The rising international role of the renminbi

Renminbi is now the second most used currency in trade finance

The international use of the renminbi has risen dramatically in the past five years. The renminbi is now the second mostused currency in trade finance and the fifth most-traded payment currency, according to Swift. The offshore renminbi market has also sprouted, with renminbi clearing centres emerging in Australia, Germany, Hong Kong, Singapore and the UK, among others, along with trillions of yuan of bilateral currency swap arrangements between the People's Bank of China (PBOC) and foreign central banks to provide liquidity support when needed. To observers, the growth of the renminbi's international role, along with China's global investment, epitomises the country's expanding global ambition, against the backdrop of its fast economic expansion and the further integration of its economy into the global system.

The shortcomings and vulnerabilities of the current global financial system, the rising outreach of Chinese trade and investment, and the progress of China's financial and capital account reforms, have all shaped the renminbi's steady rise on the global stage.

A multi-pillar international monetary system with the renminbi as a reserve currency, supported by a more open capital account and a wider floating currency, will deliver benefits to both the global financial order and better growth domestically.

Shortcomings of the global monetary system

A global financial system that uses a single fiat money as its reserve currency faces an acute problem of discipline. The rest of the world relies on the reserve currency for transactional and savings purposes, generating huge demand for the designated reserve currency. This allows the reserve currency country to spend more than its export revenue allows, since its international debt does not face the pressure of a sell-off and squeeze by investors, as in the case of non-reserve currency countries. Such an "exorbitant privilege" - as Valéry Giscard d'Estaing, then the French minister of finance, noted in the 1960s - could give the reserve currency country an enormous advantage in its economic growth and management. In addition, the dominant role of the dollar means that the US effectively acts as a global central bank, and US monetary policy has great influence over international liquidity and economic conditions in other parts of the world.

The dollar's role in the international monetary system has been under continuous debate since it replaced sterling as the reserve currency more than 70 years ago. While the dollar has facilitated the liquidity of the global financial markets, providing anchors for countries during periods of macro stabilisation, the downside of the system has also been prominent at times. The US balance of payments crisis in the late 1960s resulted in the collapse of the Bretton Woods mechanism as the dollar de-pegged from gold. In the decade before the global financial crisis, US fiscal and external deficits rose substantially, leading to concerns about global balance of payments imbalances. However, the demand by foreign companies and governments for dollars helped to keep the US interest rate low, enabling it to fund large current account deficits while fuelling domestic asset bubbles (such as real estate). A report from the United Nations Conference on Trade and Development (UNCTAD) attributed the build-up of global imbalances and global financial crisis in 2008 to the inadequacy of the international monetary system, a view shared by Justin Lin (see Fixing the fault lines of the international monetary system).1

An ultra-loose monetary policy in reserve currency countries since the global financial crisis, with the sole focus on domestic economic objectives, has depressed global interest rates while driving capital flows to emerging markets. For instance, a recent study by the Bank for International Settlements (BIS, 2014) finds that the unconventional US monetary policy spills over to Asia mainly through low domestic bond yields and rapid growth of domestic bank credit, by compromising national control over long-term rates that are key determinants of economic activity.2 The expected reversal of this process in the coming year will likely imply a bumpy ride for the rest of the world.

As summarised by Kim Jun Il, deputy governor of the Bank of Korea, in his comments at the IFF AGM in 2014, under the system of a single reserve currency, the role of the reserve currency as a medium of exchange could come into conflict with its role as a store of value, as the demand for the former could reduce the incentive for keeping up with the latter. This subjects the world financial system to the whims of the monetary policy of the reserve currency country. A more diversified international monetary system, by introducing competition into the system, would likely help to ensure the store of value of reserves. Emerging market governments, therefore, are particularly keen to see this development - as net creditors in the global financial system, they have a proportionally larger share of US government debt and are vulnerable to big valuation losses on these holdings. The current global financial governance is in need of substantial reforms (see interview with Zhu Guangyao, vice-minister of finance).

