdings. This article explores the effectiveness of ETFs for central bank portfolio diversification and their potential to add value to reserve portfolios, also discussing other key developments worthy of consideration in this area.

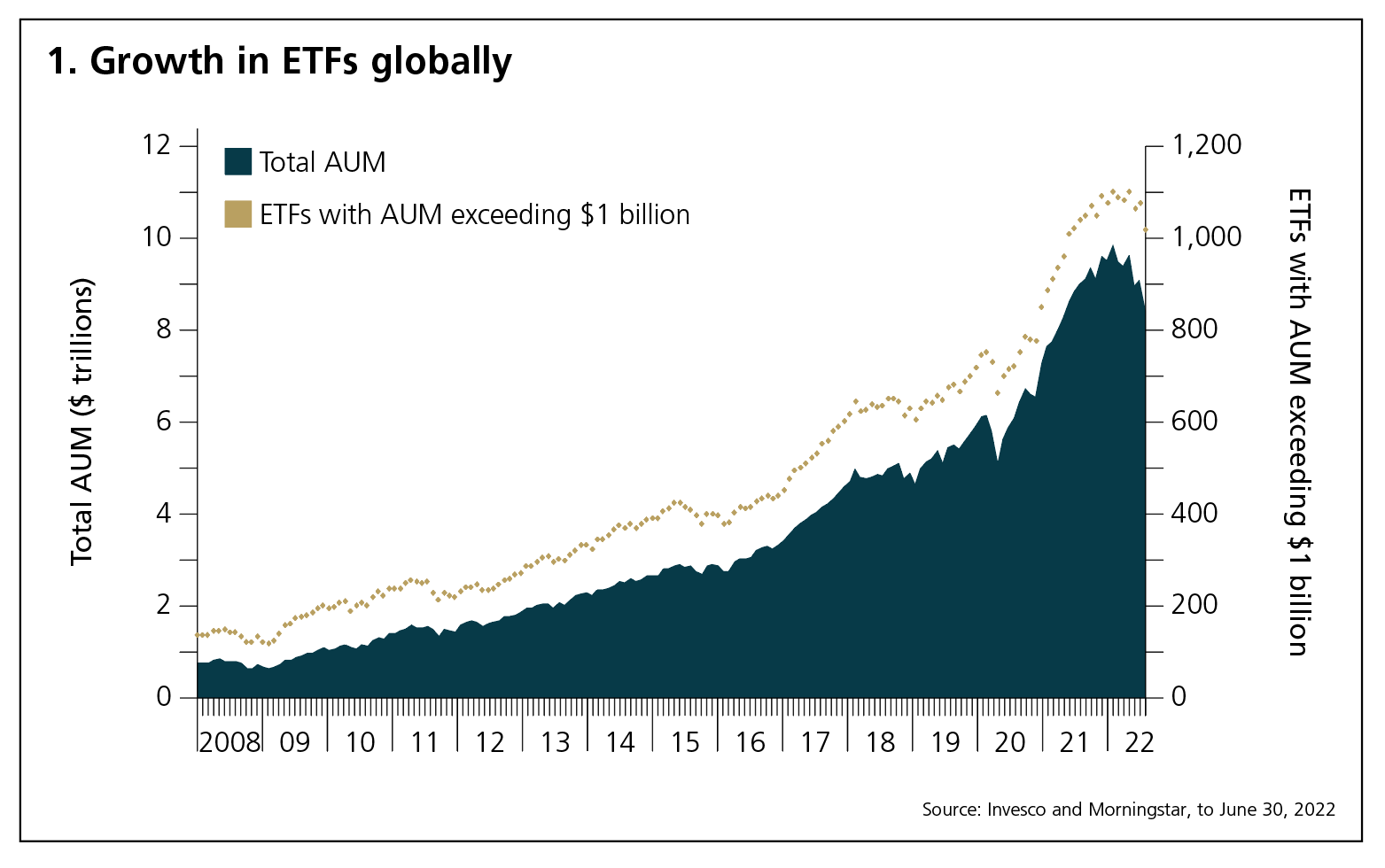

Assets invested in ETFs globally have grown significantly, at an annualised rate of 18.1% since 2008. So too has the number of large products: more than 1,000 ETFs are available globally with assets under management (AUM) exceeding $1 billion (see figure 1). This growth has been driven by an increased adoption of ETFs across investor types as issuers develop new solutions to meet demand. While the US ETF market is heavily driven by retail investors, ETFs domiciled in Europe are used more by professional investors and institutions, although most European ETFs are in fact undertakings for the collective investment in transferable securities (Ucits) funds, which can be distributed to all investor types. The European Union regulation on Ucits funds – which includes strict requirements on portfolio diversification, eligible asset types, risk management – is equally relevant for larger investors.

The normal starting point

Invesco’s experience reveals that most investors gain their first exposure to ETFs through an allocation to core asset classes such as US large cap equities. This tends to be true for small retail investors and institutions alike. ETFs that track the S&P 500 are among the largest funds on the market, have annual costs as low as a few basis points and tight bid/offer spreads on exchange. Perhaps even more appealing for central banks is that the deep liquidity in the underlying securities, as well as the ETFs themselves, means large trades can usually be filled efficiently either on-exchange or in the over-the-counter market.

