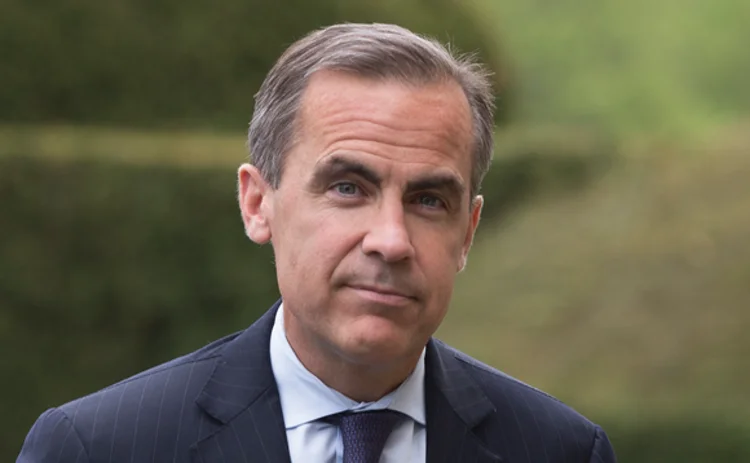

Governor of the year: Mark Carney

Carney has played a vital role in managing Brexit risks

In June 2016, a narrow majority of British citizens voted to leave the European Union, beginning three-and-a-half years of intense political and economic certainty. No-one knew for sure when or how the UK would leave the body that had shaped its economy for the previous 43 years. It was easy to see how this confusion would cause instability in Britain’s financial sector and a loss of confidence in the UK’s economic prospects. But public confidence in the UK has remained relatively high and financial market volatility muted. A major factor behind this relative calm were robust preparations undertaken by the Bank of England, led by its governor, Mark Carney.

He held office at one of the most potentially fraught periods in the UK’s recent history. But this was only one of Carney’s achievements at the BoE. Under his leadership, the central bank continued with a successful quantitative easing programme, and greatly expanded its supervisory and regulatory activities in the aftermath of the global financial crisis. Carney himself has been a key figure in pushing central banks to take effective action to deal with environmental risks.

The UK central bank started making detailed plans to ensure the country’s banking system would be able to sustain a worst-case-scenario Brexit shock, since before the referendum result. The work was carried out largely behind closed doors by the bank’s Financial Policy Committee, the body set up in 2013 to protect and enhance the resilience of the UK financial system.

The UK government subsequently announced three dates for leaving the European Union, before eventually leaving on January 31, 2020 with a temporary withdrawal agreement in place. Each time, there was a real possibility that the UK could leave the EU on trade terms set by the World Trade Organization, potentially causing significant economic damage. Yet UK banks suffered no noticeable seizing-up of funding. Part of the reason for this relative stability – although not fully tested by a ‘hard Brexit’ – was due to the FPC developing a worst-case, ‘no deal, no transition’ Brexit scenario to stress-test banks to ensure they would have sufficient capital to remain fully operational. The initial scenario included a peak-to-trough decline to GDP of 8% in absolute terms, a rise in unemployment to 7.5% and inflation at 6.5% (the scenario became less onerous in 2019 as government preparations for a potential ‘hard’ Brexit improved).

The Bank of England also introduced auctions and set up a sterling/euro swap line with the European Central Bank in the lead-up to March 28 (the original exit date), to ensure banks had access to sufficient funding in the event of market disturbance. Carney and ECB president Mario Draghi teamed up to lead a working group tasked with managing the risks to financial services from Brexit. The BoE made concerted efforts to address potential disruption risks with its supervisory counterparts in the EU, including contingencies for the multi-trillion-dollar derivatives market, notably in mutual clearing recognition.

Alongside these well-executed technical preparations, another factor that helped to maintain confidence in the broader UK financial system was Carney’s decision to extend his term as governor, first to June 2019, then until January 31, 2020 (the actual Brexit date) and finally to March 15 this year. This was to ensure an “orderly transition”, according to UK chancellor Sajid Javid, to Carney’s successor and BoE alumnus, Andrew Bailey.

Three successive UK chancellors have recognised Carney’s importance for UK financial and monetary stability. Philip Hammond, who held the role for most of the post-referendum period, wrote to Carney in September 2018, stressing his need to stay on as governor to “support a smooth exit” during an “exceptional period”.

Personal attacks

Carney was publicly supported by the successive Conservative governments, led by prime ministers Cameron, May and Johnson. But some Conservative politicians, including Jacob Rees-Mogg, who became leader of the House of Commons, and Iain Duncan Smith, the former party leader, attacked Carney as a ringleader of establishment efforts to scare the public from leaving the EU – an effort dubbed ‘project fear’.