The issue of a new global reserve system has attracted much attention in recent years, and different options have been proposed. One approach is to use a notional currency, such as by extending the special drawing rights (SDR) of the International Monetary Fund (IMF). The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries' official reserves under the Bretton Woods system. At present, the SDR comprises a basket of four currencies of developed nations: the dollar, euro, sterling and yen. Such a composition does not match the shift in global trade and investment in recent years where the importance of emerging markets is rising rapidly.

In 2009, PBOC governor Zhou Xiaochuan proposed that the currency basket of the SDR should be expanded to include emerging market currencies such as the renminbi, to make its currency composition more representative of the reality of global economic power. This year, the IMF will undertake its five-yearly SDR review, where the possibility of including the renminbi will be assessed. A positive assessment would be a strong vote for and powerful sign of the renminbi's international status, but the outcome remains highly uncertain, given the IMF criterion of the "freedom of use" of currency.

It is not the case, however, that a notional SDR - even if expanded - would be ready to replace the dollar as the international reserve currency. By design, the SDR does not have the backing of taxation and/or commodities of national currencies. According to the IMF, "the SDR is neither a currency, nor a claim on the IMF. Rather, it's a potential claim on the freely usable currencies of IMF members". In addition, it does not have enough liquidity. The SDR - despite its long history - has remained a small share of global reserve assets (around 4%), with its use mostly confined to the official sector. There remain very limited private market activities in SDR. Moreover, the creation of a global currency such as the SDR will likely meet strong resistance from current reserve currency countries such as the US.

Is the renminbi suitable as the third reserve currency?

An alternative approach where an international financial system comprises multiple reserve currencies is likely to be more promising. Each of these reserve currencies would be backed by its respective national economy, and the coexistence of multiple currencies would introduce competition and some discipline into the international monetary system.

The new system would be a departure from the current dollar-centric international monetary system. At present, the dollar remains a dominant reserve currency. Although its share has declined somewhat since the introduction of the euro, the dollar still accounts for about 62% of global reserves (compared with more than 70% in the early 2000s), 87% of global foreign exchange transactions, and 81% of international trade settlement.

Although the use of the euro has become more prominent since the adoption of the common currency (accounting for 23% of global reserves, compared with less than 15% before the adoption), its further expansion on the global stage could be challenged by two factors. First, the government debt market in Europe is segmented and the respective national government debt markets are shallow. Since there is not a single euro government debt market, none of the individual government debt markets come close to the size of the US Treasury market.

Second, the recent crisis may have thrown the currency's prospects into uncertainty. The eurozone economy is still struggling with a prolonged recession. Both the corporate sector and the financial sectors are still going through restructuring since the global financial crisis. Several euro area countries now have very large deficits and debts, raising questions about the sustainability of their public finances. In addition, debt crises in individual countries - in particular, Greece - have raised concerns about the very survival of the currency. The prospect of the euro playing a significantly larger international role in the coming decade is likely to be constrained by the uncertainty associated with these debates.

Could the renminbi be a suitable candidate for the third major reserve currency? Historically, countries with a large economy and trade combined with a stable macro environment tend to see a comparable rise in the global role of their currencies. In the view of Barry Eichengreen, professor of economics at University of California, the world needs to be prepared for a system where the dollar, euro and renminbi will all be consequential international and reserve currencies. The multi-polar international monetary system is needed to reflect a more multi-polar world economy. In his view, after World War II, when the US accounted for the majority of industrial production of the non-Soviet world, it made sense that the dollar was the principal unit in which exporters and importers invoiced and settled their trade, in which international loans were extended, and in which central banks held their reserves. But this situation makes less sense today, as the US accounts for just 20% of the combined output of countries engaged in international transactions (Eichengreen, 2010).3

Indeed, ever since the relaxation in 2009 of the self-imposed constraints on the use of the renminbi in trade settlement, the share of China's currency in global trade has rapidly grown, driven by the real needs of merchants to manage exchange rate risks in trade transactions.4 While the initial policy focus was to encourage the denomination and settlement of bilateral trade transactions in renminbi, the government started to actively promote the use of the renminbi in investment transactions to spearhead capital account reforms. The latter includes the recent expansion of renminbi-denominated cross-border portfolio investment, the increase of renminbi-denominated bonds in the offshore market and the rise of outward direct investment in renminbi.

