Sponsored feature: Defining the ‘new normal’ in China

The ‘new normal' is billed as a balanced and holistic development approach that strives for ‘quality' – even if that means lower – growth. And, overriding importance is being placed on ethics, equality, justice and social harmony. This sweeping sea change is powering a comprehensive policy overhaul, and investors and businesses – both outside of and within China – must understand that many old ways have either already gone or are on their way out.

There have been some major reforms already, such as deregulating key utility prices, experimenting with free trade zones, amending budget laws to allow local governments to issue debt conditionally, reforming the hukou (household registration) system, trying out mixedownership for some state-owned enterprises (SOEs), strengthening the foundation of law and even relaxing the one-child policy. And, more far-reaching change is to come.

Macroeconomic management

Monetary policy recalibrated

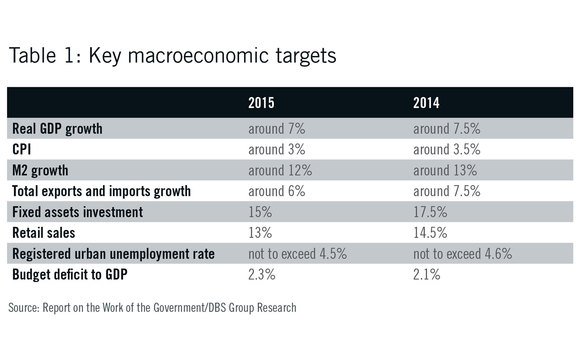

The government seems willing to accept slower growth rates as it presses on with structural reforms. This year, it lowered China's gross domestic product (GDP) growth target to around 7%, down from around 7.5% last year (see table 1).

"China is slowing, but I do not believe there will be a hard landing. Growth is tipped to come in at 7%, or maybe in the high 6% range in the short term. That is still a lot of growth. There is growing consumption, trade and investment in China, and the economic energy remains palpable. Even at 7%, that is substantial growth on which to build business," says Piyush Gupta (pictured below), chief executive of DBS.

"I also do not see China facing a systemic fiscal, financial cliff on the back of its macro issues. While debt levels have increased significantly, China has the resources to deal with this at a macro level. With more than $4 trillion in reserves, they can quite easily recapitalise the system if they need to, and choose to do so."

The inflation target has also been lowered to around 3% from around 3.5% in 2014. The government has stressed the importance of ‘monetary prudence', despite decelerating domestic demand. Nowadays, the aim of monetary policy is not to engineer a V-shaped rebound, but to support growth, which is a profound departure from past macroeconomic policy.

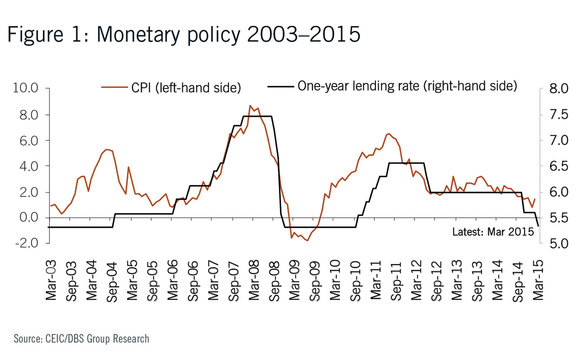

There is also a new approach to dealing with excessive credit-driven growth. Even though annual GDP growth has dipped below 8.0% since 2012, and decelerated to 7.4% in 2014, monetary loosening has remained largely restrained. The central bank mitigated the impact of temporary liquidity crunches with short-term liquidity operations, standing lending facilities and medium-term lending facilities. It has also lowered the reserve requirement ratio (RRR) for designated banks to boost lending to rural and small businesses. Moreover, sparing interest rate cuts have been counterbalanced by interest rate liberalisation in the form of deposit rate ceiling relaxation.

"With the new deposit insurance scheme, covering deposits of up to 500,000 yuan, effective on May 1, the time to liberalise the deposit rate is fast approaching," says Andrew Ng (pictured above), head of treasury and markets at DBS. "The major impact is that net interest margins will come down. At the same time, banks will be able to effectively compete with shadow banks and internet non-bank players, and may benefit from capital market reform. So their revenue mix should become more healthy. Some smaller banks may struggle a little, but the negative impact is not likely to be that great."

However, capital account reform is likely to remain limited in the near term. "I do not believe the capital account will be fully liberalised in the next one to two years. Instead, there is likely to be ongoing partial liberalisation and a simplification of procedures," says Ng. "However, the free trade zones in Shanghai and elsewhere are good places to test how full-capital account liberalisation could work on a nationwide basis."

Moving ahead, the People's Bank of China (PBoC) is likely to pay more attention to property prices than to blips on the Consumer Price Index (CPI). With property prices still moderating, one more rate cut and a further 100 basis point reduction in the RRR could be on the cards (see figure 1).