Transparency is another attractive characteristic of ETFs. Invesco publishes the full holdings of each of its European ETFs daily on its website. This may seem less relevant for an ETF tracking a familiar index, such as the S&P 500, but it can be a significant advantage when investing in funds tracking lesser-known benchmarks. With most of the ETF market being passive investments tracking a stated benchmark, assessing suitability can be more straightforward as the fund will not look to deviate from the benchmark. The benchmarks themselves follow a pre-defined methodology with regular rebalancing and any material change – for example, inclusion of a new country in a regional index – is publicly announced in advance and, in many cases, subject to public consultation.

A solution for every situation

With ETFs now covering almost every segment, asset class, region and investment style, investors can find precise solutions for strategic and tactical allocations. Large, liquid ETFs can be an efficient means for gaining exposure to an asset class quickly and at low cost, whether a core long-term holding or one used in transitioning to an active solution at a later date. These core, ‘beta’ allocations were historically focused on equity products but are now just as likely to be used for fixed income or commodity exposures. The latter two asset classes are particularly interesting discussion points.

Most central banks will have direct holdings in government bonds, such as US Treasuries, as well as physical gold. These strategic holdings, along with deposit and money-market instruments, are generally used for capital preservation. Banks may want to consider physically backed gold ETFs – or gold exchange-traded commodities in European markets – possibly not as a replacement for the bullion held in the vaults but as a more effective low-cost alternative for tactical allocations. It should be noted, however, that an exchange-traded commodity is not a fund or an ETF – these products are fully backed by physical gold, stored securely in bank vaults and easily traded on exchange just as with any ETF or common stocks and shares. This provides central banks with a regulated vehicle for making tactical increases to gold without needing to source, transport and store the bullion directly.

A similar case can be made for fixed income ETFs, even for treasuries, with highly liquid products available for specific maturity buckets as well as across the full maturity spectrum. We are seeing these ETFs used increasingly by institutions such as insurance and pension funds, many of which have similar portfolio allocation models and objectives as central banks. They can be either low-cost core holdings that offer the bank’s targeted duration and currency profile, as a tool for making tactical adjustments, or used in a liquidity sleeve to meet near-term funding requirements.

ETFs offering exposure to investment-grade, high yield and more innovative fixed income segments could be interesting for banks wanting to enhance yield or increase credit risk. These products have seen growing demand since the liquidity shock experienced at the beginning of the Covid-19 pandemic, when the additional liquidity provided by a secondary market, meant many ETFs continued to trade even when liquidity in the underlying markets dried up. Although investors saw ETF spreads widen to compensate for increased risk, they soon appreciated that ETFs provided genuine price discovery as market-makers could trade the ETFs based on estimated or implied values for the underlying securities rather than last traded prices, which were often stale and untradeable.

Sustainability considerations

One of the most prominent trends witnessed in ETF markets – especially in Europe – is demand for funds that include screens on environmental, social and governance (ESG) factors. Half of all net new assets gathered by European ETFs in 2021 were into ESG products. Investors have a choice of ETFs ranging from those applying a relatively light touch – which could mean simply excluding the most controversial industries – to those following a strict best-in-class approach. This breadth of offering allows investors to choose the degree of ESG improvement they want for their fund, and the corresponding degree of performance deviation versus the standard index.

Central banks that are required, whether through mandate or public scrutiny, to avoid exposure to certain countries, industries or assets may find passive ESG ETFs preferable to their non-ESG counterparts. As with any passive approach, the ETF’s composition will be driven by the index methodology, and investors can see what countries are included in the universe, how exclusions are determined and how the final portfolio is constructed. ESG versions are now available on most core equity and fixed income benchmarks.

The future?

The future is now, as the core of investing is to allocate capital today for the changes that will occur in the future. Thematic ETFs – one of the fastest growth areas in the industry – aim to identify trends that will drive differentiated growth in certain subsets of the market. The list of available products includes funds targeting many pressing challenges facing the world today, such as the transition to cleaner sources of energy. With the leadership of many developed and emerging economies committed to neutralising carbon emissions in the coming decades, power grids will need to increase capacity in solar, wind and other renewable energy technologies. Hydrogen will also be crucial in powering industries where other renewables are impractical. While broad-based equities funds will have some exposure to these developing themes, a more targeted ‘clean energy’ ETF can offer more precise exposure.

Climate change is also having a detrimental impact on the planet’s food and water sources. The transition to more sustainable food will have economic implications, but socially conscious investors want to steer clear of benefiting from agricultural commodity price inflation. A ‘sustainable food’ ETF could provide a means to invest, not in rising crop prices, but from the development of critical technological and infrastructure solutions necessary to fight the threat of global food shortages and world hunger.

Conclusion

Whether seeking simple, low-cost beta exposure to core markets or using thematic and other innovative exposures to diversify portfolios, central banks should consider ETFs.

About the author

Matthew Tagliani is ETF head of product and sales strategy, Europe, the Middle East and Africa, at Invesco. He is responsible for new product development, managing the existing product suite and the generation of ideas, messaging and content for the sales teams. Prior to joining Invesco, Tagliani held various trading and product specialist roles at Morgan Stanley, Goldman Sachs and Credit Suisse in New York and London. He holds bachelor’s and master’s of science degrees in applied mathematics from the University of Massachusetts at Amherst and is the author of The practical guide to Wall Street: equities and derivatives, a finance textbook published by Wiley Financial.

This feature forms part of the Central Banking focus report, ETFs in reserve management 2022

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

This marketing communication is for discussion purposes only and is exclusively for use by Professional Clients in the UK. It is not intended for and should not be distributed to, or relied upon, by the public.

Data as at 20 July 2022 unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

Published by Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire, RG9 1HH, UK.

EMEA2302934/2022

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com