To support the international use of the renminbi, the government has also developed related financial infrastructure and expanded currency swap arrangements with central banks across the globe to provide liquidity support in offshore renminbi markets. The private sector has embraced these liberalisation measures, and transaction volumes have increased strongly from a low base.

Conditions for internationalisation shaping up

There are still several important shortcomings inhibiting the renminbi's global status.

First, as the Chinese financial system remains bank-dominant, the bond market is still comparatively small. The size and liquidity of China's debt market currently lags behind those of existing reserve currency economies.

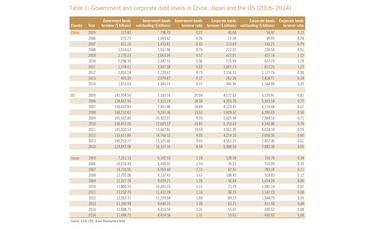

In particular, the total debt outstanding in China stands at around $5 trillion (versus $25 trillion for the US and $9 trillion of Japanese bonds). The Chinese government's bond debt is around $3.3 trillion, compared with more than $12 trillion of US government debt. The turnover ratio is relatively low, as well. In China, the turnover ratio is about 1, compared with 14.2 in the US, pointing to low liquidity in the market (Prasad, 2014). A global reserve currency will need to be supported by a large and liquid bond market so that global investors can invest and maintain the value of their assets.

Second, the exchange rate exhibits limited flexibility under the managed float regime. Both the daily central parity rate of the renminbi against the US dollar and the daily trading range around the central parity are controlled by the government.

And third, cross-border capital flows still face various restrictions. It should be noted, however, that the de jure measure of capital account openness likely significantly overstates the restrictiveness of the system, as incremental reforms over the years have greatly increased the mobility of the cross-border flows. Cross-border bank flows are particularly large, with their size (relative to Chinese GDP) on par with open economies such as Australia, according to the IMF. Current account transactions - including trade and services - have also been used as channels for disguised capital flows at times.

Despite these challenges, recent incremental efforts to liberalise the Chinese currency have resulted in the rapid increase in its use as an international currency.

First, the bond market has grown rapidly to become the third largest in the world. The development of the bond market also suits domestic objectives, as it reduces the reliance on the banking system for financial intermediation, while improving the role of direct financing, to better manage the system risks. The gradual opening-up of the domestic bond market to foreign investors could see liquidity rise.

Second, the exchange rate regime has also seen steady reforms. The government widened the daily trading band twice in the past two years, expanding the permitted daily range from +/-0.5% to +/-2% around central parity. As US interest rates start to rise and the dollar strengthens, upward pressure on the renminbi has receded, with the currency coming under some downward pressure against the dollar. The two-way flexibility is welcome - and indeed essential for the currency to move towards its reserve currency status.

Finally, incremental steps have continued to be taken to liberalise cross-border capital flows. In the last few years, the government has relaxed cross-border security investment, including by expanding the existing channels of institutional investors through the Qualified Foreign Institutional Investor (QFII) and Qualified Domestic Institutional Investor (QDII) schemes, and introducing new channels of renminbi-QFII. Renminbi-denominated bonds have been issued in more offshore centres, including recently in the UK.

The government also established the Shanghai Free Trade Zone (SHFTZ), where more liberal policies on financial flows have been introduced, in the hope of replicating the policies at a later stage in the rest of the country. In February 2015, the PBOC allowed more freedom for companies in the SHFTZ to borrow from abroad. The recent launch of the Shanghai-Hong Kong Connect programme, which permits direct equity trading between the Shanghai and Hong Kong stock exchanges, has also set the stage for broader liberalisation of portfolio flows for individual investors (see appendix).

