Website of the year: European Central Bank

ECB's revamped website optimised for all screen types

When the European Central Bank (ECB) learned it would gain responsibility for banking supervision in the eurozone, it set out to build and preserve ‘Chinese walls' between its different functions. Beyond the operational and organisation challenges this presented, it also posed somewhat of a communications headache. "We wanted to show supervision as separate from monetary policy, but at the same time we wanted to show unity with the ECB," Marcello Di Pietro, deputy head of the ECB's multimedia division, explains. "Having separate websites with similar features, and yet a distinct look, underscores this vision."

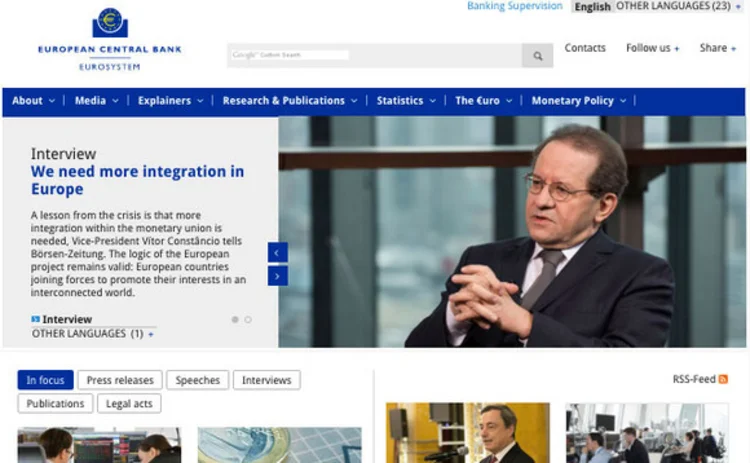

There were several layers to the eventual solution. The first saw the ECB launch a separate website for banking supervision on November 4, 2014, alongside the single supervisory mechanism (SSM). It embraced many of the hallmarks of a modern central bank website; responsive design features, simplified homepage, smooth navigational structure. Eight months later, the same technology was used in the redesign of the main ECB website – achieving the goal of individual integrity, but within a unified framework.

"The website is the ECB's primary channel to reach out to a wide variety of audiences, covering both experts and the general public. With the new web presence, we can have a more effective outreach, we can better tailor messages to key audiences, and we can promote access to our audio-visual content," Di Pietro says.

This was a major undertaking for an institution that last updated its web presence in 2004. While the old site was functional, it had fallen behind many of its peers in terms of design. In particular, it was poorly suited to mobile devices, such as phones and tablets, a problem that persists for many central bank online services.

"Everything is optimised for small screens," Paolo Ferrari, project manager of the ECB's new website, in the multimedia division, says.

With the new web presence, we can have a more effective outreach, we can better tailor messages to key audiences, and we can promote access to our audio-visual content

This has proven important as the share of users accessing the sites on mobile devices during the day has risen from 3% for the old sites to between 10% and 15% for the new ones. With modern offices embracing new ways of working, Di Pietro sees the potential for a greater share – potentially beyond 50% – in the future.

A central part of the new design is a streamlined homepage that presents less information to users at first glance, but allows them to toggle through varieties of content, adapting it to their needs. These varieties include press releases, speeches, publications and legal acts. There is a fixed bar displaying the latest key interest, inflation and exchange rates, as well as permanent links to information on the ECB's market operations. When accessed via mobile devices, the content is arranged differently – it is stacked vertically – but remains easy to scroll through.

Beyond the homepage, information is broken down intuitively by topic, with some areas, including emergency liquidity assistance and provision of collateral, now featured more prominently, perhaps a reflection of user demand. The data is split frequently to prevent users from becoming overwhelmed with information they did not want in the search for the information they did, while it is often augmented with genuinely useful interactive charts.

The design of any website is only half the battle. Ensuring the right information is available and accessible is crucial. The update of the main ECB website includes a section – dubbed ‘explainers' – where the user can "discover key topics in simple words and through multimedia". This covers some of the basic functions of the ECB, in addition to more complex topics such as the functioning of the Target2 Securities system – the latter explored through an innovative animated video.

Now the ECB is looking to go further. It is launching a study of the ‘information architecture' of the website, a process that will include usability tests. After an external company has conducted the study, the central bank will decide on any changes before rolling them out over a period of between 12 and 24 months. "We aim to change without disrupting the user experience," Di Pietro says. "The content is still good, but we hope to improve its accessibility and to cater better for dedicated target audiences."

The ECB faces a unique challenge in the central banking community. The eurozone incorporates 19 countries, with a total population that exceeds 335 million. The ECB publishes material in 24 languages, while its website is watched all around the world, in large part because the euro is a reserve currency. Its document on foreign exchange reference rates is downloaded around 150 million times per month. That's almost five times a second.

It's not just the statistics that attract high traffic. In a sample month over the past year, the main site attracted four million page views from more than 900,000 different users. As the lynchpin of the Eurosystem, the ECB faces other technological demands. Much of its data and information is used by the national central banks in the eurozone. There is little sense in replicating costs, but this adds to the ECB's responsibilities.

Part of the central bank's success in coping with these challenges is the relationship between its staff members. "We implemented this project using a scrum methodology, making continuous improvements and implementing regular testing in subsequent development rounds. This was facilitated by a very close day-to-day collaboration between the ECB's web developers and web designers," Ferrari says.

Discreetly positioned on the homepage is an invitation from the ECB to ‘follow us'. When clicked, the user is presented with links to a host of social media accounts, including Twitter, where the ECB is one of the more talkative central banks. In addition to putting out links to content, the account is used to field some basic questions from the public, though the ECB is yet to let one of its top policy-makers loose on the platform, as the Bank of England has done with Andrew Haldane, among others. Perhaps that could be the next frontier?

The Central Banking awards were written by Christopher Jeffery, Tristan Carlyle, Daniel Hinge, Arvid Ahlund, Dan Hardie and Rachael King.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com