Market liquidity drained by regulations, says DBS chief

Volcker, Basel III and Dodd-Frank have combined to reduce liquidity

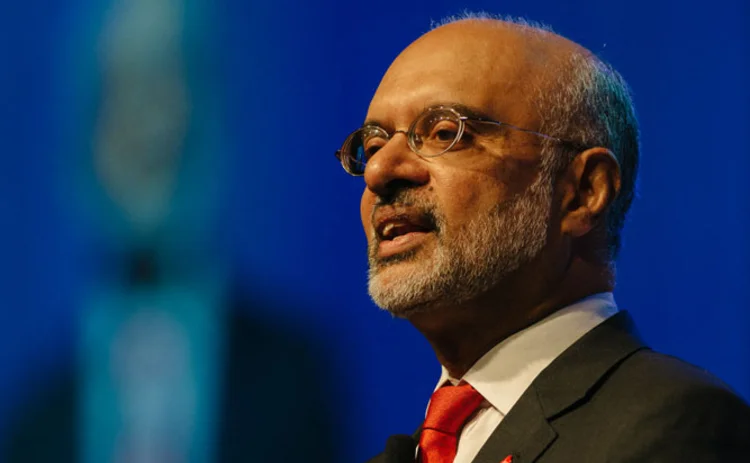

A host of new regulatory requirements governing financial institutions' trading activities has significantly restricted banks' capacity to absorb risk and provide liquidity, according to Piyush Gupta, chief executive officer at Singaporean lender, DBS.

Speaking at the 11th Asia Risk Congress on September 9 in Singapore, Gupta pointed to Basel III capital requirements, Dodd-Frank and the Volcker rule as all combining to negatively impact market liquidity.

"It is quite clear that the new capital

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Most read

- Taking stock of Bernanke: the original sin of forecasting

- Central bank of the year: Central Bank of Brazil

- Fed policy-makers disagree over risks