Capital account reforms

Capital account reforms have gathered momentum under the new leadership in China, and the party's Third Plenary in November 2014 pledged to "accelerate the pace of capital account reforms towards full currency convertibility". There are a few compelling arguments in favour of capital account reforms over time. First, capital account liberalisation is likely to help improve allocative efficiency and is in line with the government's view that the market should play a decisive role in the economy. Although China does not rely on global funding for growth (unlike other emerging market countries, where the funding gap was the primary reason for opening up internationally), high domestic savings are largely concentrated in domestic assets (deposits and real estate) with limited diversification. Second, operationally, as trade size grows, it is difficult to maintain watertight controls on capital flows. And third, from the governmental perspective, the liberalisation of capital flows could also be used as a catalyst for institutional reforms, mirroring the success of trade liberalisation two decades ago.

There are, however, active debates on how renminbi internationalisation and the associated liberalisation of capital flows should be positioned in the financial reform agenda (it should be emphasised that the debate is largely on how, rather than whether, to liberalise).

China's approach has been unorthodox, as the Chinese government pushed capital account reforms and domestic financial reforms iteratively and simultaneously, in contrast to the textbook advice of completing domestic financial restructuring before liberalising capital flows.

The main question facing Chinese officials is whether the speed of the external opening-up is too fast compared with domestic reforms. The standard dilemma is the "impossible trinity", where an open capital account, coupled with the limited flexibility of the currency, makes it difficult to control domestic monetary policy independence. To some observers, domestic reforms such as bank restructuring and state-owned enterprise reforms should precede capital account opening-up, so that the system is sufficiently resilient to deal with volatile international capital flows that have caused crises in other emerging markets (Yu Yongding). Others, however, believe that it is feasible that reforms be conducted iteratively without the pitfalls suffered by other emerging market peers because: the Chinese economy is large, and is not just a price taker in international finance; and there remain many policy tools through macro-prudence to reduce the vulnerability of its domestic institutions.

There are practical considerations in favour of accelerating the pace of reforms, as well.

First, capital controls have become quite porous, making capital account opening-up a de facto choice. For instance, despite controls in portfolio (equity and debt) flows, banks intermediated flows are high and volatile. In fact, as a share of GDP, gross bank intermediated flows are on a par with more open economies such as Australia and the US (IMF). In addition, trade flows are often sed as a disguised vehicle for cross-border capital transactions.

Second, the strength of the external balance sheet and recovery in the global economy/US rates make for an opportune time for faster liberalisation. The current account surplus and large foreign-exchange reserves provide cushions for larger-than-expected capital outflows. And a pick-up in global rates and recovery in the developed markets should allow capital inflow pressures to diminish in coming years, reducing the pressure of one-way capital flows on domestic interest rates and monetary conditions.

In a recent speech (see box below), PBOC governor Zhou indicated that capital account liberalisation will accelerate this year, making the renminbi more freely usable (thereby paving the way for the renminbi to be part of the SDR). He emphasised that, in light of the experiences after the global financial crisis, China's capital account reforms will adopt an approach of "liberalisation with management", whereby macro-prudential measures will be used to ensure financial stability after the capital account becomes convertible.

Recent progress

Owing to these liberalisation measures, the international use of the renminbi has steadily risen, as can be seen from several key developments:

- The amount of cross-border renminbi settlements in the first nine months of 2014 reached 4.8 trillion yuan, an increase from the 4.6 trillion yuan total in 2013. According to the Bank of China's global survey, about 87% of domestic firms and 69% of offshore firms plan to use the renminbi in their future cross-border trade settlements.

- The third-party use of the currency for payment purposes - an important measure of the international role of the currency - has increased from a low base. According to a survey by the Bank of China of 3,000 domestic enterprises conducting cross-border renminbi business, 41% of their overseas subsidiaries conducted renminbi transactions with third parties in 2014, compared with 10% in 2013.

- The offshore issuance of renminbi bonds by Chinese banks and corporations has been strong. The first offshore renminbi bond was issued in 2007. In 2014, gross issuance of offshore renminbi bonds and certificates of deposits hit a record high of 564 billion yuan (rising by 47% from the previous year). In October 2014, the British government issued renminbi-denominated debt - the first foreign government bonds denominated in renminbi.

