This article was paid for by a contributing third party.

Finding the right partners with the right solutions

Over the past decade, the financial crisis, globalisation and technological changes have driven uncertainty and brought about drastic changes for central banks. Vermeg‘s Yamen Bousrih explores the importance of having a consolidated, coherent and resilient information system to face the unknown.

Central banks have entered a new era, with an increased burden of expectation and challenges around their information systems. Central banks have needed to navigate through financial upheaval, rising public expectations and tense policy-making experimentation. As a result, they need to have a consolidated, coherent and resilient information system to be able to face this uncertain landscape.

Central banks are policy-making institutions in charge of macroeconomic and monetary strategies. They are also expected to fulfil several roles, including stimulating economic growth and containing inflation, while safeguarding against financial system instability and crises. They must ensure the financial system is resilient and operating in the best conditions.

Challenges central banks face

During the past decade, central banks and the global economy have been impacted by several drivers of change, including the financial crisis, globalisation and technology. Subsequently, they have adopted more unconventional monetary policies, regulation and international co-ordination. However, they remain under the constraints of being impacted again at any point as, according to Greek philosopher Heraclitus, “nothing is permanent in our world except change”.

To ensure central banks are ahead of the game, they must remain in a permanent state of evolution to face new challenges: increased threats of cyber risks; new technological trends around, for example, big data, cloud, blockchain, financial technology and regulatory technology; more international co-operation characterised by cross-border operations; and major political decisions adding more uncertainty, such as Brexit.

Considering the constant flux faced by central banks, there is greater need than ever before for them to embrace digital transformation with a holistic approach. They need flexible and data-centric solutions that are ready for deployment and easy to onboard.

Innovative solutions

Central banks need to put in place a coherent and consolidated vision for their information systems. To achieve this, they must:

1. Implement flexible solutions to reduce the time to market and increase efficiency. Offering flexible collateral solutions that can help central banks move from ‘repo models’ to ‘pool models’ – while implementing flexible business rules and risk management techniques – can be an excellent strategy.

2. Implement solutions that comply with market standards to face international harmonisation projects and standards, for example by adapting a solution already compliant with ISO 20022.

3. Put in place a digital transformation strategy to ride new technological trends, and create innovative user- and data-centric solutions.

4. Collaborate with trusted partners to implement trusted solutions to confront security and resilience risks.

Finding a trusted provider

Providers that would like to take part in a central bank’s information system must be able to bring the right solutions and an expected level of confidence.

Bringing the right solutions should be covered by two main factors:

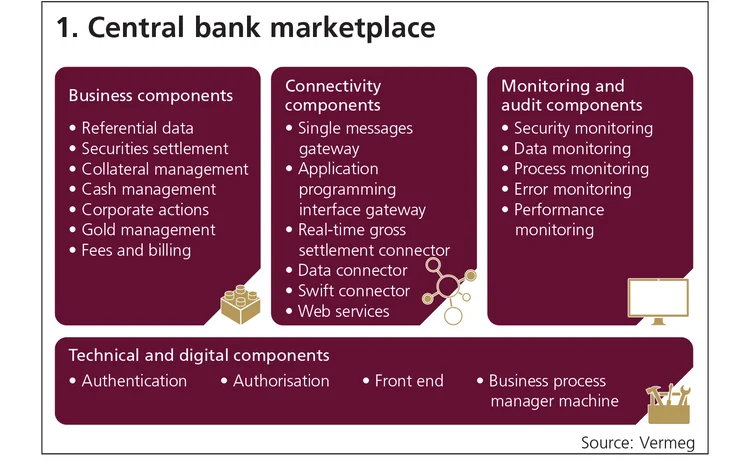

First, a marketplace where a central bank can quickly find out which solutions need to be deployed. This one-stop shop should cover a wide range of business, connectivity, monitoring and technical solutions that a central bank may need. Choosing solutions from a marketplace will ensure a certain level of harmonisation is reached and will ease onboarding for these solutions (see figure 1).

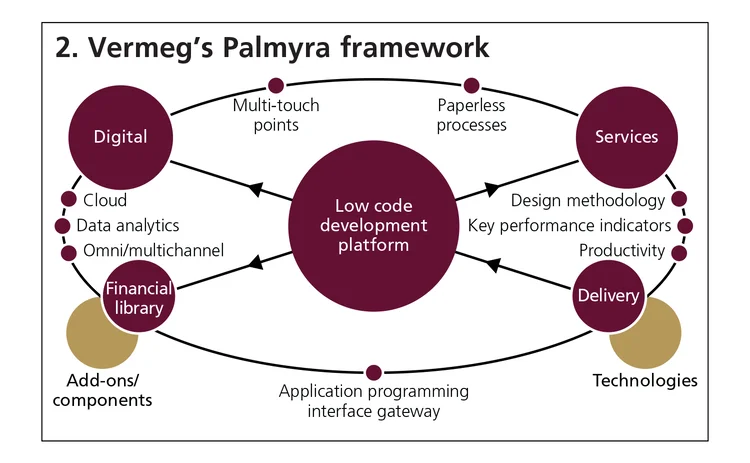

Second, a low code development platform embedding best-of-breed market standards that allows central banks to develop their own solutions. This platform must ensure high productivity and faster development processes (up to 200% for some platforms), support agile and design-focused methodologies for a quickly delivered prototype, and benefit each year from a continuously strong innovation road map (see figure 2).

In conclusion, central banks must find a trusted provider with strong experience, and with safe and resilient solutions fit for purpose. More than ever, central banks must be sure they are in the safe hands of those committed to software excellence.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com