This criticism appears to be misplaced. Carney has frequently been asked by lawmakers for his and the bank’s professional assessment of the economic and financial consequences of certain possible Brexit outcomes, and he has replied. He has then been criticised for replying.

Carney has repeatedly defended his actions, saying that, while the BoE expected a Brexit deal would be secured, there was a significant risk there would be no trade or withdrawal agreement. Ultimately, Carney and the BoE’s job of developing realistic Brexit scenarios has been made far more difficult because of lawmakers being vague and inconsistent in their own predictions of the likely outcome of Brexit discussions. Developing sound policy response to this level of uncertainty was a challenging task. Many participants in the Brexit debate did not want to hear unwelcome truths. But the governor of the Bank of England did not have the option to keep quiet.

Institutional capacity

That Carney’s team was able to chart a course through such an uncertain environment to prepare the UK financial system against Brexit shocks was in part due to the creation of an institutional framework that allows policymakers to better understand and manage risks. The Monetary Policy Committee, the Prudential Regulation Authority and the FPC can now work together, where necessary to ensure ‘joined-up’ oversight. This was highlighted by the formation of worst-case, Brexit scenario stress tests, which involved the micro- and macro-prudential authorities working together.

Another benefit of joined-up oversight is that there is less likelihood of making policy mistakes due to misdiagnosis – for example, by understanding that unusually low mortgage spreads were the result of the implementation of the UK’s new ring-fencing regime. Carney has also overseen significant efforts to tackle the risks posed by ‘too big to fail’, including the resolution of systemically important institutions. Although not completed, the BoE now thinks of resolvability “not as binary, but as a continuum”, Carney told Central Banking last summer.

Carney and the BoE’s job of developing realistic Brexit scenarios has been made far more difficult because of lawmakers being vague and inconsistent in their own predictions of the likely outcome of Brexit discussions

All these efforts have led to a better-prepared banking and financial system – albeit that the worst-case scenarios that would test the system, including how the BoE would manage moral hazard issues, have not materialised to date. The preparations have also offered new insights, and the institutional structure offers greater opportunity for a more varied career at the bank, helping staff retention. At the same time, Carney has strongly supported the BoE being an equal opportunities employer, notably backing female appointments, even if they haven’t always been successful.

Inflation on target?

Meanwhile, the UK’s consumer prices index (CPI) inflation rate ended the year at 1.9%, down from its peak of 3.1% in November 2017 and close to its 2% target. It has since fallen to 1.3% (although wages are rising by more than 3%). The Bank of England’s governor must write to the chancellor in the event inflation strays more than one percentage point away from target. The last exchange of letters was in February 2018, when Carney said high levels of inflation were “almost entirely” due to the effects of higher import prices caused by the effective 16% depreciation of sterling following the vote to leave the European Union.

The Bank of England’s quantitative easing effort – a programme inherited by Carney – has also proven to be a qualified success – at least when looking solely at inflation figures and when compared with the schemes run by Bank of Japan and the European Central Bank. The Federal Reserve’s policies may have proven more successful – and research indicates US policy has had important spillover benefits for the UK – but the fiscal environment in the US was more accommodative. Like the Fed, the BoE has indicated it does not favour negative interest rates.

While the BoE’s forward guidance exposed flaws in the detail – its 7% unemployment threshold turned out to be way too high – the broad message that rates would stay relatively low for some time was communicated. But the BoE learned lessons, including how to better measure labour supply. And, as central banks around the world continue to use exceptional monetary policy measures, Carney said in January this year that BoE economists would embark on a year-long research project to examine whether the inflation-targeting framework remained fit for task. While he said the “bar for change to the regime is very high”, he cautioned against complacency.

Open-minded and outspoken

Carney has often led the debate during the past year in the UK and internationally on important issues, including improving the payments system, tackling climate risks and addressing the challenges linked to US dollar funding. His attitude towards fintech and climate risks – two areas where central banks will place increased emphasis during the coming years – has been neither unquestioningly optimistic nor aggressively obstructive.

When asked about disruptions to the payment system caused by the potential introduction of Facebook’s libra, Carney reminded Central Banking that the BoE “ultimately serves the people of the UK, not banks or other intermediaries”. He said libra is “shining a light on deficiencies” in the payments system, with domestic payments “still too slow” and cross-border payments “much worse”. Carney added that new entrants “coming up with new architecture” was a “good thing”, but high standards would remain in place for all payment providers, including new entrants.

“For something like libra, which could be adopted by a huge number of people very quickly, you cannot learn as you go. You are either ready or you are not. And if you are not ready, you do not start. That is increasingly appreciated. So, we need work with these initiatives to see if they can get ready. And if they cannot, what are the alternatives to solve the issue?” he said. Ultimately, Carney believes properly run fintech firms could access the BoE’s balance sheet.

