Developing China's capital market is central to 'new normal' reform

China's capital market only accounts for about 45% of GDP

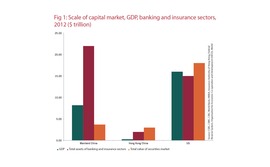

China's capital market is small. For example, in the US, the capital market accounts for around 115% of GDP, similar to the banking and insurance sectors combined. The relative size of the capital market in Hong Kong is even higher than in the US, as may be expected for an international financial centre.

In China, however, the capital market only accounts for about 45% of GDP, or one-sixth of the size of the banking and insurance sectors combined, pointing to significant scope for further development.

Capital markets are still largely viewed as supplementing the activities of the bank-dominated financial services industry, even though they help to diversify risk.

Capital markets are still largely viewed as supplementing the activities of the bank-dominated financial services industry, even though they help to diversify risk.

The underdeveloped equity market in particular has contributed to the heavy reliance on bank financing and high leverage ratios in the corporate sector. Also, the capital market can help businesses and individuals to improve returns and manage their risks.

For example, commodity producers can use futures and other derivatives to help them hedge against commodity price cycles, and pensioners can benefit from more consistent returns from their retirement savings.

In the absence of a well-functioning capital market, an unregulated ‘shadow banking' sector has emerged to satisfy unmet borrowing demand, and the associated ‘regulatory gap' has given rise to concerns about financial stability.

There are several inter-related components required for capital market development: foremost, capital markets should become more diversified and multi-layered. This requires a fundamental change of the process for initial public offerings (IPOs) from an approval-based system to a disclosure-based system. For further details, see box below, in which Xiao Gang, chairman of the China Securities Regulatory Commission (CSRC), lays out the key areas of reform in this area.

Other reforms that are also important include the development of an over-the-counter (OTC) equity market and encouraging institutional investors to participate in capital market activities to increase liquidity in the capital market.

The IPO process

The equity market has been particularly weighed down by an onerous IPO approval process. At present, the CSRC approves all new IPO applications based on the quality of the company, with the regulator also responsible for addressing any irregularities associated with listed companies. Such an institutional set-up traces back to the need to protect investors when the equity market started to develop in China at the start of the millennium.

Over the years, however, the CSRC appears to have taken on an implicit role for endorsing listed companies and has tightened its approval process in response.

New reforms under way will replace the approval process with registration requirements. The new system, due to be introduced this year, will rely on pre-IPO information disclosure and post-IPO rulesbased regulation, with harsh penalties for companies found guilty of breaching the rules.

In addition to the Main Boards and the Growth Enterprise Market, the development of the New Third Board, an OTC market that is similar to the OTC Bulletin Board in the US will enable share transfers of companies that do not meet the listing requirements of other boards.

The development of the OTC market is critical for enabling better financial services for small and/or growth enterprises. China's OTC market is still insufficiently developed because of the process of reform in China.

In the past 20 years, one of the main features of the capital market is that legal and political systems were established with a focus on stock exchanges, with little focus on OTC markets. For instance, security institutions approved by the CSRC can deal with exchange-listed stocks, but almost none of them have OTC businesses.

This is inadequate in the view of Zhu Chongjiu, the former assistant chairman of the CSRC (see pp. 49-50), as one of the most important roles of the OTC market is to support small and medium-sized enterprises (SMEs) in their start-up and growth stages.

The development of the OTC market requires the relaxation of registration requirements for public equity raising, as well as the standardisation and proper regulation of crowdsourcing. Further steps include an equity trading platform dedicated to small companies being developed, and regional share-trading platforms expanded to serve the needs of non-listed companies.

There has been some progress in these areas over the past year. The development of a futures market, including foreign-exchange futures, could also play an important role in risk management, as well.

Derivatives markets, particularly financial futures markets, are an integral part of a modern capital market, as they facilitate hedging and risk management. China's financial futures market is still small, with only the CSI 300 stock index and five-year government bond futures being traded. In the National People's Congress (NPC) meeting in March 2015, Premier Li Keqiang noted in a government report that financial derivatives will be developed - the first time such a statement has been made in the yearly government report.

The chairman of the China Financial Futures Exchange (CFFEX), Zhang Shenfeng (see pp. 53-54), has said that significant efforts will be made to expand derivatives - particularly the futures market - by introducing interest rate and foreign-exchange futures and options in the coming years.

Box: XIAO GANG: REFORMING THE IPO PROCESS

IPO reform is a top priority as part of overall capital market reform in 2015. It involves major participants in the market and represents an important breakthrough in regulatory reform by the China Securities Regulatory Commission (CSRC).

Why does the IPO process need to be reformed?

Since March 2000, when the approval-based IPO system was introduced in China, about 1,700 companies have been listed, with a combined market value of 5.31 trillion yuan. This has represented an important role in raising capital. In addition, from the end of 2006 to September 2014, public companies have issued 2.97 trillion yuan of cash dividends.

Meanwhile, the operating incomes of public companies in 2013 accounted for 47.56% of GDP and tax contributions accounted for 21% of the entire country's tax revenues. So public companies are playing an increasingly important role in the development of our economy.