Fiscal reform accelerates

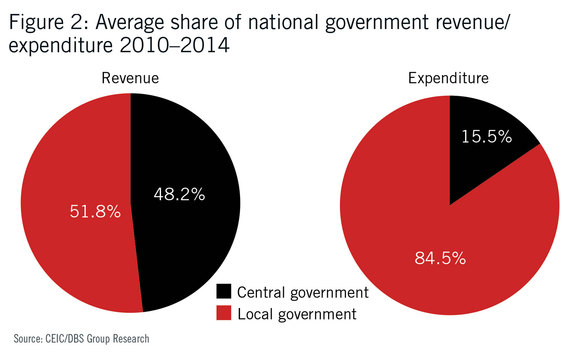

Most of China's local governments are debt burdened, with limited autonomy to raise their own funds. For decades, revenues have been divided between the central and local governments more or less equally, even though the latter are responsible for nearly 80% of public expenditure (see figure 2).

To make up this shortfall, local governments have resorted to wasteful transfer payments from the central government. They have also pursued extra-budgetary land revenues, often resulting in unfair land expropriation and overinvestment in property. Many took on mountains of debt via local government finance vehicles.

The central government has acknowledged the urgent need for reform, particularly as the economy slows. In mid-2014, China's Ministry of Finance set up a pilot programme in which 10 local governments – including Beijing, Shanghai and Guangdong – were empowered to issue bonds. To help make this work, budgetary information is being made more transparent. The central government is also seeking better long-term solutions, which might include local governments raising their own taxes.

Meanwhile, some quicker fixes have been put in place. The Ministry of Finance has permitted local governments to convert as much as one trillion yuan of high-yielding debt (out of 17.9 trillion yuan) into loweryielding municipal bonds. This is to reduce interest rate burdens on local governments.

"In the quest for market-oriented reform, I believe that all state entities will no longer receive the same kind of support they once did, and this could cause problems, particularly in the property and propertyrelated sectors," says Gupta. "There could also be idiosyncratic counterparty risks, as the ongoing anti-corruption drive could create risks for companies related to the affected individuals. What this means is that a rising tide will no longer carry all boats. With structural reform, some individual companies will go. It is therefore important to focus on the kind of business you're doing and the relevant counterparties."

Flexible exchange rate management

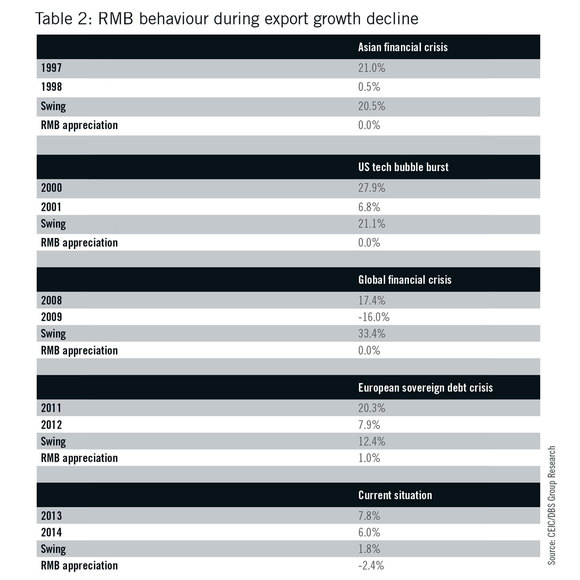

China's growth rate is slowing, while disinflation in the CPI and deflation in the producer price index (PPI) deepen. Against this backdrop, Beijing is permitting the renminbi (RMB) to weaken against the US dollar via cuts in both interest rates and the RRR. This is a major departure from the past, when China steadfastly kept the RMB stable against the US dollar during crisis episodes (see table 2).

A turning point came in the Q1 2014 when the PBOC engineered RMB depreciation and altered expectations of a ‘one-way bet' on the currency. Although the RMB stabilised by Q3 2014, an interest rate cut in November triggered market expectations of further RMB depreciation in 2015. Indeed, the RMB continued to weaken in Q1 2015.

There are several possible explanations for what was a clear divergence from past exchange rate management:

• Exchange rate depreciation is being used to help cushion China's economic slowdown.

• Many currencies are depreciating against the US dollar, including the Japanese yen and the euro, thanks to new rounds of quantitative easing. As a result, the RMB appreciated 6.2% against other currencies in trade-weighted terms in 2014. Moreover, China's cost of labour had risen substantially since its entry into the World Trade Organisation.

• The Chinese government is now committed to greater exchange rate flexibility. In March 2014, the RMB trading band was widened from 1% to 2%.

"Many attributed the renminbi depreciation last year to the central bank. But the depreciation of the renminbi this year seems to have been driven by corporates, including the multinationals," says Ng. "The end of US quantitative easing and an expected Federal Reserve rate hike has led the dollar to appreciate significantly against all the major currencies except the renminbi. So, for major corporates, it is prudent to pare down US dollar borrowings and switch from renminbi to US dollar. But most of the US dollars are still sitting in the Chinese banking system, with the US dollar deposit share in the Chinese banking system rising in the first quarter."