- The offshore renminbi market has expanded. At the end of 2014, offshore renminbi assets exceeded 2.7 trillion yuan, which included 1.8 trillion yuan worth of deposits, 272 billion yuan of certificates of deposit and 672 billion yuan of bonds, according to Standard Chartered Bank. Notably, offshore renminbi loan growth is expected to accelerate as more cross-border loan programmes start, paving the way for more rapid offshore banking and monetary expansion through the multiplier effect.

While the initial momentum of the renminbi's international rise is reflected in its strong trade links, further growth of the international renminbi market will likely be bolstered by increasing cross-border capital flows, and in particular outward investment by Chinese corporations and the country's government.

Such investment allows enterprises to benefit from the lower cost of production in neighbouring countries (particularly in South-east Asia). For the government, such investment - for instance, through the recently launched ‘One belt, one road' initiative - helps to strengthen the regional trade and economic links. See Fine-tuning the new era of outbound investment, by Li Keping, vice chairman, president and CEO of China Investment Corporation.

The steady progress of capital account liberalisation and further renminbi internationalisation, as we expect, will have a profound impact on the landscape of the global financial markets. According to estimates by US financial institution Goldman Sachs, assuming China reaches full convertibility by 2020, portfolio inflows and outflows could reach 5-7% of GDP each way, compared with less than 1% of GDP at present. Total portfolio flows could rise to between $1.5 trillion and $2 trillion in the next five years. The annual renminbi cross-border trade could increase to between $2 trillion and $3 trillion in the next few years, or 10-15% of global trade. The renminbi bond market could rise to $20 trillion (15% of the world bond market) with liberalisation in the coming decade.

Box: PBoC governor Zhou Xiaochuan on China's plan to make the renminbi more freely usable

This year, the International Monetary Fund (IMF) will conduct its quinquennial special drawing rights (SDR) review. One important issue in the review will be whether the renminbi will be included in the SDR currency basket. One of the criteria for an SDR currency is that the currency must be ‘freely usable', which requires a certain degree of capital account convertibility.

This year, the International Monetary Fund (IMF) will conduct its quinquennial special drawing rights (SDR) review. One important issue in the review will be whether the renminbi will be included in the SDR currency basket. One of the criteria for an SDR currency is that the currency must be ‘freely usable', which requires a certain degree of capital account convertibility.

The goal of achieving capital account convertibility was first put forward in the early 1990s by China, and was reiterated in the Twelfth Five-Year Plan and at the Third Plenum of the Eighteenth Central Committee of the Communist Party of China (CPC).

Over the last two decades, China has been making steady progress towards achieving this goal, despite the adverse impact of the Asian financial crisis and the global financial crisis. As well as being the time for the SDR review, 2015 is also the final year of the Twelfth Five-Year Plan.

China is prepared to take a series of targeted reforms to further increase the renminbi's capital account convertibility.

Capital account convertibility

At the Third Plenum of the Fourteenth CPC Central Committee in 1993, China set the goal of "gradually making the renminbi a convertible currency".

In 1996, the country achieved current account convertibility and announced it would seek to achieve capital account convertibility. However, this process was delayed by the Asian financial crisis that erupted soon after. At the Third Plenum of the Sixteenth CPC Central Committee in October 2003, China once again made it clear that it would "gradually achieve renminbi capital account convertibility".

From then on, much progress has been made in streamlining foreign exchange management and promoting capital account convertibility:

- the renminbi has largely become convertible for foreign direct investment (FDI) and outward direct investment (ODI);

- registration-based management has been adopted for trade credit and trade-related claims on nonresidents, and only external debt remains subject to quota management;

- and the Qualified Foreign Institutional Investors (QFII) and Qualified Domestic Institutional Investors (QDII) programmes have been introduced and improved.

The process of renminbi capital account convertibility was interrupted again by the global financial crisis in 2008. At the same time, because of the shortage of hard currencies and increased volatility among major currencies, the demand for the renminbi in many countries has increased.

