IMF research looks to jumpstart market for Italian NPLs

Nadège Jassaud and Kenneth Kang evaluate distressed debt in Italy

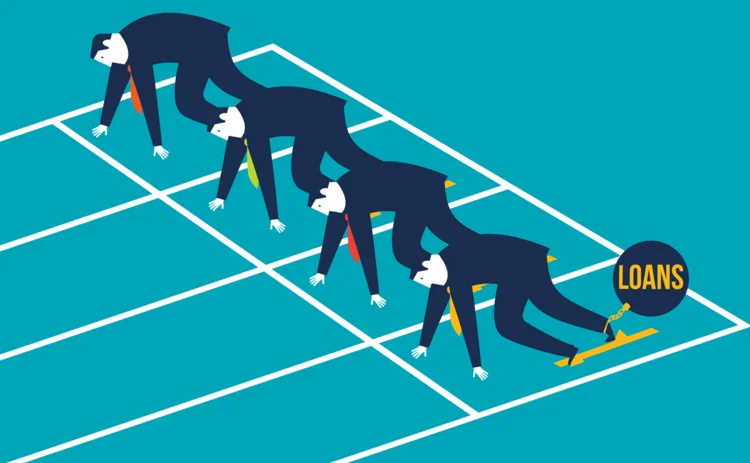

High and rising levels of non-performing loans (NPL) in Italy are depressing bank profitability and constraining new lending, prompting two IMF staff members to consider how the market for distressed debt could be jumpstarted in the country.

In their working paper, A Strategy for Developing a Market for Nonperforming Loans in Italy, Nadège Jassaud and Kenneth Kang highlight the need to tighten supervisory policies on provisioning and write-offs to speed-up the resolution and restructuring

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Most read

- Supervisors grapple with the smaller bank dilemma

- Fed policy-makers disagree over risks

- Central bank of the year: Central Bank of Brazil