Socio-microeconomic management

Thirty years ago, fewer than 200 million people lived in China's cities and towns. Today, this figure is around 700 million. This migration supplied the urban labour force needed by China's export-driven economic boom. Urbanisation remains a key policy and the government wants to reach a 60% urbanisation rate by 2020. That will be a tall order, as it will require a 1.1% increase in the annual urbanisation rate on average, compared with 1.0% from 1978 to 2013.

Rapid urbanisation in the past was largely driven by pull factors such as employment opportunities in cities and large urban-rural wage gaps. But these gaps have narrowed in recent years and, from now on, push factors need to play a bigger role. For instance, the benefits of rural residency – primarily the allocation of a plot of farmland – sometimes outweigh the benefits of migration to a city. A 2014 survey in Sichuan province found 90% of migrant workers wanted to keep their rural status and did not want an urban hukou as, under existing laws, farmers are unable to transfer or sell their rural land use rights even if they have moved to an urban area.

Also, many cities were simply overcrowded in the past. The three largest cities contained 14% of the population, but took up less than 3% of China's land area. Migrant workers with rural hukou status were not entitled to many of the social welfare benefits that were afforded to registered city dwellers. Urbanisation under the new normal is likely to emphasise efficiency and equality, particularly through hukou and land reforms.

In the area of hukou reform, migrants coming to cities must meet a set of criteria before they can apply for local resident status – the larger the city, the more stringent the criteria. This serves to minimise overcrowding in the most populous cities and encourage migration to the less populous. Eventually, local governments are expected to go further and scrap rural-urban distinctions altogether.

Institutional reform

Much of China's future success will depend on institutional reforms that engender the credibility of governance and deepen trust.

President Xi Jinping's anti-corruption campaign is currently centre stage. The temporary crackdowns of the past simply purged political opponents and asserted authority, but this campaign is perpetual in nature and seems to be intensifying. During the past two years it has ensnared both ‘tigers' (top party leaders) and ‘flies' (low-ranking officials). According to reports, close to 200,000 corrupt officials have been arrested, demoted or dismissed.

The other big wave of reform is the simplification of the bureaucratic structure. China has recently abolished the Ministry of Railways, which was folded into the Ministry of Transport. It has also dismantled the State Population and Family Planning Commission.

But deeper institutional reform will require the state to cede active participation in the economy. Although privatisation of SOEs is not uncommon nowadays, the state still retains effective control of many of them. Major tangible benefits are likely to come if the state lets go. When disinflation and deflation hit between 1996 and 2003, China ended direct subsidies to SOEs and made them accountable for their performance. The number of SOEs in that period fell from 262,000 to 146,000. The corporate performance of the remaining SOEs, in terms of return on equity (ROE), improved markedly from 0.4% in 1998 to 6.7% in 2003, according to the Ministry of Finance. The government, however, did not allow SOEs to be sold or shut down easily after 2003. As a result, many inefficient SOEs survived simply because the banks continued to lend to them – regardless of risk – on the assumption that the government would not let them fail. Unsurprisingly, the financial performance of SOEs deteriorated until now.

Foreign policy

Beijing is starting to flex its economic strength as it pursues its foreign policy goals. This approach is embodied in a grand international infrastructure and development initiative dubbed ‘one belt, one road'. It aims to build highways, ports, railways and so on throughout a Silk Road Economic Belt across the Eurasian land mass. Similar ambitions are planned for the Maritime Silk Road, or 21st Century Maritime Silk Route Economic Belt, which is to take in the South China Sea as well as the South Pacific and Indian Oceans.

To do this, China is setting up, and largely funding, the Asian Infrastructure Investment Bank (AIIB), a multilateral lender for development projects. In the process, Beijing is showing it is now an economic giant with significant diplomatic clout. Dozens of countries in Asia and Europe – many of them long-time allies of the US – as well as Russia and India, signed up as partners in the AIIB. This was despite initially strong misgivings from Washington, which for decades has dominated the international developmental lending space. But, even American resistance seems to be softening. The AIIB initiative could also hasten the internationalisation of the RMB.

Conclusion

China is embracing long-term change and ongoing reform. Monetary and fiscal policies are being recalibrated in the pursuit of quality growth. GDP and other targets have been lowered. And, the old one-way bet on the RMB no longer prevails. Fears about massive local government debt promise to be assuaged by evolving policies aimed at long-term fiscal sustainability. Some progress has already been made in institutional reform, although much more needs to be done as the government reassesses its relationships with SOEs and presses on with its anti-corruption campaign. On the world stage, China's economic power has given it real diplomatic clout as it pursues new foreign policy ambitions. Welcome to the new normal – which will have massive ramifications on how business is done in China from now on.

Chris Leung is senior economist and Lily Lo an economist at DBS Group Research

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com