Climate of change

Carney was also one of the first central bankers to recognise the financial risks posed by the growing prevalence of extreme weather and the transition to a low-carbon economy. As early as 2015, he was navigating this new terrain in his capacity as chair of the Financial Stability Board (FSB). It was also treacherous, politically charged territory.

A turning point was a speech in September 2015 in which Carney framed the issue in terms of the ‘tragedy of the horizon’. The tragedy of climate change was that action needed to be taken immediately and collectively, but the damage would play out over a much longer horizon beyond the political cycle, the business cycle and the view of central banks, Carney warned: “We don’t need an army of actuaries to tell us that the catastrophic impacts of climate change will be felt beyond the traditional horizons of most actors – imposing a cost on future generations that the current generation has no direct incentive to fix.”

Concerns about overstretching mandates were addressed by central banks slotting climate risks into the financial stability frameworks (rather than in monetary policy) that many had gained in the wake of the 2008 crisis. An initial goal was better disclosure. If it was possible to create a market to price climate transition risks, capital would start flowing to well-prepared businesses – which would also tend to be those less reliant on fossil fuels. In December 2015, the Task Force on Climate-related Financial Disclosures was launched under the aegis of the FSB, the same month in which the Paris Agreement was struck.

Momentum was building. In December 2017, the Central Banks and Supervisors’ Network for Greening the Financial System (NGFS) formed with eight members, the BoE among them. Since then, the NGFS has seen its membership swell to 54 full members and 12 observers. In 2019, the BoE told banks and insurers it expected them to manage climate risks, saying they would be judged accordingly during the supervisory process. The Prudential Regulation Authority became the world’s first regulator to publish explicit expectations for the control of climate risks. Since then, firms have asked for more detail, which the PRA has committed to providing.

A mark of the prescience of Carney’s ‘tragedy of the horizon’ speech is that the broad framework he outlined remains an excellent guide to the policy agenda for green finance. As the BoE governor told the World Economic Forum in January this year, creating a market for climate assets remains essential, as it will give investors a channel through which they can apply pressure to laggards. He argued investors were ready to accelerate a green transition, but said they needed the backing of governments. Carney will continue pressing the case when he becomes a United Nations envoy on finance and climate change (taking over from former New York mayor Michael Bloomberg) when he leaves the BoE in March. Reflecting the respect with which he is held in the UK, Carney has also agreed to advise prime minister Johnson in the run-up to a major UN climate conference taking place in Scotland this November.

Dollar asymmetry

In 2019, Carney also used several public engagements to warn of possible risks from “asymmetry” at the heart of the global system. Investors have huge demand for safe US dollar assets, but supply is rising at a much slower pace, and alternative options – namely the euro and renminbi – remain underdeveloped. That puts pressure on the dollar and links financial conditions worldwide to the fate of the greenback. A sudden loss of confidence among investors could spell widespread havoc. “While the system has served us well, the strains on that system will become increasingly apparent,” Carney told Central Banking.

The non-bank system represents around half of all global financial assets, with just 13.6% held by firms in the FSB’s ‘narrow measure’ of the riskiest forms of non-banks – those subject to possible runs – as of December 2018. But as Carney noted in his June 2019 speech, ‘Pull, push, pipes’, these firms could be potent amplification mechanisms for global liquidity flows. Particularly problematic are open-ended funds, which offer daily redemptions, even where their assets are highly illiquid. Many of these funds are invested in emerging market bonds, thereby tying local conditions in the financial sector and real economy to the vagaries of global capital flows and the animal spirits of investors.

Again, Carney’s high-profile support helped create momentum internationally. The FSB has debated many of the issues, and is weighing up how it can better gauge systemic risk at the global level. And the BoE and Financial Conduct Authority have begun changing UK rules, requiring open-ended funds to impose either a time delay or price discount on customers wanting to liquidate illiquid investments. If others follow, that should limit the threat of damaging runs developing. Speaking at a press conference in December 2019, Carney said he believed the issues were “increasingly recognised” at a global level. Deputy governor Jon Cunliffe said the discussion had “come a long way” since the FSB published a set of recommendations for asset managers in 2017.

Carney arrived at the BoE during a very difficult period – the aftermath of the financial crisis. He has spent the last three years coping with another, trying to limit the instability that followed the Brexit referendum. The period has marked a fall in sterling, but no widespread instability in the currency, funding or other markets. Without the efforts of the BoE under its governor, Mark Carney, this might not have been the case.

The Central Banking Awards were written by Christopher Jeffery, Daniel Hinge, Dan Hardie, Rachael King, Victor Mendez-Barreira, Alice Shen and William Towning

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com test test test

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com test test test