However, with the deepening of reforms and the development of the markets, the defects of the current IPO approval-based system have become visible.

Firstly, government endorsement of the likely profitability of companies and the sound value of their equity has lowered risk awareness among investors. Meanwhile, the CSRC has had to take on a high burden of responsibility, while the responsibility of issuers, sponsors and accounting firms has been weakened.

Secondly, under the approval-based system, the CSRC controls the new stock's price, issuing pace and scale.

Although these measures can stabilise investor expectations in the short term, they hamper self-regulating mechanisms, distort demand and supply, and hurt the mid- and long-term development of the stock market.

Thirdly, the approval-based system necessitates excessive administrative intervention and high levels of subjectivity. To solve all these problems, IPO reform is needed. The registration-based system is a highly market-driven IPO regulatory system and lies at the core of reform aimed at improving the relationship between the government and the market.

Thirdly, the approval-based system necessitates excessive administrative intervention and high levels of subjectivity. To solve all these problems, IPO reform is needed. The registration-based system is a highly market-driven IPO regulatory system and lies at the core of reform aimed at improving the relationship between the government and the market.

It can resolve problems caused by information asymmetry between investors and issuers, and also help to draw the boundary between the market and the regulator - thereby preventing excessive intervention.

The government will no longer act as a guarantor for the issuer or pay much attention to businesses' performance and prospects. Investors will have to make their own judgements and choices.

The volume of the stock issued and its price will be driven by market participants, so the market will play a decisive role in allocating resources. Meanwhile, the regulatory institution will maintain market order and protect the rights of investors.

So our overall goal of IPO reform is to establish a market-orientated IPO system with an emphasis on information disclosure and effective regulation.

What are some of the risks during the reform process?

Risks exist in pushing through the reform. For instance, the risk of fraud by companies may increase, so there is a need for gradual and steady reform.

It also needs to be systematic, targeted and co-ordinated, maintaining a balance of longterm versus short-term profit, and balancing the reform, development and stability of the capital market.

This will also require an integrated and co-ordinated effort that strengthens the design of the market to promote healthy and stable development, and risk-monitoring, -warning and -management systems that can strengthen the ability to identify, guard against and deal with risk will need to be further developed.

What are the key ingredients needed to support the new system?

Firstly, driven by investor demand, we need to address and balance some key relationships:

• The relationship between the unity of information disclosure and the diversity of investor demands. To try to satisfy different demands of

different groups without bias.

• The relationship between the amount and the quality of information. To simplify the disclosure process while increasing the readability

and clarity of the disclosure.

• The relationship between the comparability and usefulness of the information disclosure. To formulate and improve rules intended for particular industries and areas.

• The relationship between market participants' information and regulatory information. To ensure information disclosure truly satisfies the

demands of market participants.

• The relationship between information disclosure in the issuing stage and that in the following stage, thereby strengthening different parts and different levels of information disclosure in the capital market.

• The relationship between compulsory and voluntary information disclosure. To encourage market participants to comply with voluntary principles to provide useful information for investors.

• The relationship between regular reports and temporary reports - increasing the consistency of market participants' information disclosure to avoid overlapping or conflicting information.

• The relationship between the stability of the information disclosure system and its flexibility. Secondly, different layers of regulations are needed under the Securities Law, Corporate Law and other legal requirements:

• Divisional regulations that include measures to establish, manage and regulate the information disclosure system.

• Regulatory documents that fully integrate current rules and form specific information disclosure rules for different market levels and areas.

• The self-regulating rule. The Shanghai Stock Exchange, Shenzhen Stock Exchange, national stock exchange companies and industrial associations should improve their respective information disclosure rules according

to the divisional regulations and regulatory documents formulated by the CSRC.

Thirdly, we should clarify the information disclosure system and the division of responsibilities. The group in charge of information disclosure affairs should speed up plans to assign tasks that include formulating organisational rules, regulatory documents and self-regulating regulations to all the related organisations as soon as possible in 2015.

Meanwhile, the information disclosure group should reinforce integration and co-ordination to avoid overlapping rules and unevenly balanced requirements. The day-to-day regulation of information disclosure should be grouped and managed according to the respective information disclosure obligator.

What would be the procedure for investor protection under the new system?

In 2013, the General Office of the State Council introduced its Advice on Reinforcing the Work of Protecting the Rights of Medium and Small Investors and comprehensively established a protective system for those investors. The work of protecting investors began to penetrate every aspect of the system and the entire process of the regulatory work. The requirement of protecting investors is applied to mergers and restructuring, delistings, the second-board markets and the new OTC ‘Bulletin Board' reform.

This helped intensify regulation and encourage the actual controllers of public companies - controlling shareholders and affiliated parties - to honour their promises by improving profit-allocation disclosure systems, supervising cash dividends and increasing the number of companies giving cash dividends.

In 2015, we should continue to implement the General Office's instructions, by strengthening system construction, properly dealing with complaints and disputes, and by continuing to evaluate the new system.

This box contains a summary of a speech, "Deregulation of the OTC, PE and futures markets", made by CSRC chairman Xiao Gang this year at the National Work Conference on Securities and Futures Supervision.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com