In response, China began to facilitate the use of the renminbi in cross-border trade, and direct investment expanded renminbi cross-border financial investment in several ways, including: allowing foreign institutions to invest in the domestic interbank market, and launching the Renminbi Qualified Foreign Institutional Investor (RQFII) programme; continuously deepening bilateral monetary co-operations, with 28 bilateral local currency swap agreements signed; promoting the steady development of offshore renminbi markets; and establishing renminbi clearing banks in 14 countries/regions.

These steps have not only supported the fast development of renminbi internationalisation, but also further strengthened renminbi capital account convertibility.

In 2011, the goal of "gradually achieving renminbi capital account convertibility" was reiterated in the Twelfth Five-Year Plan. At the Third Plenum of the Eighteenth CPC Central Committee in 2013, it was announced that China would seek to "speed up the process toward renminbi capital account convertibility". The China (Shanghai) Pilot Free Trade Zone was established in 2013.

In the second half of 2014, the Shanghai-Hong Kong Stock Connect programme was successfully launched, representing an important step in the liberalisation of the capital market.

At present, there are only a few capital account items that are completely inconvertible. According to the IMF's classification of capital account transactions, 35 out of the 40 items are fully or partly convertible in China, and only five items remain inconvertible.

These five items mainly involve individual cross-border investment and the issuance of shares and other financial instruments by nonresidents on domestic markets. Therefore, China is not far from achieving its goal of renminbi capital account convertibility.

A more freely usable currency

In 2015, China will launch a series of reforms targeting currently inconvertible items under the capital account, with the aim of further promoting renminbi liberalisation and making it a more freely usable currency.

First, the country will create channels for cross-border investments by individual investors, including the launch of the pilot Qualified Domestic Individual Investor (QDII2) programme.

Second, China will introduce the Shenzhen-Hong Kong Stock Connect programme, and nonresidents will be allowed to issue financial products on the domestic markets (with the exception of derivatives).

Third, foreign exchange regulations will be revised to remove requirements for ex ante approvals in most cases, and an effective system will be built for ex post monitoring and macro-prudential management.

Fourth, measures will be taken to further facilitate access to the Chinese capital markets by overseas institutional investors.

Fifth, efforts will be made to further facilitate the international use of the renminbi by removing unnecessary policy barriers and providing the necessary infrastructure.

Sixth, steps will be taken to ensure sound risk prevention.

It is worth noting that the concept of capital account convertibility has changed since the global financial crisis. The capital account convertibility that China seeks to achieve is not based on the traditional concept of being fully or freely convertible. Instead, drawing lessons from the global financial crisis, it will adopt a concept of managed convertibility.

After achieving renminbi capital account convertibility, the country will continue to manage capital account transactions, but in a largely transformed manner, including using macro-prudential measures to limit risks from cross-border capital flows and to maintain the stable value of the currency and a safe financial environment.

China will retain capital account management in four cases.

First, cross-border financial transactions that involve money laundering, financing of terrorism, as well as those that overly exploit tax havens will be subject to monitoring and analysis. This is a practice widely adopted by most countries. Second, macro-prudential management of external debt remains necessary in emerging market economies. Excessive foreign debt in the private sector and significant currency mismatches were the origins of the Asian financial crisis. Countries need to learn the lesson from the crisis, and macro-prudential measures could be used to manage their external debt when necessary.

Third, short-term speculative capital flows will be managed when appropriate, while lifting controls on the medium- and long-term capital flows that support the real economy. This is also a recommendation by the IMF.

Fourth, balance of payments statistics and monitoring will be strengthened. As suggested by the IMF after the global financial crisis, countries may adopt temporary capital control measures when there are abnormal fluctuations in the international markets, or there are balance of payments problems.

This text is an excerpt of a speech made by Zhou Xiaochuan at the IMF World Bank Spring Meeting in April 2015 and is published with permission from the People's Bank of China.

Notes:

1 unctad.org/en/Docs/tdr2009_en.pdf

2 www.bis.org/publ/work478.pdf

3 eml.berkeley.edu/~eichengr/managing_multiple_res_curr_world.pdf

4 www.hkma.gov.hk/media/eng/publication-and-research/research/china-economic-issues/cei_200902.pdf

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com test test test

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com test test test